Company Encyclopedia

View More

CATHAY PAC AIR

00293.HK

Cathay Pacific Airways Limited, together with its subsidiaries, offers international passenger and air cargo transportation services. The company provides airline operations, including catering, cargo terminal operations, ground handling services, and commercial laundry operations, as well as scheduled services. The company operates in the Americas, Europe, Southeast Asia and Oceania, North Asia, South Asia, the Middle East, and Africa. As of June 30, 2025, it operates 234 aircraft and 93 new passenger and freighter aircraft.

422.15 B

00293.HKMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

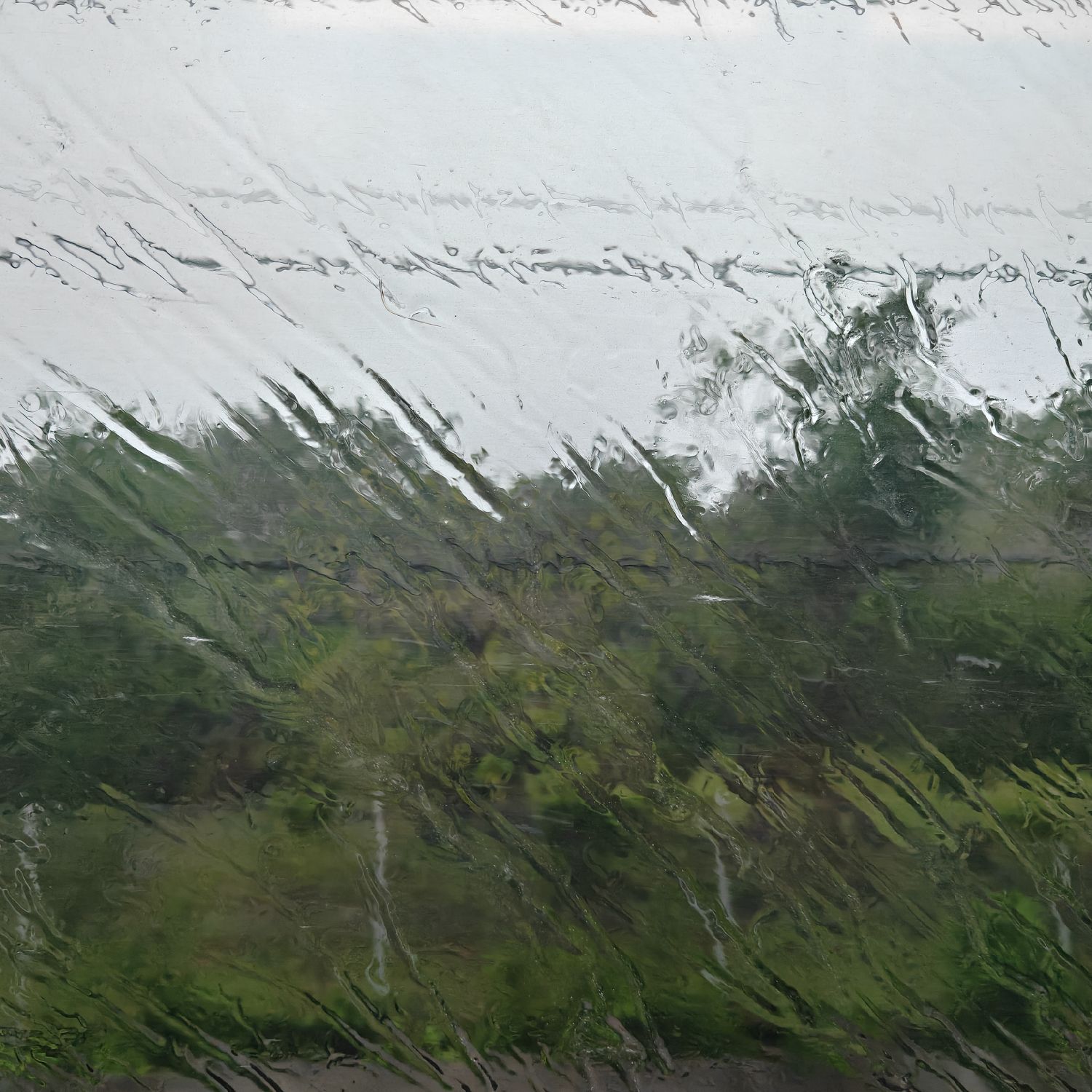

Heavy rain, can the plane take off on time? Cathay Pacific's pilots are very strong. 😄 Happy weekend

Flying around, Cathay Pacific is still the best choice.

Back to Hong Kong.

This time I chose the new headphones, the previous BOSE QC35II was disliked. This time I chose the most fashionable one.

$XTALPI(02228.HK)The Cathay Pacific lounge at Hong Kong Airport is truly an amazing lounge. The pinnacle of service among global airlines. Taking a break from busy schedule to have breakfast before bo...