Global Trading

Order Types

At-Auction Limit Order

A limit order with a specified price that is applicable to morning call auction sessions and closing call auction sessions. Orders of this type submitted during sessions other than those above will be temporarily stored in the system in the form of parked orders and placed during the next call auction session.

If order matching has been completed, but the order cannot be fully matched, the unmatched quantity will be converted into the applicable order type and carried over to the next applicable session, and will remain on the market until matched and executed.

Trading Hours

Morning Call Auction Session 9:00 - 9:22

Closing Call Auction Session 16:01 - 16:08

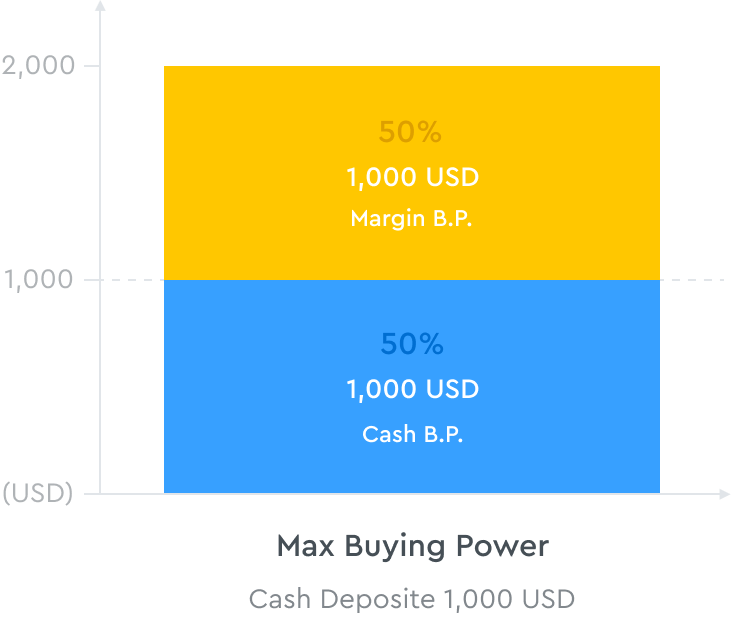

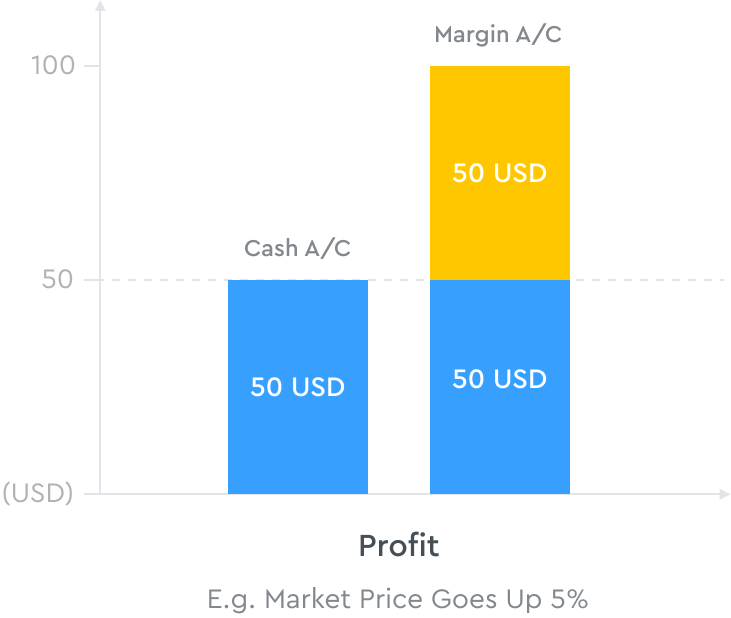

Margin Trading

To acquire more buying power from borrowing money from Longbridge for more profit, but also, at the same time, will take more risks.