Crystal International 4000-word in-depth research report

$Qiming Information(002232.SZ)$SHENZHOU INTL(02313.HK) $PACIFICTEXTILES(01382.HK) researched Crystal International Group, with the focus on the coexistence of cost moat and cash flow risks in garment OEM.

🎯 Core logic: Global garment OEMs rely on low costs and economies of scale. The industry is discretionary consumption, demand is cyclical, concentration is low (CR5 <30%), growth depends on emerging markets (Southeast Asia grows 5-10% annually). The company has a presence in Vietnam and Cambodia (70%+ of capacity), labor costs are 20-30% lower than the industry, annual capacity is hundreds of millions of pieces, one-stop service reduces customer costs by 10-15%, forming switching cost barriers. The profit model is high volume with thin margins, 100% revenue from OEM, casual wear accounts for 40%, sportswear grows fastest (12% annual growth), gross margin 15-20%, profits rely on high turnover (asset turnover 1.5x).

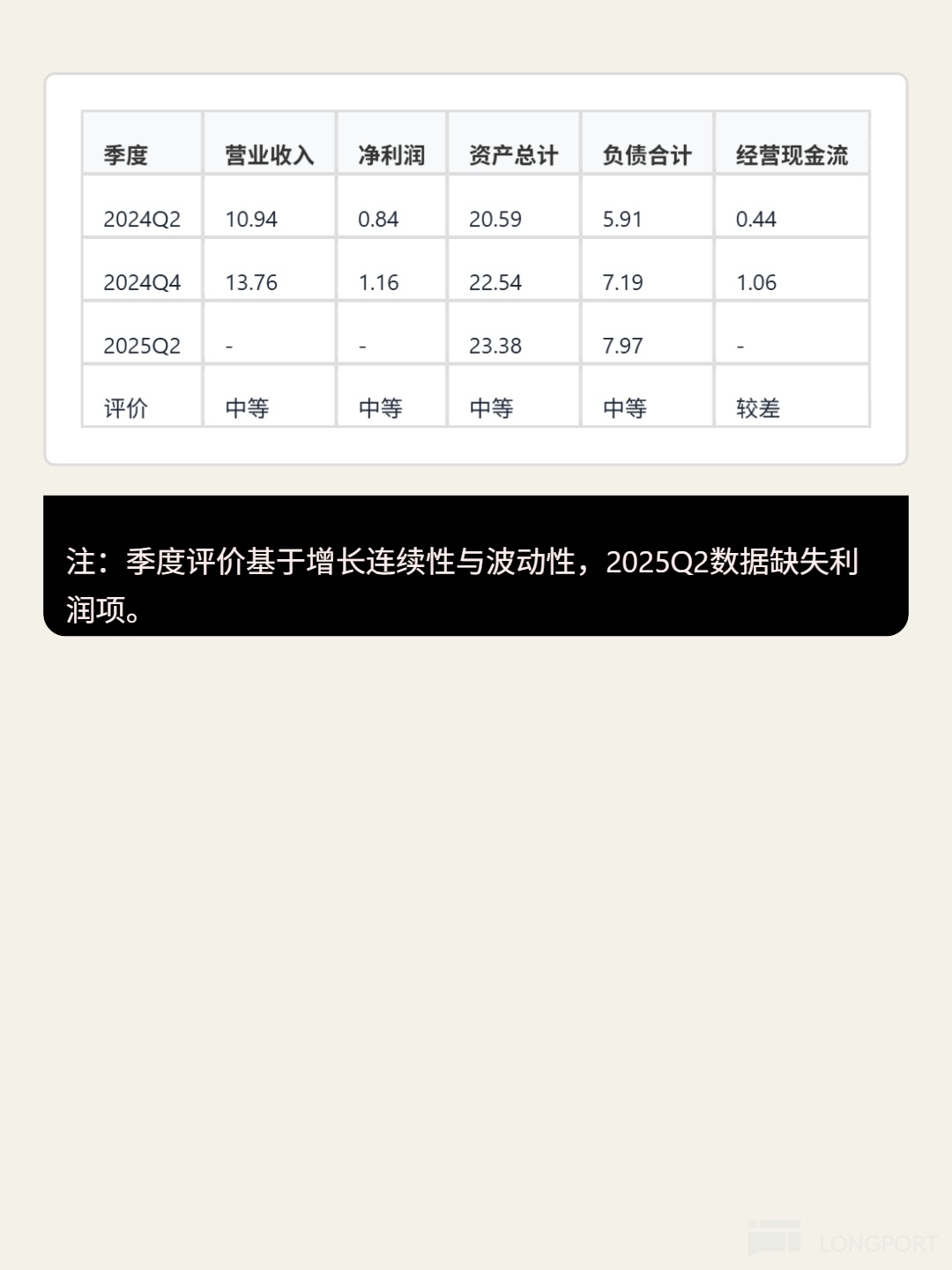

📈 Financial highlights: 2024 gross margin 19.7% (stable 19.1-19.7% over five years), ROE 13.5% (above manufacturing benchmark of 8-15%). Safe financial structure, debt-to-asset ratio 31.9% (below 40% threshold), current ratio 2.05, no long-term debt. But cash flow pressure: 2024 free cash flow turned negative for the first time (-3 million), net profit cash ratio 0.53 (below 0.5 warning line), accounts receivable 501 million (+102% YoY), turnover days increased to 55 days. Revenue growth slowed, 5-year CAGR 5.6%, 2024 revenue 2.47 billion (+13.5%), net profit 200 million (+22.7%), but asset turnover fell to 1.17x, capacity utilization to be observed.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.