LIVE MARKETS-From election heat to AI hype, ING maps US growth path

ING's Chief U.S. International Economist, James Knightley, forecasts U.S. growth in 2026, highlighting looser financial conditions, tariff concessions, and AI investment as key drivers. The upcoming elections may push for a $2000 'tariff dividend' for lower-income households. However, concerns about an AI bubble burst pose risks, as it could impact high-income earners who drive growth. Despite fears, AI's role remains crucial for economic stability.

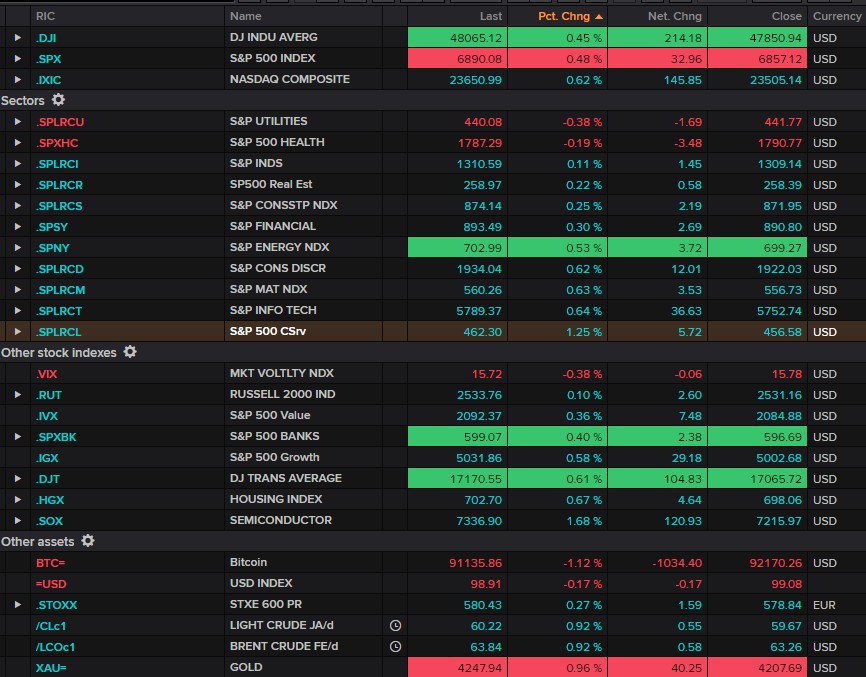

Main US indexes rise slightly: Nasdaq leads, up ~0.1%

Energy leads S&P 500 sector gainers; Utilities weakest group

Euro STOXX 600 index falls ~0.01%

Dollar edges red; bitcoin off >3%; gold, crude rise

US 10-Year Treasury yield edges up to ~4.14% Welcome to the home for real-time coverage of markets brought to you by Reuters reporters. You can share your thoughts with us at

FROM ELECTION HEAT TO AI HYPE, ING MAPS US GROWTH PATH

Tariff dividend payments, looming elections and worries about what would happen if the AI bubble bursts are elements considered by ING’s Chief U.S. International Economist James Knightley as he estimates the prospects for U.S. growth in 2026. Knightley remains broadly upbeat about growth, citing looser financial conditions, U.S. President Donald Trump’s willingness to make tariff concessions as well as his proposed “tariff dividend” payments that could benefit lower-income households.

With all house seats and 35 Senate seats up for grabs during November’s midterm elections, ING says it could mean a bigger push from Trump for the $2000 ‘tariff dividend’ for lower income households and increased interference over monetary policy.

Knightley expects high-income households and the tech sector to be the main growth drivers for the first half of the year and AI investment - which has played a big role in the economy through 2025 - to continue to contribute in 2026.

However, a question floated during Friday’s outlook call about the biggest risk in 2026 had 26% of the audience pressing the ‘AI bubble bursting’ option in live polling.

ING analysts wrote in a note that an AI bubble burst “would be a major problem for the US economy.” While they say fears of recession sans AI investment may be overdone, AI’s importance cannot be understated.

They estimate that the top 20% earners own 71% of the wealth and so, with AI valuations surging, these richer consumers have kept up with spending while other households have come under pressure. So a popped bubble would mean a key driver of growth would suffer.

(Twesha Dikshit)

EARLIER ON LIVE MARKETS: WALL STREET INDEXES LOOK TO END THE WEEK STRONG AFTER DATA CLICK HERE BOFA SEES REGULATORY U-TURN PUTTING EUROPEAN AUTOS BACK IN THE DRIVER’S SEAT CLICK HERE INDIVIDUAL INVESTOR BULLS CHARGE, BEARS RETREAT - AAII CLICK HERE SPAIN SHINES AS CITI LIFTS EURO ZONE GDP GROWTH FORECAST CLICK HERE EUROPEAN AUTOS: RUNNING ON EMPTY OR ABOUT TO SHIFT GEARS? CLICK HERE STOXX 600 HEADS FOR WEEKLY RISE CLICK HERE EUROPE BEFORE THE BELL: FUTURES IN THE GREEN CLICK HERE FIRMING FED CUT BETS BUOY STOCKS, UNDERCUT DOLLAR CLICK HERE

Wall Street indexes climb