With strong U.S. regulation, a robust fiscal and treasury model, and solid earnings reports, on the first day after the interest rate cut, the cryptocurrency market sees both "cryptos and stocks rising."

On the first day of the Federal Reserve's interest rate cut, the cryptocurrency market surged across the board, with Bitcoin breaking through $117,000, and the stock prices of digital asset exchanges skyrocketing. The shift in regulation, influx of funds, and impressive financial reports created a resonance effect: first, the SEC's new regulations shortened the approval time for digital asset ETFs from 240 days to 75 days, paving the way for more cryptocurrency ETFs; second, the treasury model gained popularity, with Cathie Wood teaming up with the UAE to bet $300 million on Solana treasury company; third, Bullish exchange turned a profit and obtained a regulatory license in New York

On the first day of the Federal Reserve's interest rate cut, the cryptocurrency market saw a comprehensive rise, with digital asset exchange stock prices soaring and Bitcoin breaking through the $117,000 mark. Analysts state that behind this strong performance lies a triple resonance of the shift in U.S. regulatory policies, an influx of funds from the treasury model, and impressive financial report data, driving the cryptocurrency market to a "simultaneous rise of coins and stocks."

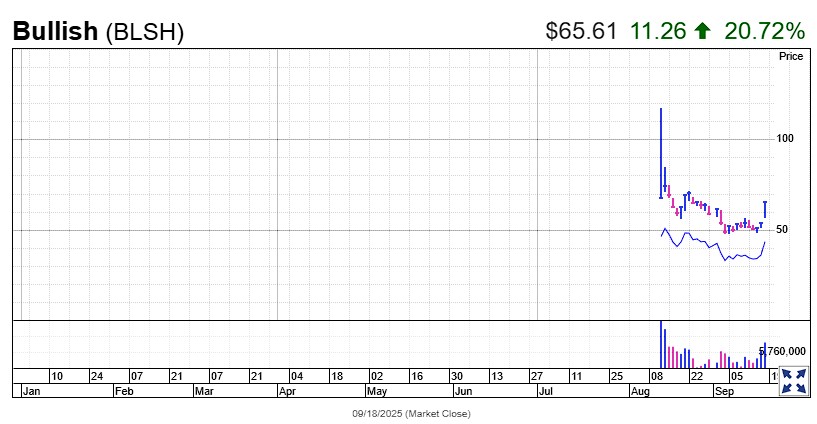

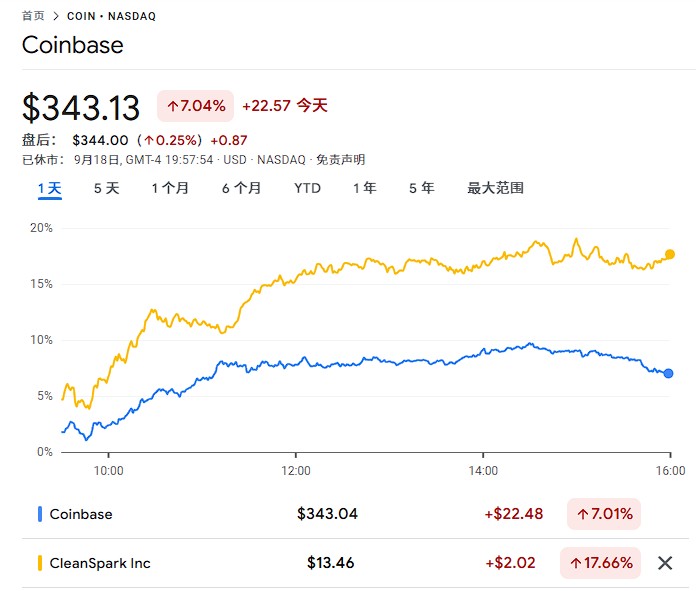

On Thursday (September 18), the newly listed Bullish exchange's stock price surged over 20%, Coinbase jumped more than 7%, and Bitcoin mining company CleanSpark soared nearly 18%. Meanwhile, the price of Bitcoin rose 1.5% to above $117,500, with a year-to-date increase of 26%. The market generally attributes this round of increase to factors such as the Federal Reserve's interest rate cut stimulus and improved regulatory environment.

The SEC approved new rules on Wednesday that establish a universal listing standard for digital asset ETFs, reducing the approval time from the previous 240 days to a maximum of 75 days. This milestone change is expected to pave the way for more cryptocurrency ETFs, such as Solana and XRP, further releasing institutional capital allocation demand.

At the same time, the treasury model represented by Solana has gained favor from star investors, with Cathie Wood partnering with the UAE to invest $300 million in a Nasdaq company to accumulate SOL tokens. The newly listed Bullish exchange has delivered a turnaround profit report after obtaining a New York regulatory license.

Analysts point out that the expectations of easing brought by the Federal Reserve's interest rate cut, along with a series of favorable factors such as regulatory shifts, are driving a revaluation of the entire digital asset ecosystem.

SEC New Rules Open ETF Floodgates, Approval Accelerated by 75%

According to previous articles mentioned, the SEC voted on Wednesday to approve rule changes for three national securities exchanges, clearing key obstacles for the comprehensive opening of the digital asset ETF market. The new rules establish a universal listing standard, fundamentally changing the cumbersome process of case-by-case review.

Under the new standard, asset management companies and exchanges can now apply for new cryptocurrency spot ETFs based on unified standards, with approval times significantly shortened from the previous 240 days or longer to a maximum of 75 days. This change is seen as a watershed moment in the U.S. regulatory approach to digital assets.

Teddy Fusaro, president of Bitwise Asset Management, stated: "This overturns over a decade of precedent since the first Bitcoin ETF application in 2013." Steve Feinour, a partner at the law firm Stradley Ronon, expects that the first products may be listed as early as October. **

The market generally expects that the ETFs tracking Solana and XRP will be among the first products approved under the new rules. Asset management companies began submitting these applications to the SEC over a year ago, but the regulator had only approved Bitcoin and Ethereum spot ETFs previously. This is highly consistent with the Trump administration's policy direction to mainstream digital assets.

Just on Thursday, the Rex-Osprey Dogecoin ETF has begun trading. In addition to the Dogecoin ETF, Rex Financial and Osprey Funds will also launch the first XRP ETF in the U.S. and have applied to issue the $TRUMP ETF, which invests in Trump's personal meme coin. The management fee for the Dogecoin ETF is 1.5%, while the XRP fund is 0.75%, and both funds will be listed on the Cboe exchange. Currently, there are 90 to 100 cryptocurrency ETF applications awaiting approval, and analysts expect these products to be approved.

Cathie Wood Bets $300 Million on Solana Treasury Model

According to a report, renowned investor Cathie Wood has teamed up with the UAE to invest $300 million in Brera Holdings, which is listed on Nasdaq. The company will transform into a treasury company specializing in accumulating Solana tokens and will be renamed Solmate. Following the announcement, the company's stock price surged by 592% at one point, closing with a gain of 225%.

To inject strong momentum into the transformation, Solmate has assembled an impressive executive team. Marco Santori, a legal pioneer in the crypto industry, will serve as CEO, and economist Arthur Laffer, known for the "Laffer Curve" theory, will join the board. It is reported that after Laffer confirmed his joining, Cathie Wood quickly decided to invest in Solmate.

Despite the increasingly crowded field, Solmate seeks a differentiated advantage through deep cooperation with the Solana Foundation. The Solana Foundation will sell some tokens to Solmate at a discounted price and will receive two board seats. In return, Solmate will collaborate with the foundation on projects in the UAE and share related revenues.

This business model essentially emulates the successful precedent of MicroStrategy transforming into a "Bitcoin treasury company." By accumulating cryptocurrencies through issuing stocks or bonds, these companies aim to drive their stock prices to exceed the value of their held crypto assets. According to statistics, over 100 companies have adopted this strategy.

Bullish Turns Profit, Approved for U.S. Business License

According to a previous article from Jianwen, the newly listed cryptocurrency exchange Bullish on the New York Stock Exchange has released its first earnings report as a public company, achieving a net profit of $108.3 million, in stark contrast to a net loss of $116.4 million in the same period last year. It has also obtained the New York BitLicense, clearing the final hurdle for entering the U.S. market.

CEO Tom Farley stated that the New York BitLicense is the "last key project" for the company to launch its business in the U.S. The company expects adjusted earnings for the third quarter to be between $12 million and $17 million, with adjusted revenue projected to be between $69 million and $76 million.

Bullish's ambitions extend beyond the exchange business. Farley clarified the strategic positioning of its CoinDesk brand to create the "MSCI of the cryptocurrency space." A trust product based on the CoinDesk 5 index, in collaboration with Grayscale, has been approved by the SEC to convert into an ETF. As of June 30, the assets under management linked to the CoinDesk index have reached $41 billion