Ctrip 4000-word in-depth research report

$Trip.com(TCOM.US)$Trip.com(TCOM.US) $TC Medical(600763.SH) A research report on Ctrip was dug out, with the core logic being the leading barriers and dual-engine growth momentum in a highly concentrated industry.

🎯 Core Logic: As the absolute leader in online travel booking (OTA), the industry CR5 has long exceeded 70%, dominating the mid-to-high-end market. The business model relies on a two-sided network effect: connecting 400M+ annual active users with 1.4M hotels and 200+ airline resources globally, forming a positive cycle between users and suppliers to reduce transaction costs. Growth is driven by dual engines: globalization (Trip.com brand, international revenue accounting for 35%, outbound travel exceeding 120% of pre-pandemic levels in 2025Q2) and the lower-tier market (6,000+ new partner hotels in 2025), supported by a light-asset model for expansion efficiency.

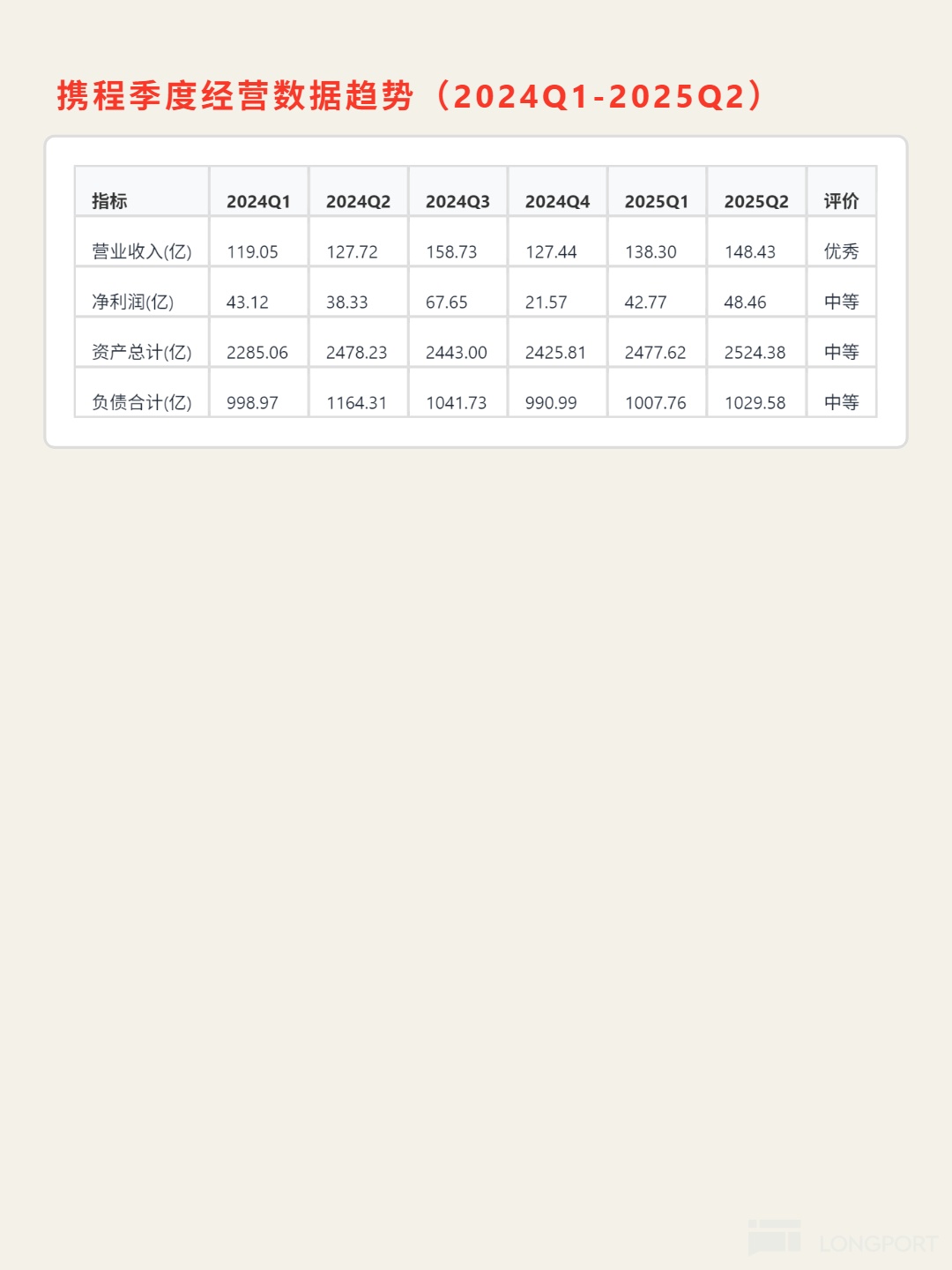

📈 Financial Highlights: Revenue grew 19.7% in 2024, net profit grew 72%, 2025Q2 revenue was 14.8B, up 16% YoY, inbound travel bookings doubled. Gross margin 80%+ (81.25% in 2024), net margin 32.02%, with outstanding profitability efficiency. Free cash flow 19B (2024), cash reserves 58.3B (2025Q2), strong profit conversion capability. Debt-to-asset ratio 40.85%, current ratio 1.51, manageable debt risk.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.