Broadcom 4000-word in-depth research report

$Broadcom(AVGO.US)$Qualcomm(QCOM.US) $NVIDIA(NVDA.US) Recently researched Broadcom (AVGO.US), the core logic is its dual high-barrier semiconductor + software business model locked in global key clients, generating high-margin stable cash flow.

🎯Core business: Semiconductor solutions (data center, networking chips, custom ASICs for Microsoft/Meta) and infrastructure software (VMware, >60% virtualization market share), highly concentrated industry (data center switch chip CR3 >70%), clients include AWS, Azure etc. global cloud providers with essential digital infrastructure demand, less volatile than consumer electronics.

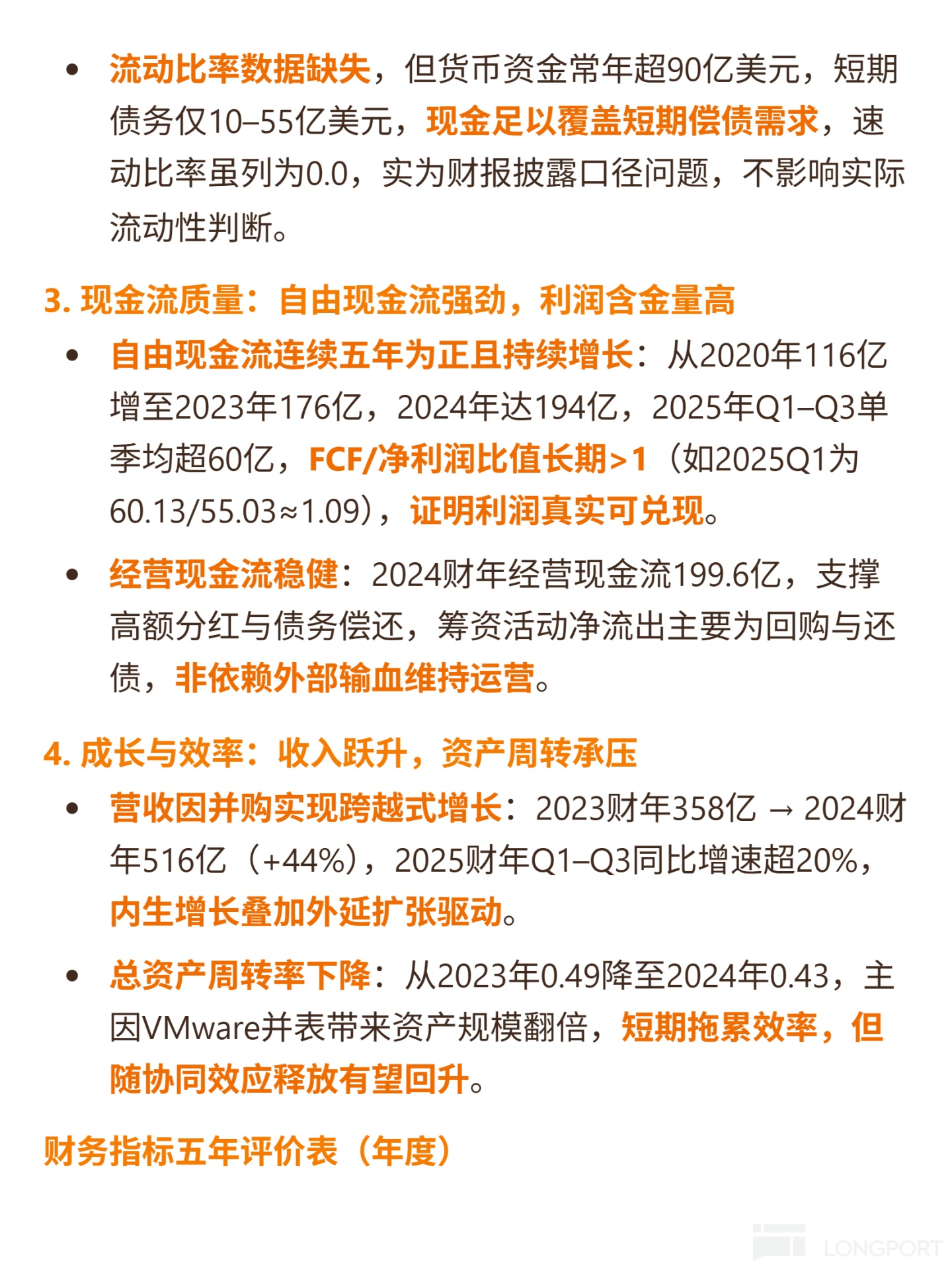

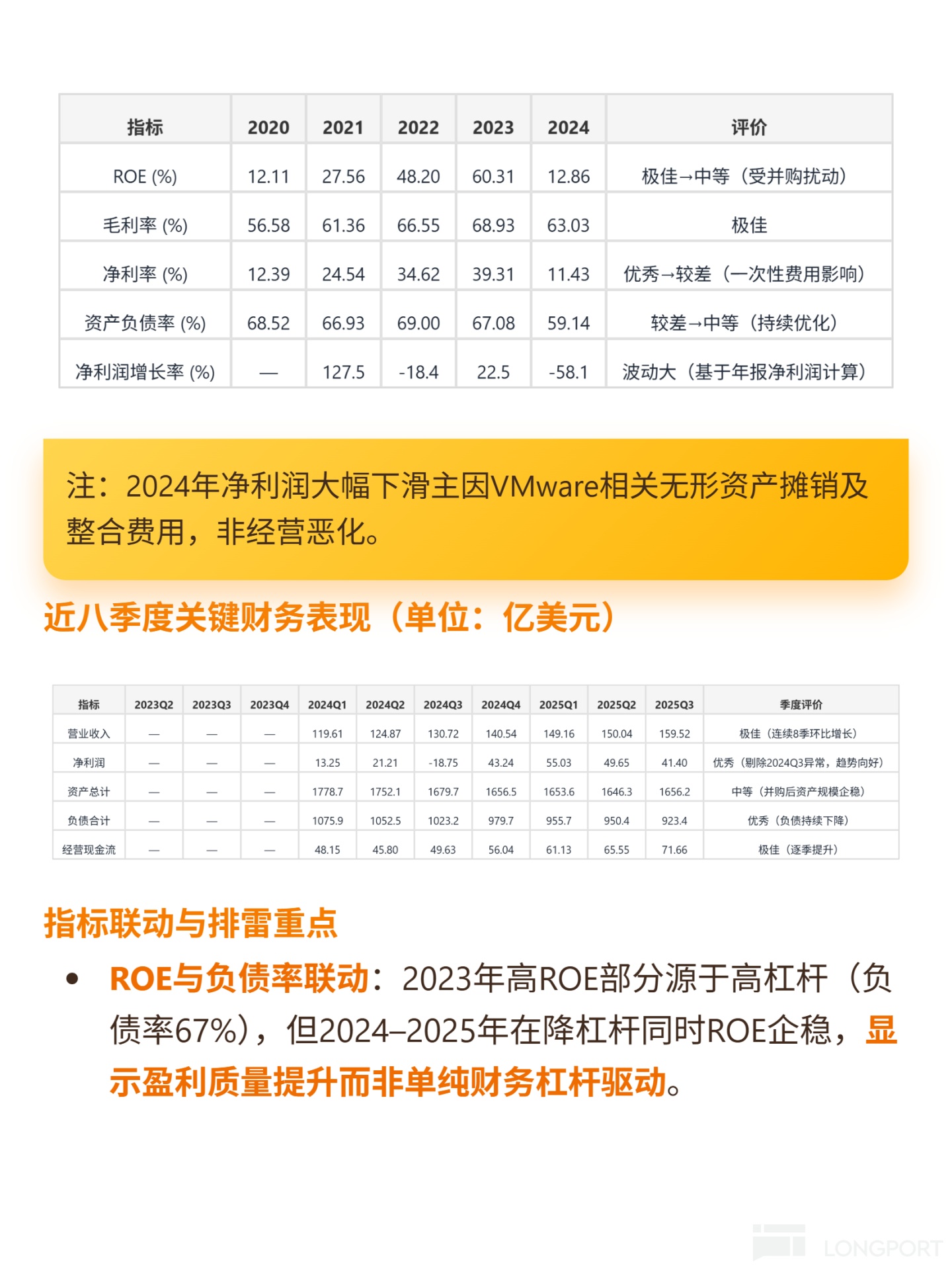

📈Financials: FY2023-2024 revenue grew from $35.8B to $51.6B (+44%), first three quarters of 2025 >20% YoY; long-term gross margin 60%+ (68.9% in 2023), software contributes 42% revenue but >60% profits; positive FCF for 5 consecutive years ($19.4B in 2024), FCF/net profit often >1 (~1.09 in 2025Q1); AI-related revenue grew >80% YoY in 2023.

🔍Risks: $97.8B goodwill (59% assets), potential impairment if VMware synergy underperforms; FY2024 net margin dropped to 11.4% due to M&A amortization but recovered to 25%-37% in 2025.

💰Leverage: Debt-to-asset ratio decreased from 67% to 55.8% in 2025, >$9B cash covers short-term debt, stable cash flow supports dividends/debt repayment.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.