Company Encyclopedia

View More

Bank of America

BAC.US

Bank of America Corporation, through its subsidiaries, provides various financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. The company operates through four segments: Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, and Global Markets. The Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and IRAs, checking accounts, and investment accounts and products; credit and debit cards; residential mortgages and home equity loans; and direct and indirect loans, such as automotive, recreational vehicle, and consumer personal loans. The GWIM segment provides investment management, brokerage, banking, and trust and retirement products and services; wealth management solutions; and customized solutions, including specialty asset management services.

6.562 T

BAC.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

$Bank of America(BAC.US) and $Financial Select Sector SPDR Fund(XLF.US) both hit 52 week high list today. None in trade account but do own in investment/spec/gamble account

Source: Sunrise Trader

$Bank of America(BAC.US) ex-divy today. $0.28 per share.

Source: Sunrise Trader

🚀 Super Earnings Week is Here! US Tech Giants Report Results, 100,000 Task Coins Prize Pool Ready (10/27-10/31)

📢 Major Announcement! Earnings season is Heating Up!

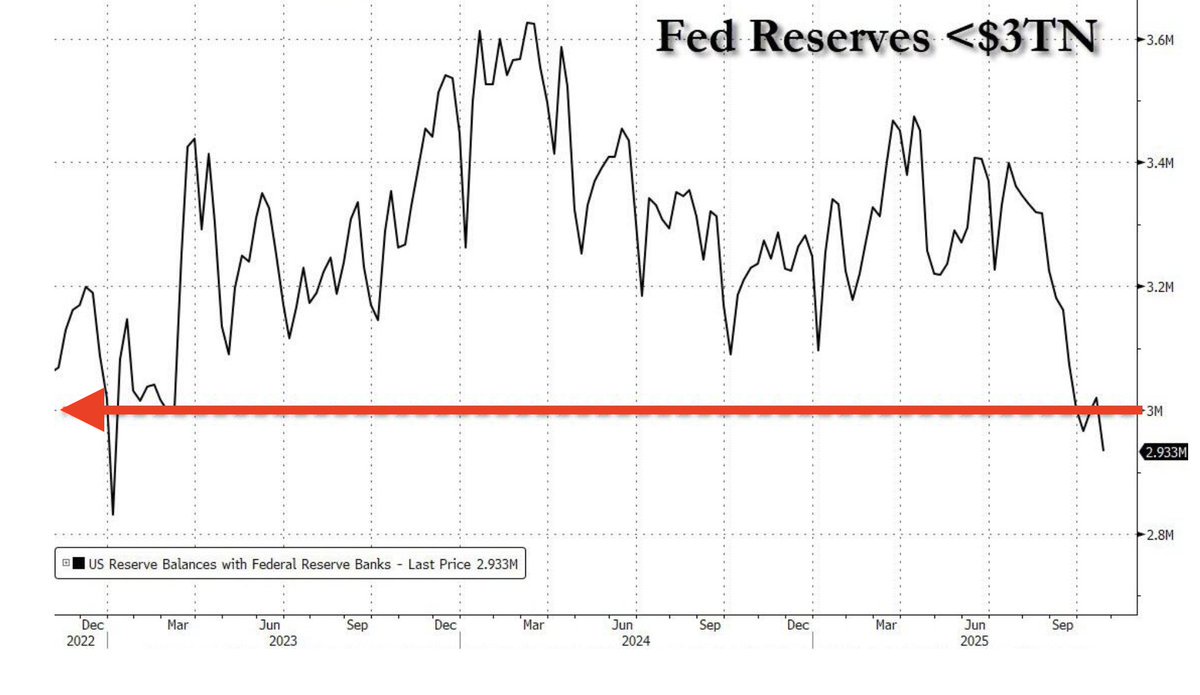

Get ready — this week (October 27–31), five of the Magnificent Seven — $Agilent Tech(A.US)gilent Tech(A.US)pple (AAPL.US), $Macys(M.US)acys(M.US)ic........................Fed reserves just slipped under $3 trillion again, sitting at $2.933 trillion for the week ending October 22, down another $59 billion.

That’s the second week in a row below the $3T mark, and the dec..................Summary of Q3 2025 financial reports of the four major US banks and verification of post conclusions

X post (from @tonyhua64243679) discussed the latest financial reports of the four major U.S. banks (JPMorgan Chase, Bank of America, Citigroup, Wells Fargo), concluding that there is no need to panic....