Heartcore Company 4000-word in-depth research report

$XD INC(02400.HK)$TENCENT(00700.HK) $NetEase(NTES.US) Recently studied Xindong Company, whose financial quality in 2024 achieved a remarkable turnaround from trough to peak, with ROE surging from -4.62% to 38.43% being the highlight.

🎯 Core logic: The company builds an ecosystem with "self-developed games + TapTap platform". TapTap, as a leading "zero-commission" player community and distribution platform in China (with tens of millions of MAU), forms network effects and user stickiness through user reviews and community interactions, providing low-cost customer acquisition channels for self-developed games while attracting third-party developers. The profit model is driven by "platform + content", with revenue from self-developed/agent game operations (e.g., "Torchlight: Infinite", "Sword of Linglan") and TapTap platform advertising and technical services.

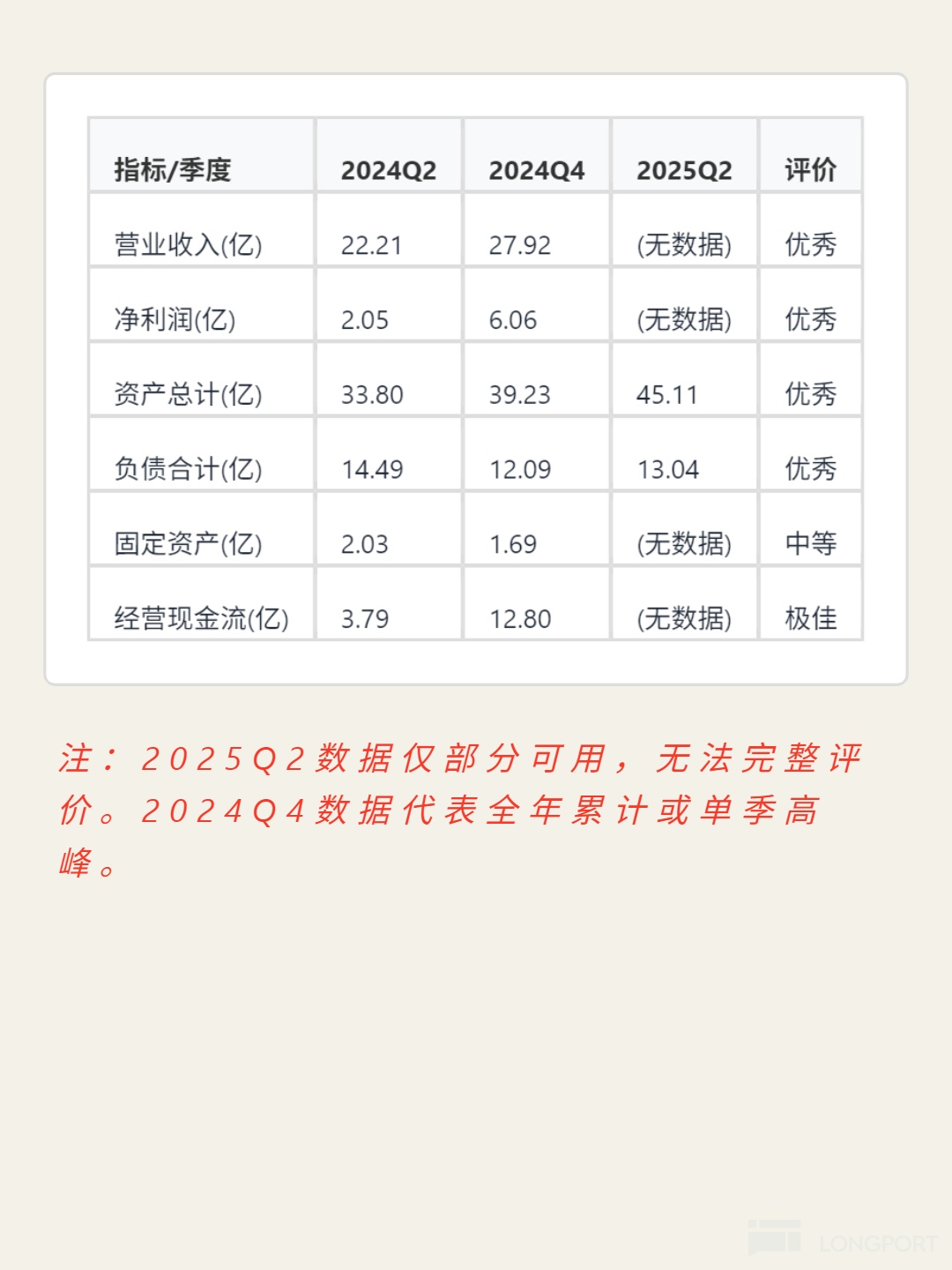

📈 Financial highlights: 2024 revenue of 5.012 billion (+48% YoY), net profit of 812 million (-83 million in 2023). Gross margin of 69.40% and net margin of 16.19%, both rising to industry-leading levels. Operating cash flow of 1.280 billion and free cash flow of 1.253 billion far exceeded net profit, indicating high-quality earnings. Debt-to-asset ratio of 30.81%, current ratio of 3.10, and cash of 2.781 billion covering current liabilities of 1.079 billion show strong solvency. Total asset turnover of 1.20 times indicates significantly improved operational efficiency. Q4 2024 revenue reached 2.792 billion, showing strong growth momentum.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.