What is Total Shareholder Return ?

2180 reads · Last updated: December 5, 2024

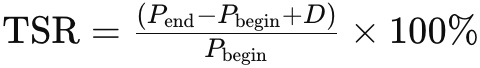

Total Shareholder Return (TSR) is a key metric that measures the total returns generated by a company for its shareholders over a certain period. It includes both dividend income and capital gains. Specifically, TSR represents the total gains a shareholder receives from holding a company's stock over a specific period, including stock price appreciation and reinvested dividends. The formula for calculating TSR is:where Pend is the ending stock price, Pbegin is the beginning stock price, and D is the total dividends paid during the period. TSR provides a comprehensive view of the actual returns received by shareholders, making it an essential metric for investors to assess a company's performance.

Definition

Total Shareholder Return (TSR) is a key metric that measures the total return a company generates for its shareholders over a specific period. It includes both dividend income and capital appreciation. Specifically, TSR refers to the total earnings shareholders receive from holding a company's stock over a certain period, including stock price appreciation and reinvested dividends. The formula for TSR is:

Origin

The concept of Total Shareholder Return originated in the late 20th century as investors sought more comprehensive ways to evaluate company performance. It was initially used to help investors understand the value created for shareholders beyond just stock price changes.

Categories and Features

TSR can be divided into two main components: dividend income and capital appreciation. Dividend income refers to the cash dividends paid to shareholders during a specific period, while capital appreciation refers to the increase in stock price. The advantage of TSR is that it provides a comprehensive reflection of shareholders' actual returns, but its disadvantage is that it may be affected by market volatility.

Case Studies

A typical example is Apple Inc., which has maintained a high TSR over the past decade due to its consistently rising stock price and stable dividend payments. Another example is Coca-Cola, which has provided substantial total returns to shareholders through long-term dividend payments and steady stock price growth.

Common Issues

Common issues investors face when using TSR include accurately calculating reinvested dividend returns and assessing the reliability of TSR amid market volatility. Typically, investors need to use other financial metrics in conjunction to comprehensively evaluate a company's performance.