ETH/BTC Ratio

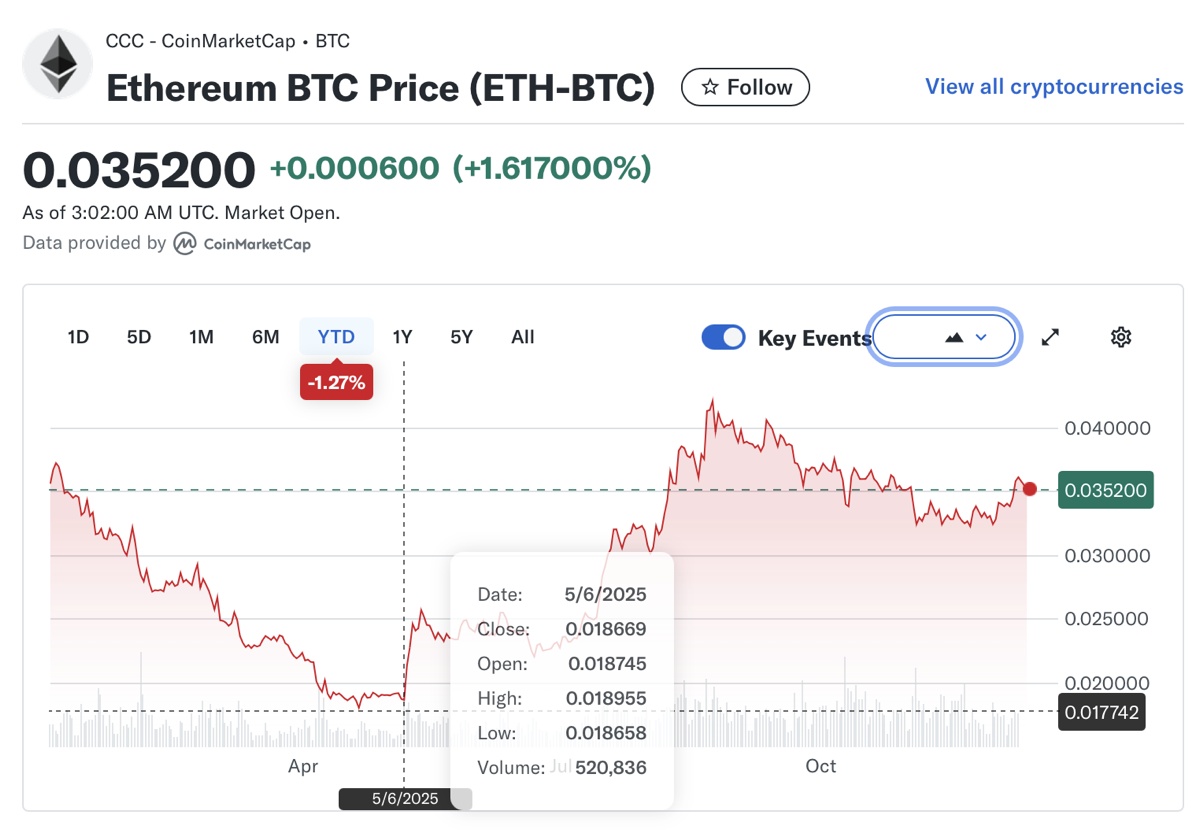

An important data point is the ETH/BTC Ratio, which reflects the relationship between ETH and BTC. If one acknowledges ETH's niche in the on-chain traditional finance ecosystem, ETH will have a narrative independent of BTC. This ratio suddenly accelerated in May 2025, coinciding with the peak of stablecoin momentum, as multiple companies announced transitions to DAT, and institutions like Peter Thiel and ARK began entering the market. Even after the crypto downturn post-10.10, this ratio remained in the 3%–4% range, nearly doubling from the May low.

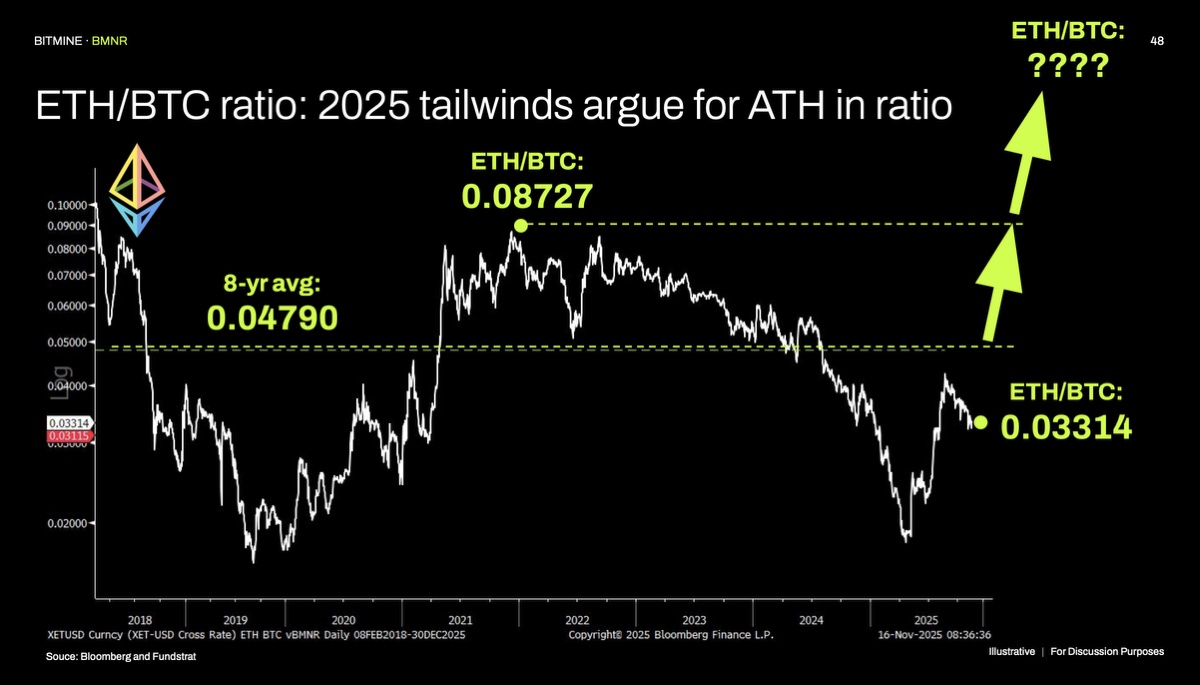

Looking at the longer-term picture, which is the core logic behind Tom Lee's ETH price projection, the ETH/BTC ratio averaged 4.7% over the past 8 years, with a historical high of 8.7%. Currently at 3.5%, combined with ETH's narrative shift this year, it is undervalued.

The key driver behind this ratio's rise is the increasing buy-in from institutional investors into ETH's ecosystem narrative. Narrative shifts take time (Google is a prime example—it took nearly 2 years to transition from an OpenAI valuation hit to an AI juggernaut narrative). BMNR's vision is to play a bigger role in this narrative, acting as a bridge between traditional finance and the crypto ecosystem.

$IShares Ethereum Trust ETF(ETHA.US) $BitMine Immersion Tech(BMNR.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.