ENN Energy 4000-word in-depth research report

$ENN ENERGY(02688.HK)$CHINA RES GAS(01193.HK) $CHINA GAS HOLD(00384.HK) Research on ENN Energy, its franchise network is the core moat.

🎯 Core logic: Natural gas as a transitional fuel for clean energy transformation has strong demand stability (residential + commercial consumption), with clear industry growth (targeting 15% share of primary energy by 2030). ENN is a leading city gas enterprise (market share ~10%), with its core barrier being the franchise network covering 228 cities, creating regional exclusivity, high switching costs, and economies of scale. The business model is evolving from traditional "gas sales + connection" to integrated energy services, with integrated energy revenue growing over 30% for several consecutive years, becoming the future growth engine.

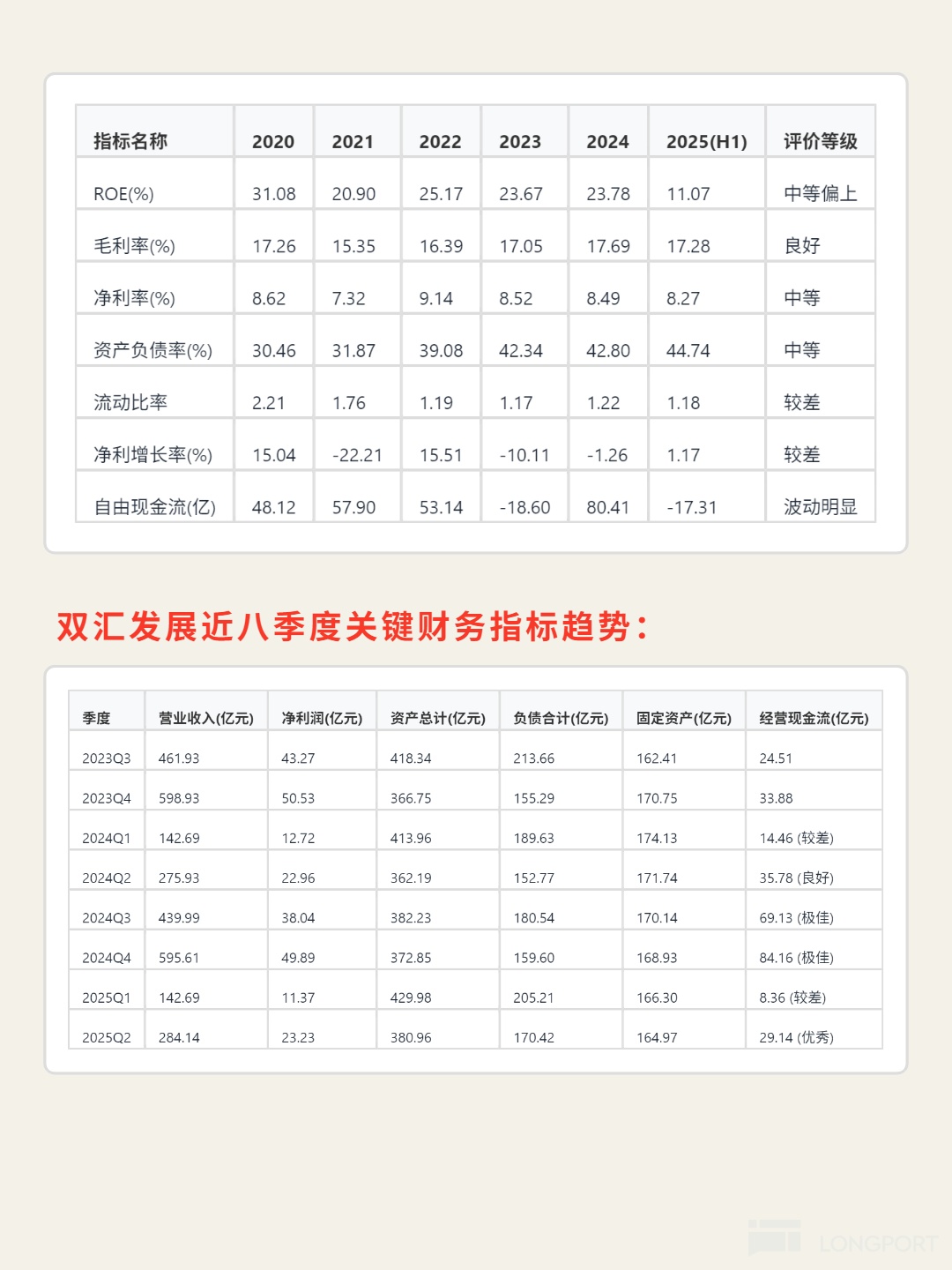

📈 Financial highlights: ROE dropped from 22.25% in 2020 to 13.64% in 2024, gross margin 12.20%, net margin 5.45%. Although efficiency has declined, it remains above industry standards. Debt-to-asset ratio 50.52% (safe range), current ratio 0.68 (weak short-term solvency). Stable operating cash flow (CNY 10.294 billion in 2024), free cash flow CNY 3.56 billion, net profit cash ratio 1.72 (high-quality profit). 2024 revenue CNY 109.853 billion (-3.5% YoY), net profit CNY 5.987 billion (declining for two consecutive years), growth entering a plateau, relying on new customer expansion, increased share of integrated energy services, and M&A integration.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.