If you don't understand the problem, you won't cherish the solution

I might be exaggerating a bit, but the good news is, you now have a chance to enter Bitcoin—the bad news is Bitcoin is falling, but for those looking to enter, this is precisely good news. Those who have been hesitating, debating "wait for a pullback to buy," the opportunity is here. The recent pullback has caused a bit of panic, but the fourth quarter is still promising. Buy the dip—it's always the best time to add to your position.

Remember, you don’t need to buy a whole Bitcoin to invest—that’s the flexibility of this "game." The problem is, one Bitcoin is already out of reach for most households, and this window is closing rapidly. In 5-10 years, 0.1 Bitcoin will become an unattainable number for most families. So, right now is always the cheapest. But most people turn a blind eye, and the reason is simple: they don’t see the problem, so they naturally ignore the solution.

1. The essence of Bitcoin: Solving the core problem of "inflation"

I keep advocating for Bitcoin because Bitcoin is a solution to a problem—and that problem is inflation.

Everyone in the world is suffering from inflation: the more debt governments take on, the more money they inject into the economy; the more money there is, the higher the cost of living. That’s why prices have skyrocketed in recent years—if you don’t understand how bad inflation is, you won’t understand how important Bitcoin is.

- The root of inflation: Fiat currency abandoning the gold standard, becoming an "unlimited money-printing tool"

In the past, we had the gold standard (which is long gone now): countries agreed that "the U.S. dollar is pegged to gold, and other currencies are pegged to the dollar," limiting money supply to gold reserves. But in 1971, the U.S. completely abandoned the gold standard—since then, money no longer needs to be pegged to anything tangible, and they can print as much as they want.

The more dollars the U.S. prints, the more inflation other dollar-pegged currencies face. It’s like a scam: if I borrow $1 million from each of my six siblings, I have $6 million to spend, but when it’s time to repay, I borrow another $1 million from my cousin—my cousin asks, "You don’t earn enough to repay, how dare you borrow so much?" I just say, "Look at my past debts—when have I not repaid?" As long as I can keep borrowing from the next person, the scam continues.

But if an ordinary person did this, they’d be rejected—but the U.S. government isn’t: they can endlessly "swipe their credit card," rolling debt into an ever-larger pile—that’s the root of inflation. - The nature of inflation: Your wealth is being "diluted"

Think of money as a "network"—people exchange goods and services using money, and the "share of the network" you own determines your wealth:

If you have $10,000 and the global money supply is $100,000, you own 10%—that’s valuable.

But if the government prints money and the global money supply becomes $200,000, you still have $10,000, now just 5%—you didn’t spend a dime, but you’re poorer because your wealth was "diluted."

Every night while you sleep, the money in the economy increases; when you wake up, your share of wealth has shrunk—that’s the truth behind "waking up poorer."

Bitcoin is completely different: if I hold 1 Bitcoin, that’s 1/21 million of the total supply—no matter how big or small the network grows, my share remains 1/21 million. If the network’s value doubles, my wealth doubles, but my share isn’t diluted.

No one can dilute your Bitcoin share—that’s its core power. - 2. Bitcoin vs. other assets: Why is it the "best inflation hedge"?

Inflation doesn’t just raise living costs—it also drives up asset prices (stocks, real estate). But if you don’t hold assets, life only gets harder. Yet stocks and real estate have fatal flaws:

Stocks: Companies can issue more shares anytime, diluting your ownership.

Real estate: More houses can always be built, and you pay property taxes—if I buy a house outright for $3 million, I pay $50,000 in taxes over 10 years, $100,000 over 20. Even if you buy outright, as long as you pay property taxes, you’re essentially "leasing" your own house from the government.

Bitcoin, however:

Has a fixed supply of 21 million—no one can print more (even if Satoshi Nakamoto came back, they couldn’t change this rule).

Has no "holding costs"—no taxes, no maintenance, your share is never diluted.

The higher the demand, the higher Bitcoin’s value—it’s the first asset in human history with an "absolutely fixed supply."

3. Bitcoin’s "halving cycle": A "value booster" every 4 years

Bitcoin has another key mechanism—"halving":

A fixed amount of Bitcoin is mined daily (like "mining gold," but with computing power), and miners sell some to cover costs.

Every 4 years, the daily Bitcoin supply is cut in half—meaning "new supply decreases," and miners’ "selling pressure" also halves.

Past cycles prove that 15-18 months after halving, Bitcoin tends to surge:

2016 halving: Bitcoin was ~$600, 18 months later it hit $20,000.

2020 halving: Bitcoin was ~$6,000, 15 months later it hit $68,000.

April 2024 halving: Bitcoin was ~$60,000, the next surge is likely in Q4 2025, I estimate $180,000–$240,000.

In the next 12 years, there will be 3 more halvings (2028, 2032, 2036), corresponding to 3 bull cycles:

A 20-year-old will be 32 in 12 years; a 30-year-old will be 42; a 60-year-old will be 72—this is a once-in-a-lifetime wealth-building opportunity.

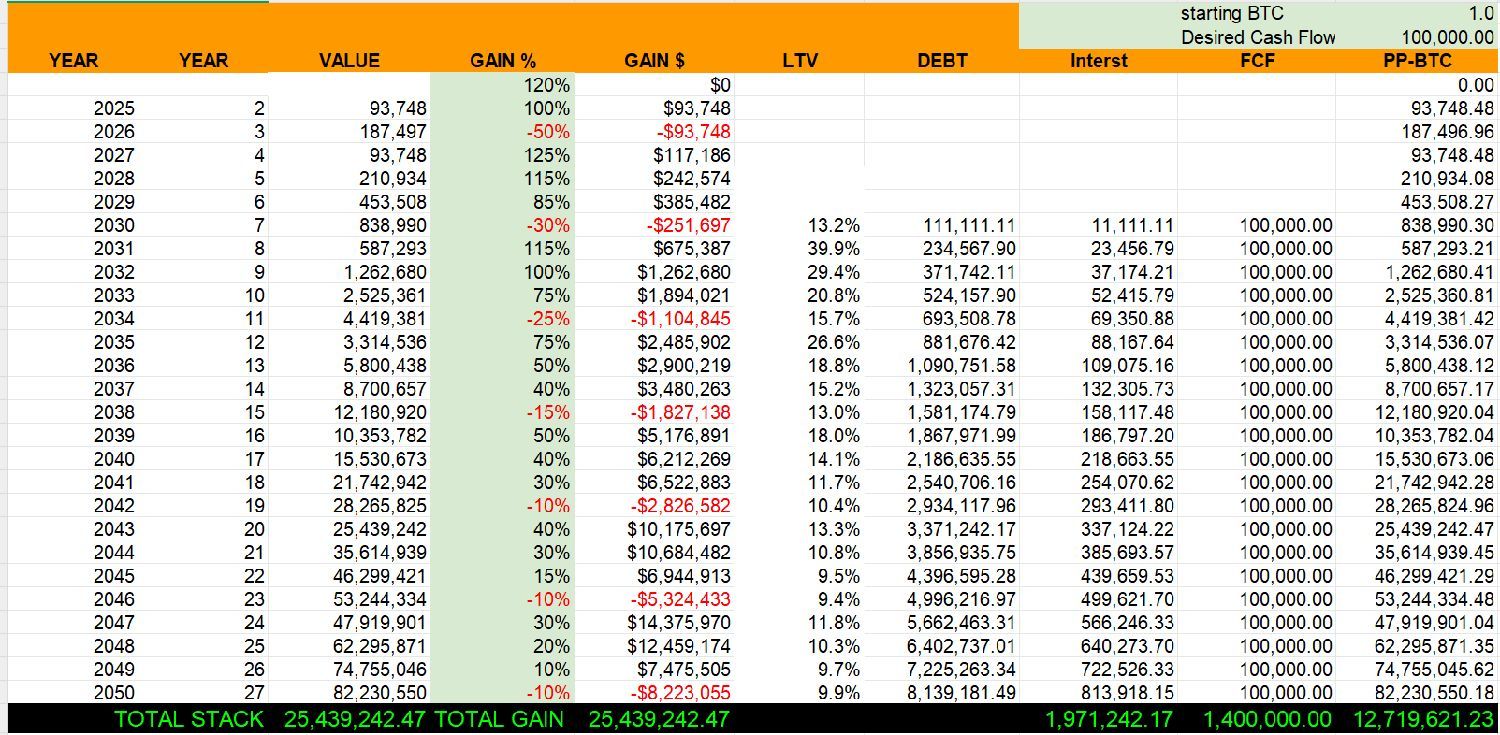

My prediction: In the next 12 years, Bitcoin could reach $5–$10 million per coin.

4. Why Bitcoin will rise: Because "if the problem isn’t solved, the solution has value"

Bitcoin’s rise is rooted in "inflation isn’t solved, and it’s getting worse":

The U.S. government’s debt has reached the point of "borrowing new money to repay old debt"—they can only print more to cover principal and interest.

It’s like using one credit card to pay another, then a third to pay the second—mathematically, it’s impossible to repay, so they keep borrowing.

As long as the U.S. keeps printing, global inflation won’t stop, and living costs and asset prices will keep rising.

Now, not just ordinary people are waking up—businesses, churches, banks, even governments are realizing Bitcoin’s value:

Countries like China and Russia, pressured by the "weaponization" of the dollar, need inflation-resistant solutions.

Companies are swapping cash for Bitcoin to avoid wealth dilution.

More people will realize: "Instead of holding depreciating fiat, hold Bitcoin that can’t be diluted." - 5. Final advice: Don’t wait—understand first, then act

First, grasp the problem, then trust the solution: Don’t just see "Bitcoin can rise," first understand "inflation is diluting your wealth." Recommended books: *The Price of Tomorrow*, *The Bitcoin Standard*, *The Fiat Standard*, *The Broken Money*, *The Philosophy of Bitcoin*; Christians can read *Thank God for Bitcoin* (the title seems exaggerated, but the content is profound).

The time to enter is now: Bitcoin is ~$109,000 now, it could reach $2 million—"The Bitcoin price you get depends on the price you deserve." Don’t wait until it’s high to regret it.

Remember Bitcoin’s essence: You’ll come for the "number going up," but you’ll stay for the "revolution"—Bitcoin isn’t just a tool to make money, it’s a weapon against "unlimited money printing," a shield to protect wealth.

The whole world faces the same problem, and the solution is right in front of you. Don’t just take my word—check the data, do the research. After all, your wealth should be guarded by you.$Strategy(MSTR.US) $BTC/USD(BTCUSD.HAS)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.