Baker Hughes Co-A 4000 字深度研报

$Baker Hughes(BKR.US)$Halliburton(HAL.US) Recently studied Baker Hughes, the biggest contradiction is the deep intertwining of traditional energy volatility and low-carbon transition opportunities.

🎯 Core logic: Leader in the full industrial chain of oil & gas equipment services, covering upstream exploration to downstream production. While affected by oil price cycles (5-8 year fluctuations), it builds moats through technology integration. The business model centers on hardware+software bundling (oilfield equipment + industrial IoT closed-loop services with high customer switching costs) and low-carbon technology positioning (leading in LNG equipment and carbon capture), combined with long-term maintenance contracts with giants like ExxonMobil to smooth cyclical risks.

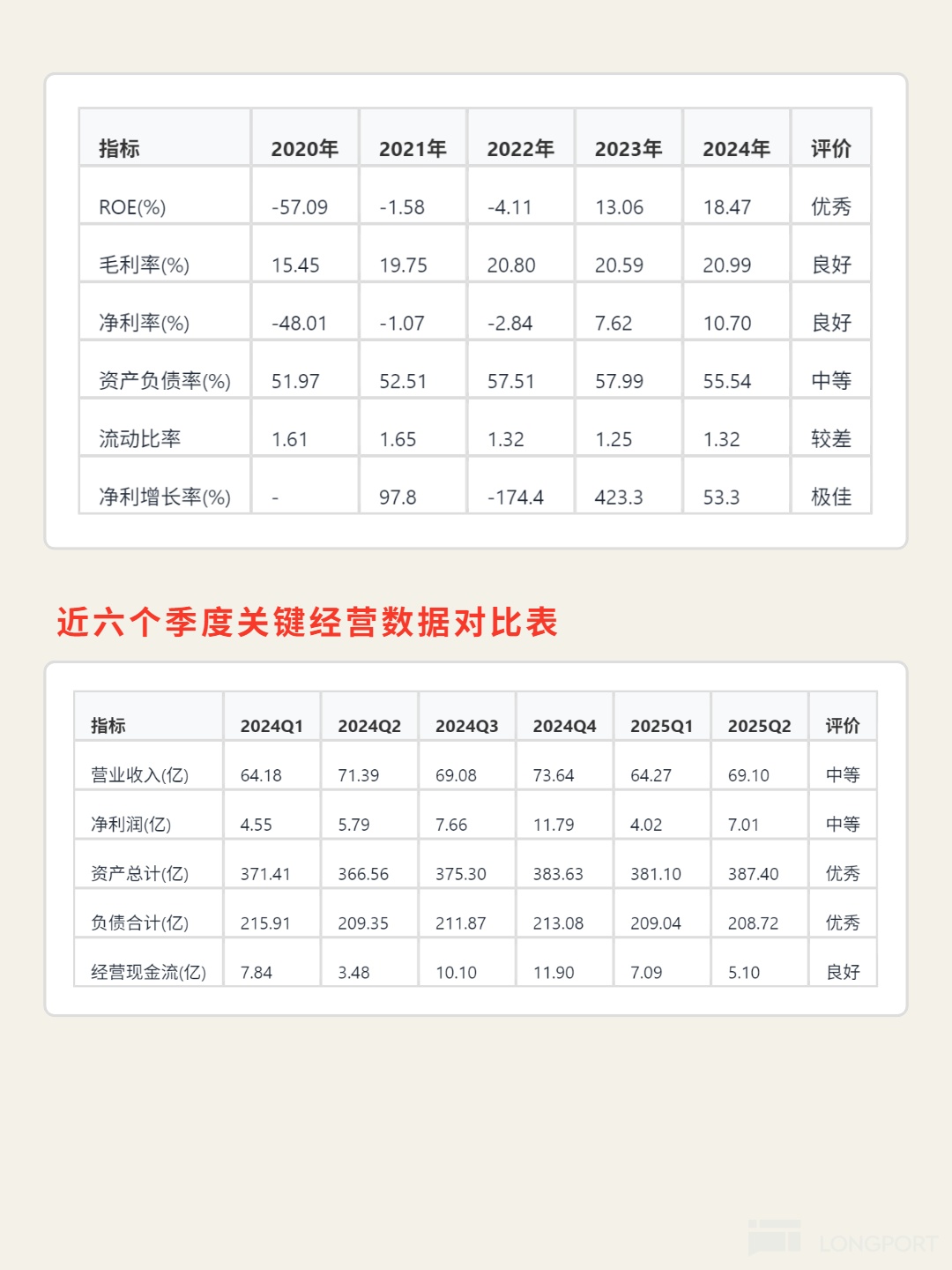

📈 Financial highlights: 2024 ROE reached 18.47% (surpassing the 15% excellence benchmark), with gross margin at 20.99% and net margin at 10.70% in healthy ranges; Net profit surged from ¥1.943B in 2023 to ¥2.979B (53.3% growth), operating cash flow was ¥3.332B (cash conversion ratio of 1.12, fully realizing profits as cash), and free cash flow grew positively for 5 consecutive years. Risks: Q1 2025 net margin dropped sharply to 6.25% (cost volatility needs monitoring), accounts receivable turnover days at 93 (above warning line), goodwill at ¥6.078B (16% of assets, impairment risks require attention).

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.