Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

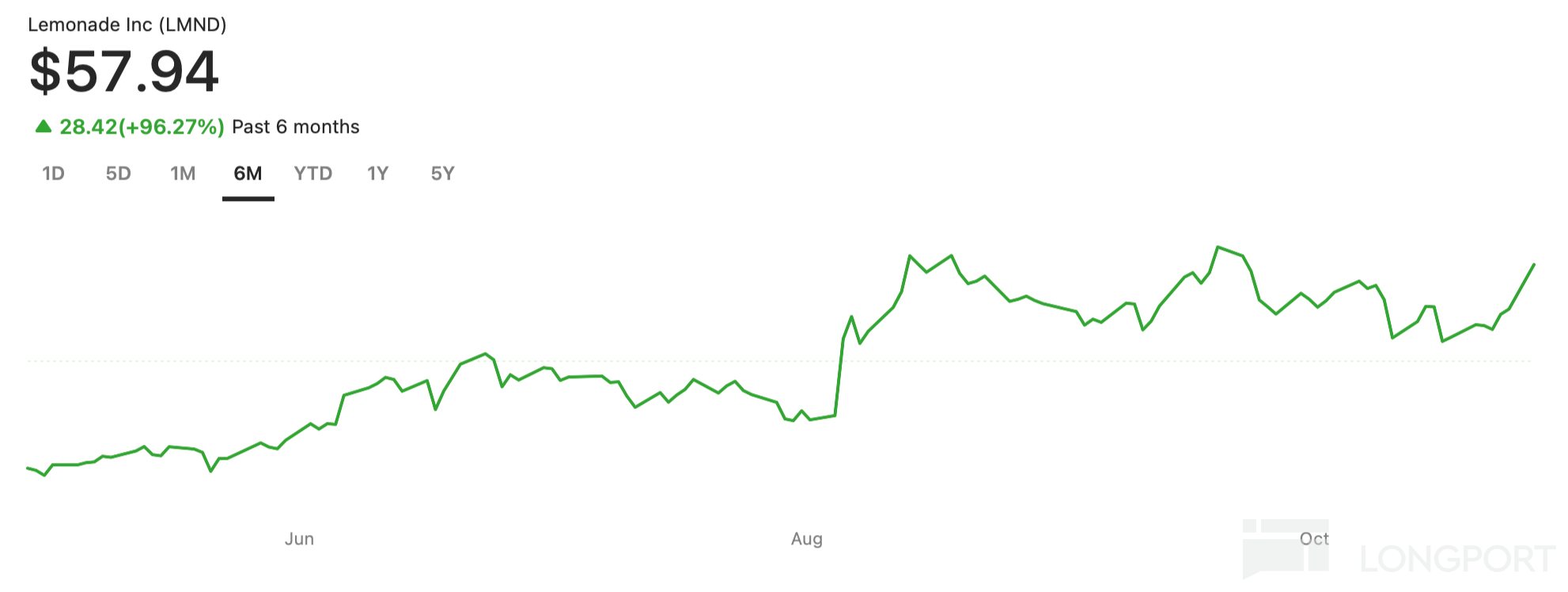

$Lemonade(LMND.US) The following answer systematically breaks down how Lemonade (LMND.US) integrates AI across the entire insurance value chain, its current outputs, and how it is reflected in financi...

Request for GPT-5 Pro Reasoned for 28m 27s Indeed, human affairs are the most complex. It took nearly half an hour to reach a conclusion: Below is a clear explanation of **"people" and "reputation/eva......

Request for GPT-5 Pro Reasoned for 21m 1s One-sentence conclusion $Lemonade(LMND.US) Lemonade is transitioning from a phase of "rapid growth but highly reinsurance-dependent" to one with "more retaine...

$QuantumScape(QS.US) Ouch, that hurts.

$QuantumScape(QS.US) A small bet can be enjoyable. Be sure to watch your position.