Trending | PATH Surges 24% on Thursday, Some Call options Soar 334%

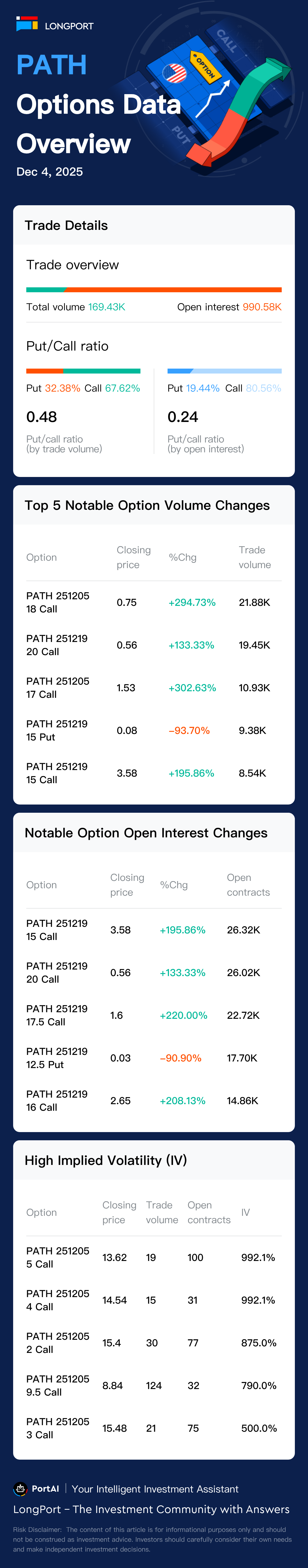

On December 4, Eastern Time, UiPath options saw a total of 169432 contracts traded, with calls accounting for 67% and puts making up 32%.

On December 4, Eastern Time, UiPath options saw a total of 169432 contracts traded, with calls accounting for 67% and puts making up 32%.

UiPath has 990581 contracts outstanding, with calls accounting for 80% and puts making up 19%.

The top volume gainer was the 18 dollars Call option expiring on December 5, 2025, with 21879 contracts traded.

On the news front, Based on recent key news:

1. Dec 3, UiPath reported strong Q3 results, exceeding expectations with $411 million in revenue and $88 million in non-GAAP operating income, leading to a stock surge. Analysts praised the performance, with Canaccord Genuity raising the price target to $19. Source: Benzinga

2. Dec 4, RBC raised its price target for UiPath to $16, maintaining a sector perform rating, contributing to positive market sentiment. Source: MT Newswires

3. Dec 5, BMO Capital increased UiPath's price target to $17, reflecting confidence in the company's growth prospects. Source: MarketBeatAI and automation sectors show strong growth potential.

Please note: The chart below does not include options expiring within five days.