Fiserv Financial Services 4000-word in-depth Research Report

$Fiserv(FI.US)$PAB(000001.SZ) $CM BANK(03968.HK) Recently studied Fiserv's financial services, the biggest takeaway is its high profitability efficiency and strong cash flow advantage, but need to be cautious about high leverage and goodwill risks.

🎯Core logic: Global payment infrastructure leader, fintech service provider for banks and merchants. Weak industry cycle (payment is a necessity), moat lies in scale effect (network value) and high switching cost (system replacement cost is extremely high). Profit model includes transaction processing fees (per transaction/amount) + system service fees (subscription/usage), with growth driven by Clover cloud platform and value-added services.

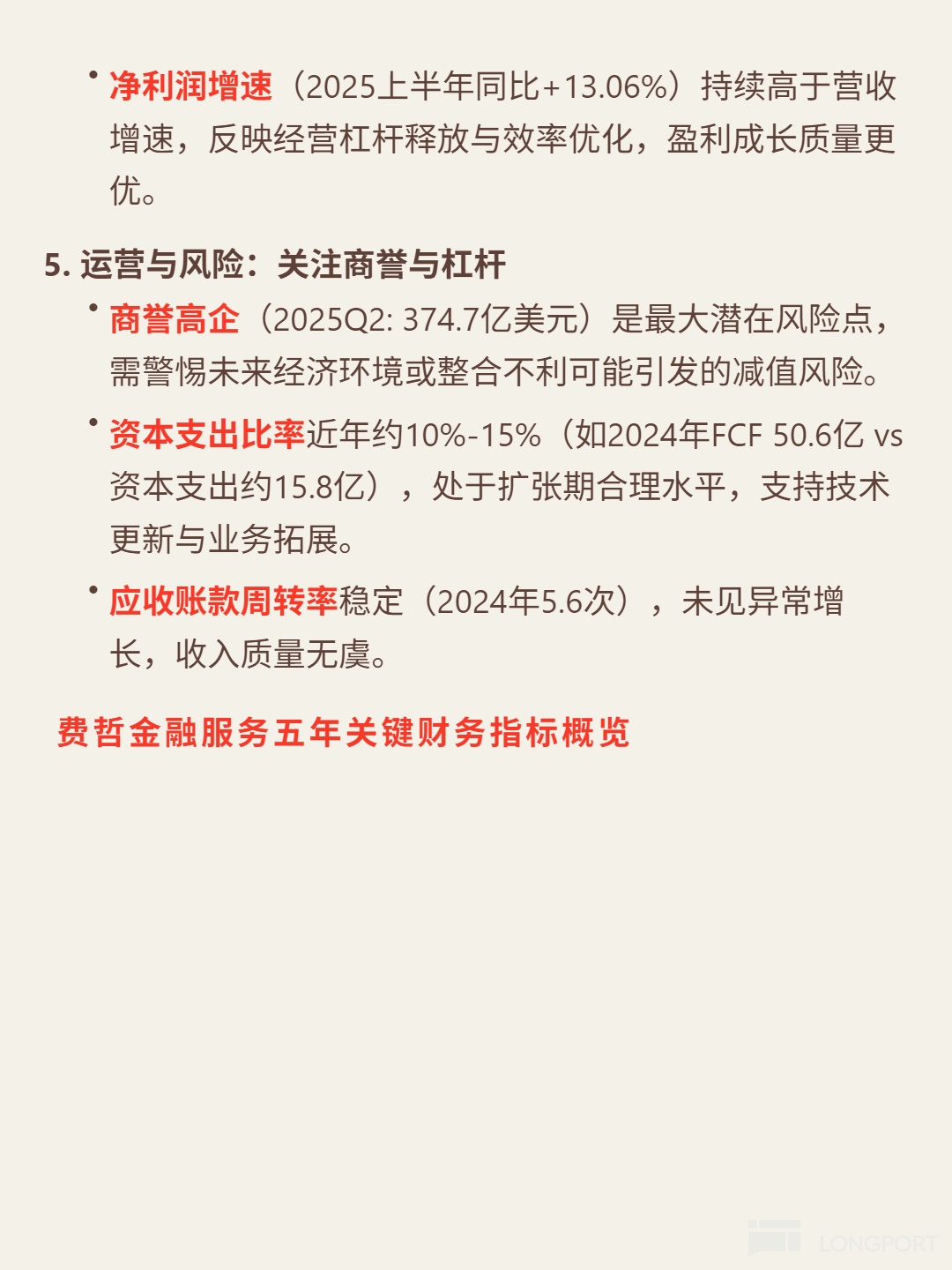

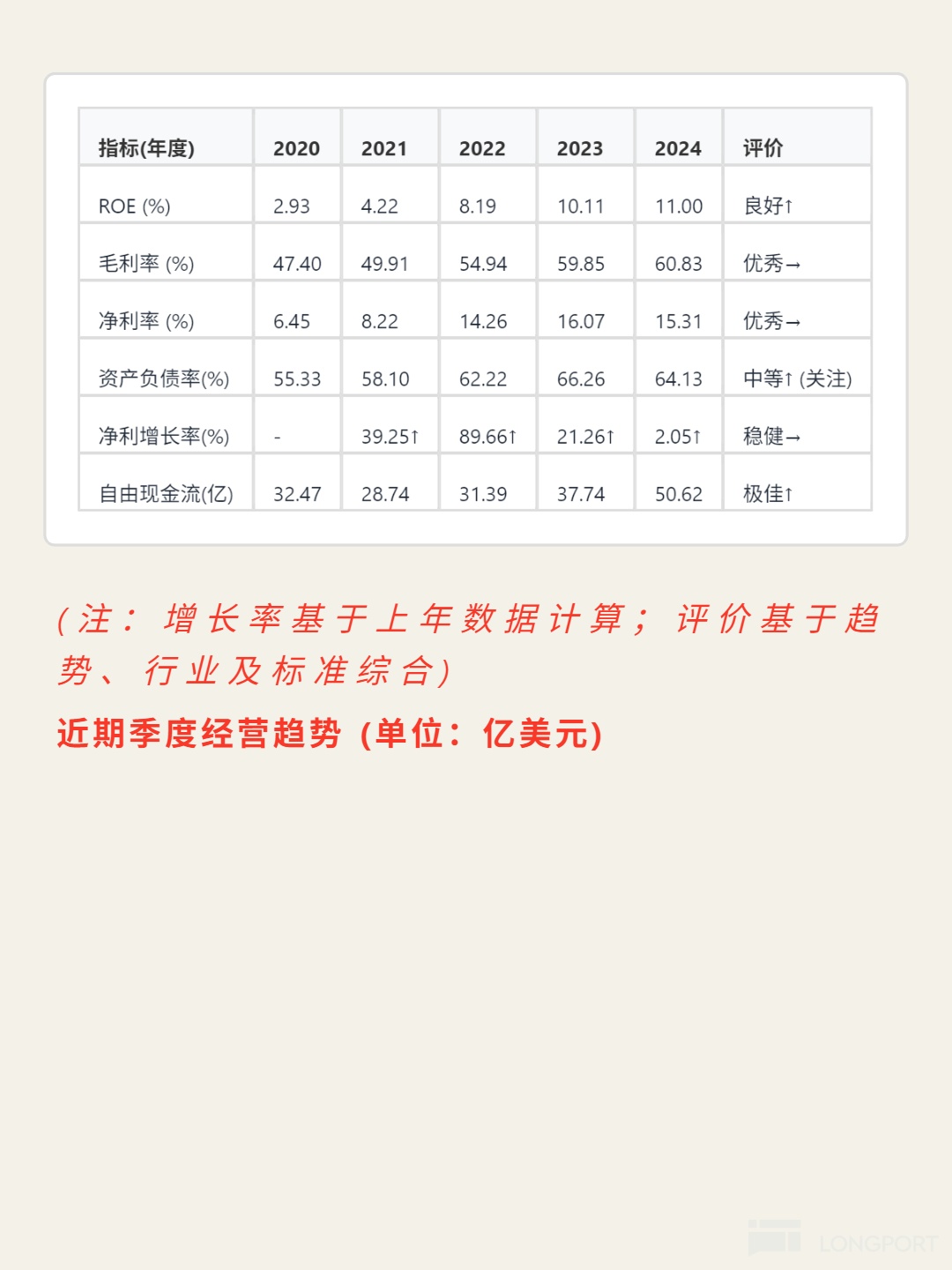

📈Financial highlights: Gross margin stable around 60% (2025Q2 61.8%), net margin 18.6% (2025Q2); 2024 free cash flow 5.06B, net profit cash ratio 2.16 (high cash content of profits); H1 2025 net profit growth 13.06%, higher than revenue growth 6.57%; but debt-to-asset ratio 68.4% (2025Q2), goodwill $37.47B (45% of total assets), need to monitor debt and impairment risks.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.