Likes Received

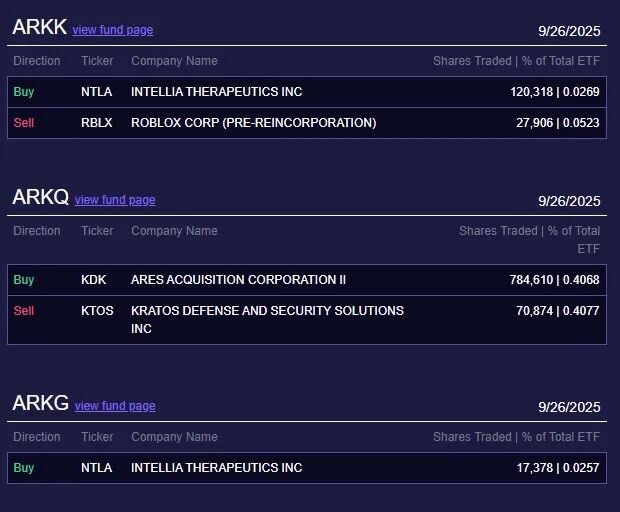

Likes ReceivedCathie Wood bottom-fished buying $6 million KDK $2.2 million NTLA sold $6 million KTOS

It was said that August-September are historically the worst-performing months for U.S. stocks, but unexpectedly, as we approach October, the market has started to rise one day and fall the next at the end of September. Yesterday, the three major indices closed higher, with the Nasdaq up 0.44%, the S&P 500 up 0.59%, and the Dow up 0.65%.

The happiest are those doing day trading, maximizing returns by flipping positions back and forth—though this is safest when done in a stable uptrend.

Cathie Wood bought $2.2 million worth of NTLA today. She’s been bullish on it since it was at $10, and now, with the recent U.S. stock pullback, today’s move was a well-timed setup 😄

She also bought $6 million worth of KDK (AACT). Originally, AACT was a shell company that went public via Kodiak. The stock has been declining lately, coinciding with Trump’s announcement of tariffs on imported trucks, including electric heavy trucks—Kodiak’s focus is AI-powered trucks. Cathie’s move here is essentially bottom-fishing.

Trump recently wielded the tariff stick again—announcing a 25% tariff on all imported heavy-duty trucks, including electric ones, effective October 1, 2025.

She sold $6 million worth of KTOS, which has been performing well lately, trending upward as a slow-moving bull stock, with institutions continuously raising price targets. She also sold $3.7 million worth of RBLX, which spiked after talks with EA. Is an acquisition coming? If the talks fall through, the stock might pull back 🤔

Today’s 9.26 Trading Activity

Buys:

NTLA: Bought 120,318 shares in ARKK, accounting for 0.0269%; bought 17,378 shares in ARKG, accounting for 0.0257%.

KDK: Bought 784,610 shares in ARKQ, accounting for 0.4068%.

Sells:

RBLX: Sold 27,906 shares in ARKK, accounting for 0.0523%.

KTOS: Sold 70,874 shares in ARKQ, accounting for 0.4077%.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.