Trending | GTLB Plummets 12% on Wednesday, Some Put options Soar 126%

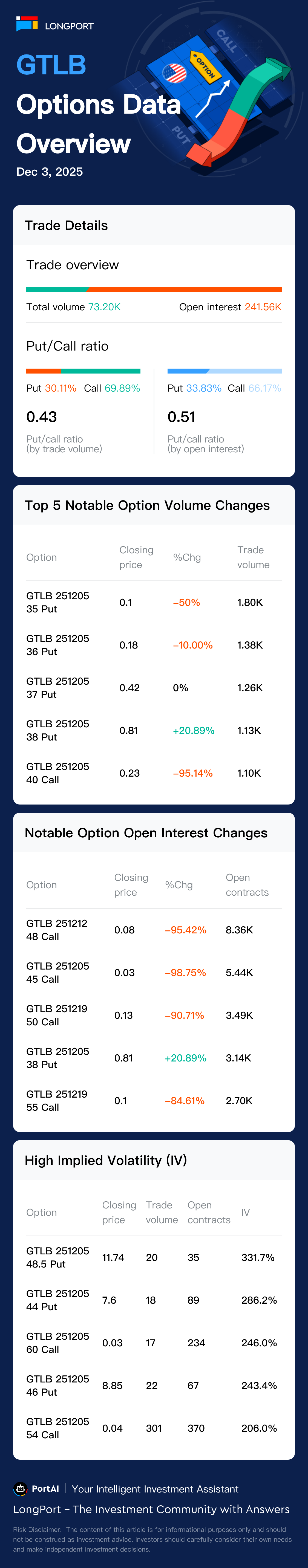

On December 3, Eastern Time, GitLab options saw a total of 73199 contracts traded, with calls accounting for 69% and puts making up 30%.

On December 3, Eastern Time, GitLab options saw a total of 73199 contracts traded, with calls accounting for 69% and puts making up 30%.

GitLab has 241563 contracts outstanding, with calls accounting for 66% and puts making up 33%.

The top volume gainer was the 35 dollars Put option expiring on December 5, 2025, with 1802 contracts traded.

On the news front, Based on recent key news:

1. Dec 3, GitLab's Q3 results and Q4 guidance disappointed investors, leading to an 8.5% premarket drop. The company's revenue forecast was in line with estimates, but seen as conservative due to government shutdown impacts. Six brokerages cut price targets. Source: LSEG

2. Dec 3, Analysts expressed concerns over GitLab's slowing net revenue retention and customer growth, citing AI-driven challenges. The net retention rate fell to 119%, below expectations. Multiple firms lowered price targets. Source: Bloomberg Intelligence

3. Dec 3, GitLab's strategic changes, including a new CFO appointment, aim to address growth challenges. Despite efforts, analysts remain cautious about near-term revenue upside. Source: WSJTech sector faces AI-driven growth challenges.

Please note: The chart below does not include options expiring within five days.