Motorola Solutions 4000-word in-depth research report

$Motorola Solution(MSI.US) Research on Motorola Solutions reveals its core competitive advantage lies in the "irreplaceable" barriers in the Mission-Critical Communications (MCC) sector, leveraging a full-stack ecosystem and strong customer lock-in for long-term profitability.

🎯 Core Thesis: MCC is a highly concentrated (CR5 >75%), heavily regulated, and demand-inelastic sector where MSI holds 45% global market share. Clients include public safety (police, fire) and critical infrastructure sectors, with budgets accounting for 5-8% of government spending, demonstrating strong cyclical resilience. The company has built a "hardware-protocol-software" full-stack 闭环: Proprietary protocols (DMR, TETRA) and APX radio hardware hold >60% market share, while integrated command center software (Command Central) and video analytics (Avigilon) create switching costs at 1.5x initial investment, with >90% service contract renewal rates. Through in-house MCP protocol chips, strategic spectrum licensing, open APIs (200+ integrated apps), and the Envistacom acquisition for "air-space-ground" integration, it solidifies pricing power as a one-stop solution provider.

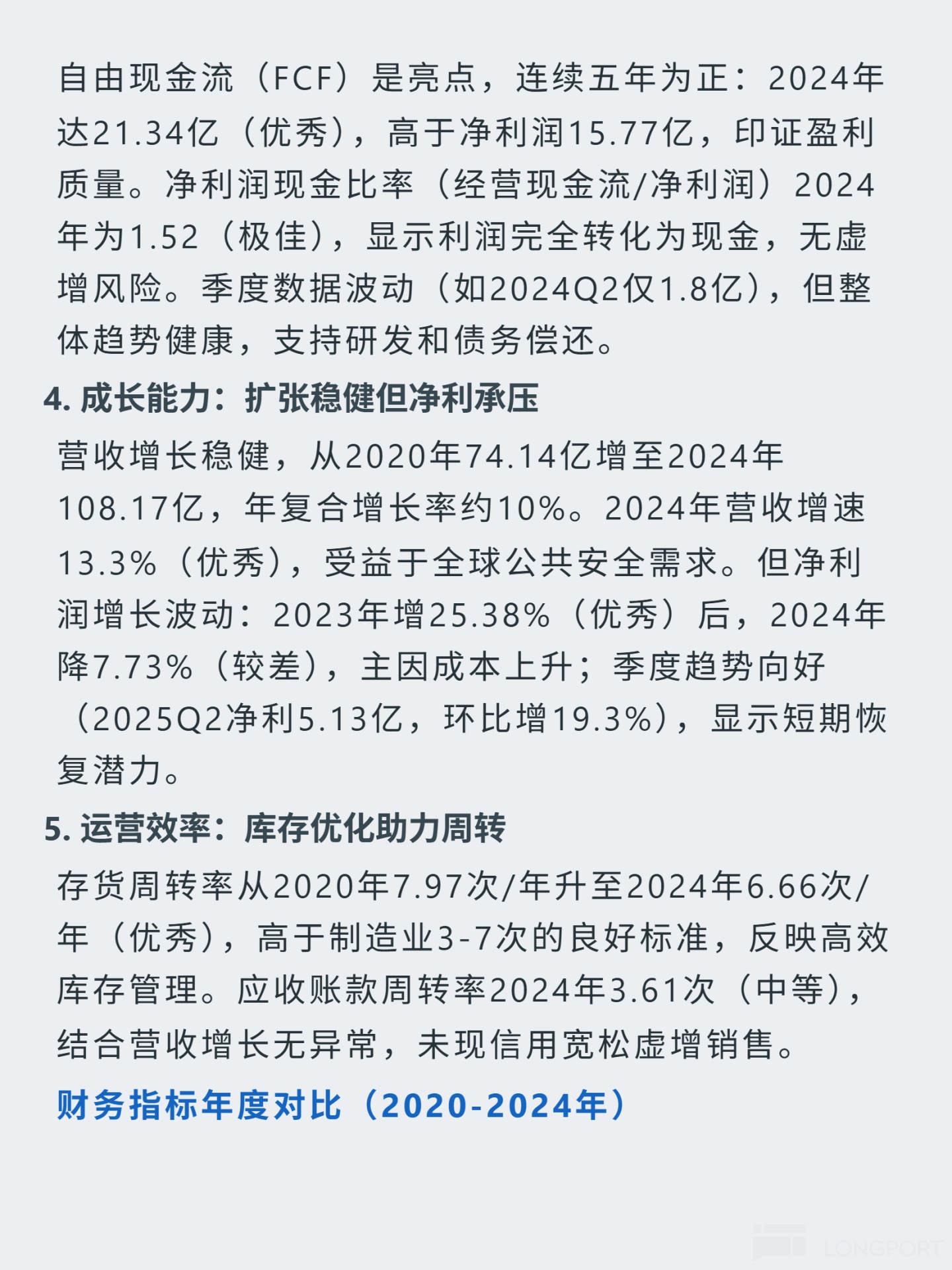

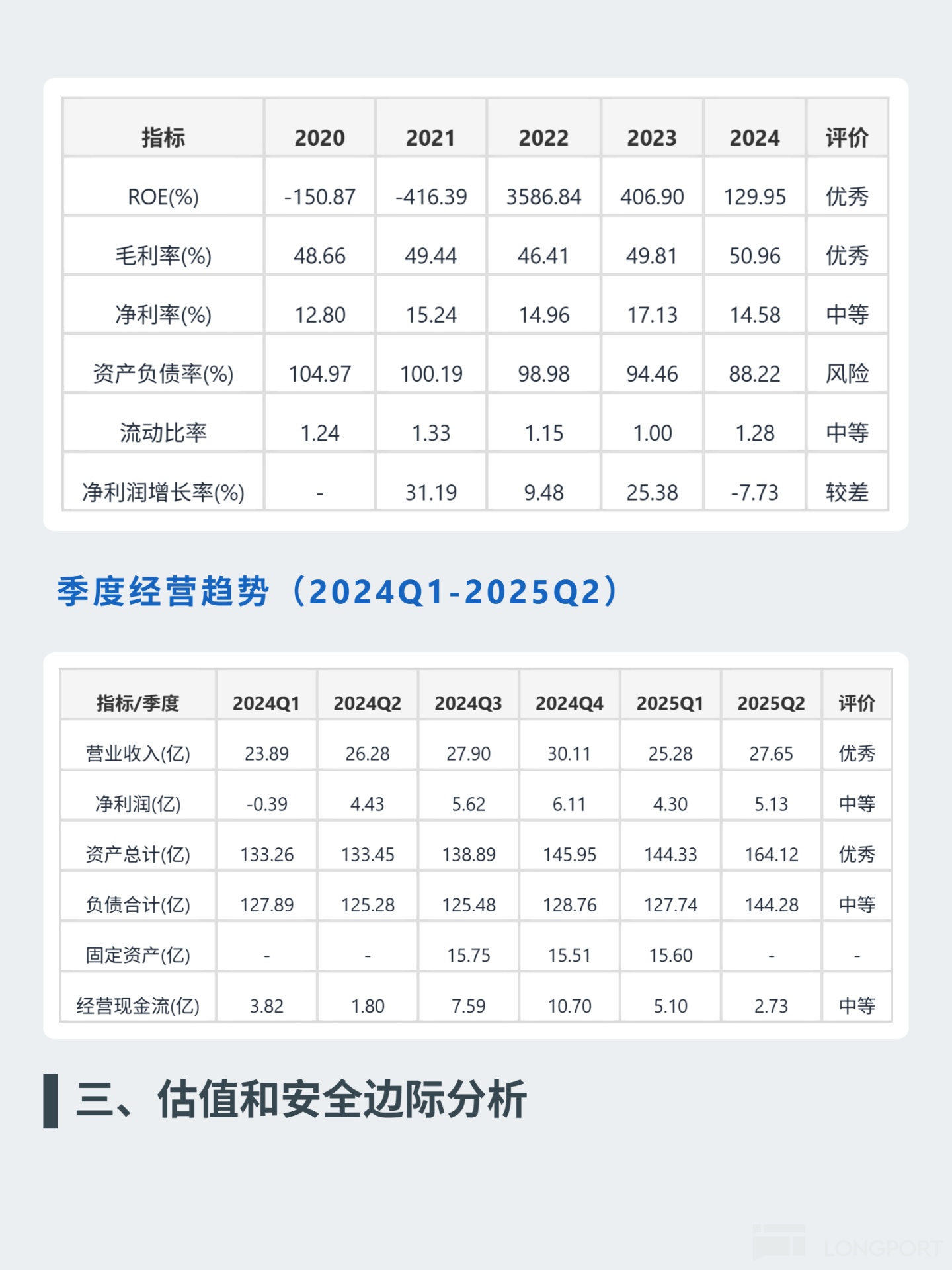

📈 Financial Highlights: Exceptional profitability with leverage dependence - 2024 ROE 129.95% (vs. 15% excellence benchmark), gross margin 50.96% (above 50% industry standard); positive FCF for 5 consecutive years (2024: $2.134B vs. net profit $1.577B); 10% revenue CAGR (2020: $7.414B → 2024: $10.817B) with 13.3% YoY growth in 2024; 2024 net profit declined 7.73% (mainly interest/tax expenses) but 2025Q2 net profit reached $513M (+19.3% QoQ); debt-to-equity ratio improved from 104.97% (2020) to 88.22% (2024) (still above 70% warning threshold); current ratio 1.73 (2025Q2) shows strong short-term liquidity; inventory turnover 6.66x (2024) exceeds manufacturing industry benchmark (3-7x).

$Huawei(HUAWEI.NA) $ZTE(00763.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.