Total Assets

Total Assets CNOOC commentators

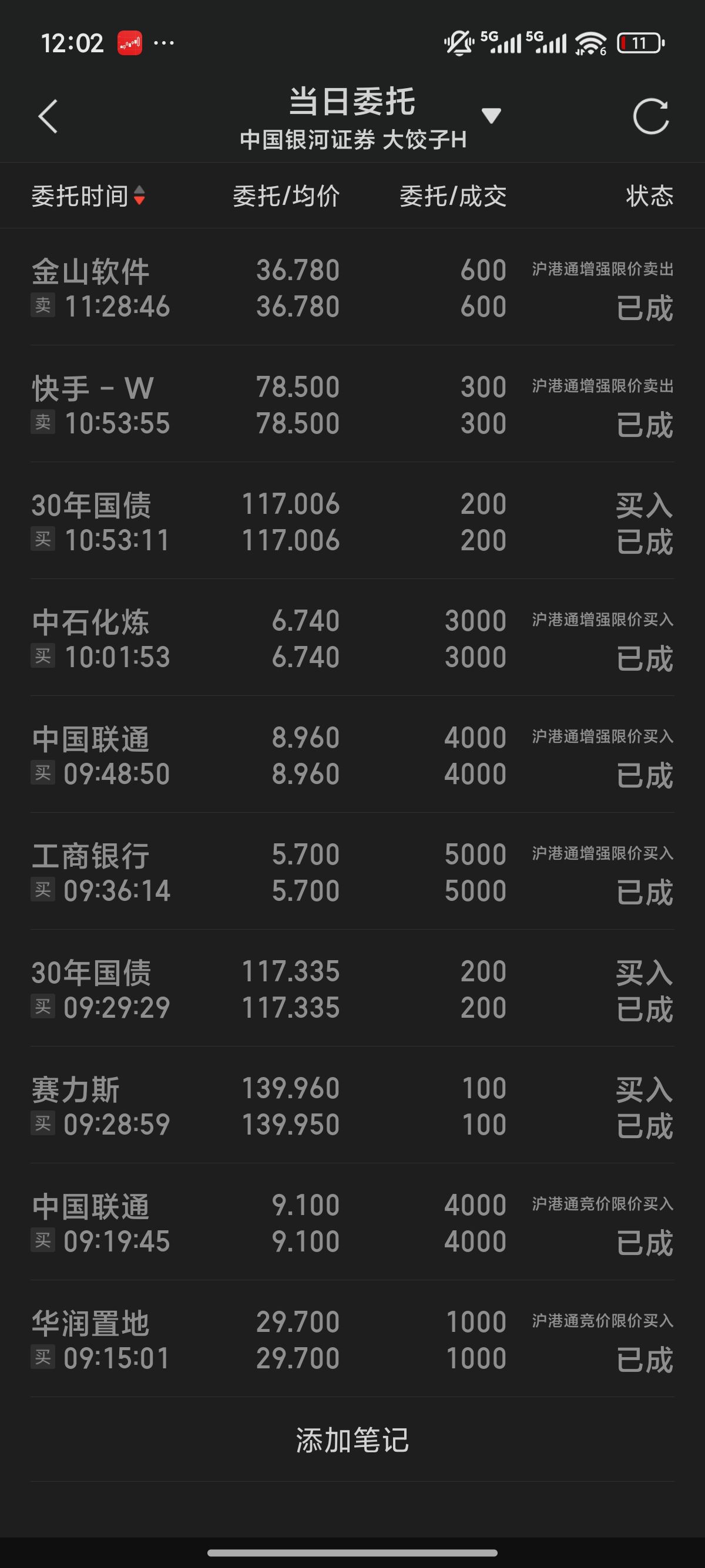

CNOOC commentators $CNOOC(00883.HK)$COSCO SHIP HOLD(01919.HK)$CHINA UNICOM(00762.HK)

Cash is almost fully allocated to dividends and government bonds

Also cleared JD.com in US stocks

In the current stock portfolio, except for Lijin and Meituan, the expectations for other holdings are relatively good

Previously thought it would lose time, but now looking at the trend of government bonds and indices, it won't lose for too long—the more extreme, the shorter

Lijin's market cap is too small, now suspecting ethical issues in stock recommendations, this point cannot be judged for now

Meituan is affected by the ongoing food delivery war, and the negative impact of Q3 earnings may still be realized once more

I still keep these two in the portfolio because I'm not at the point of cutting losses, but I don't recommend allocation

The capital game in A-shares is very clear

Margin traders are going all out, hoping to replicate the epic takeover on 1008

GJD reduced positions in SSE 50 and CSI 300, preparing for impact

At this stage, it's a matter of choosing sides—if you're not at the table, you're on the menu

If you're not absolutely sure, staying in cash or buying bonds are better choices

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.