Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

LULU 3Q25 First Take: overall a beat against a low bar. Overall, the quarter came in better than muted expectations.

After two straight guide-downs, Q3 results topped the high end of guidance with reve...

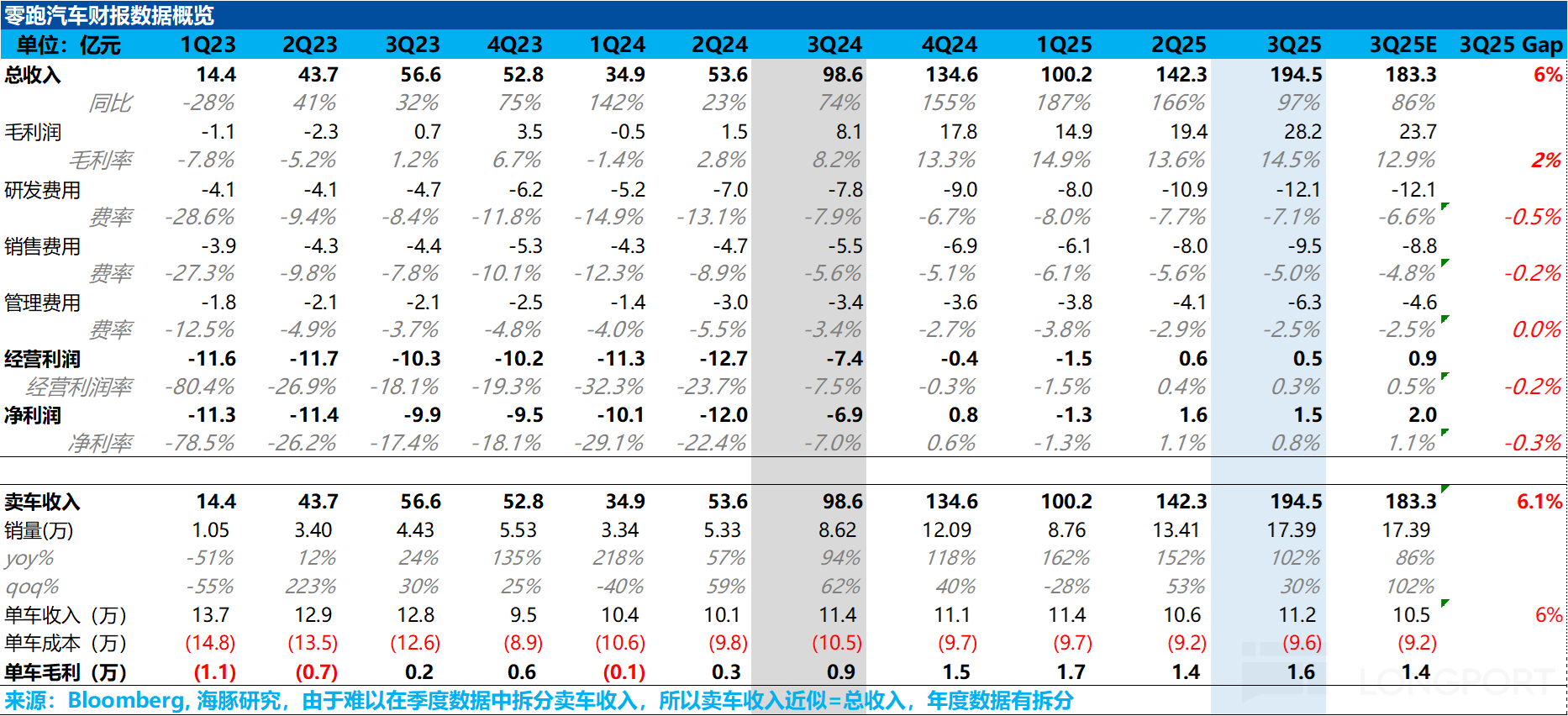

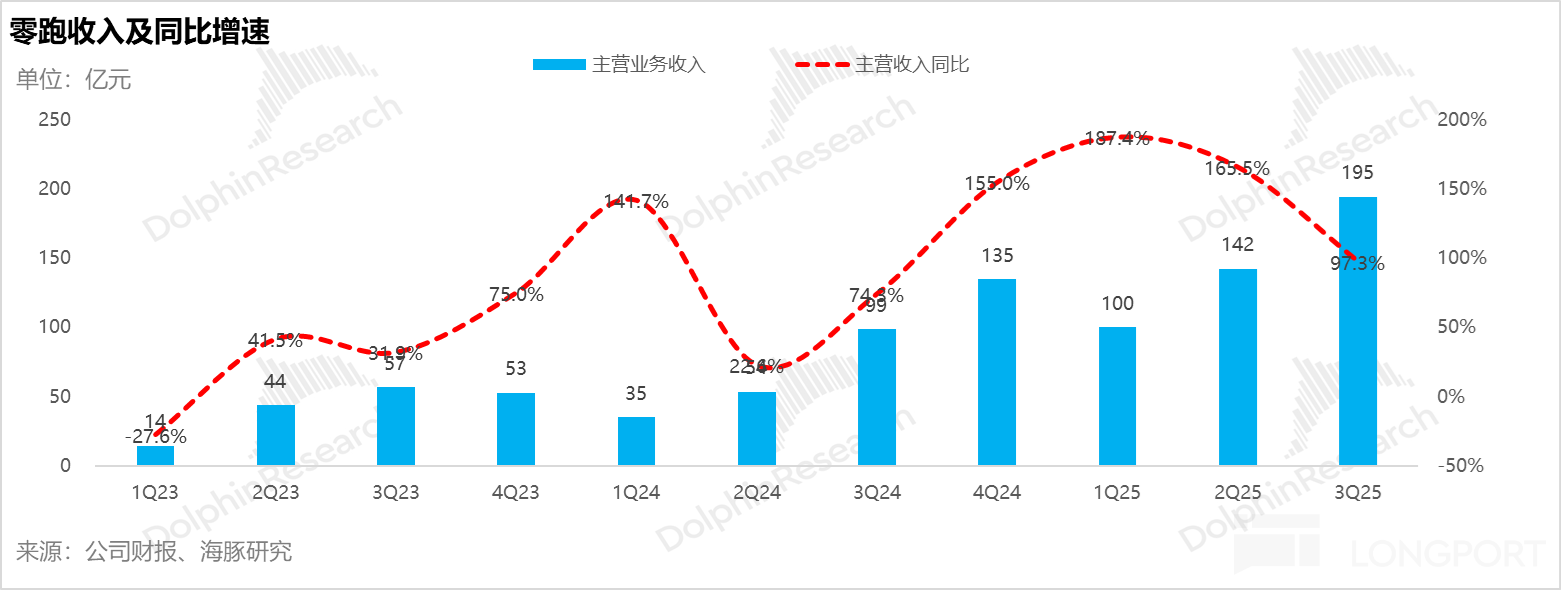

The significant increase in the three expenses has eroded Leapmotor's net profit.

$Palantir Tech(PLTR.US) released its Q3 2025 earnings after the market closed on November 3rd, Eastern Time. Overall, the Q2 performance remains impressive. Although the guidance and operational indic...

Hello everyone, I am Dolphin Research! $Meta Platforms(META.US) released its Q3 2025 financial report after the market closed on October 30th, Eastern Time. Although the 'horrifying' net profit of 2.7...

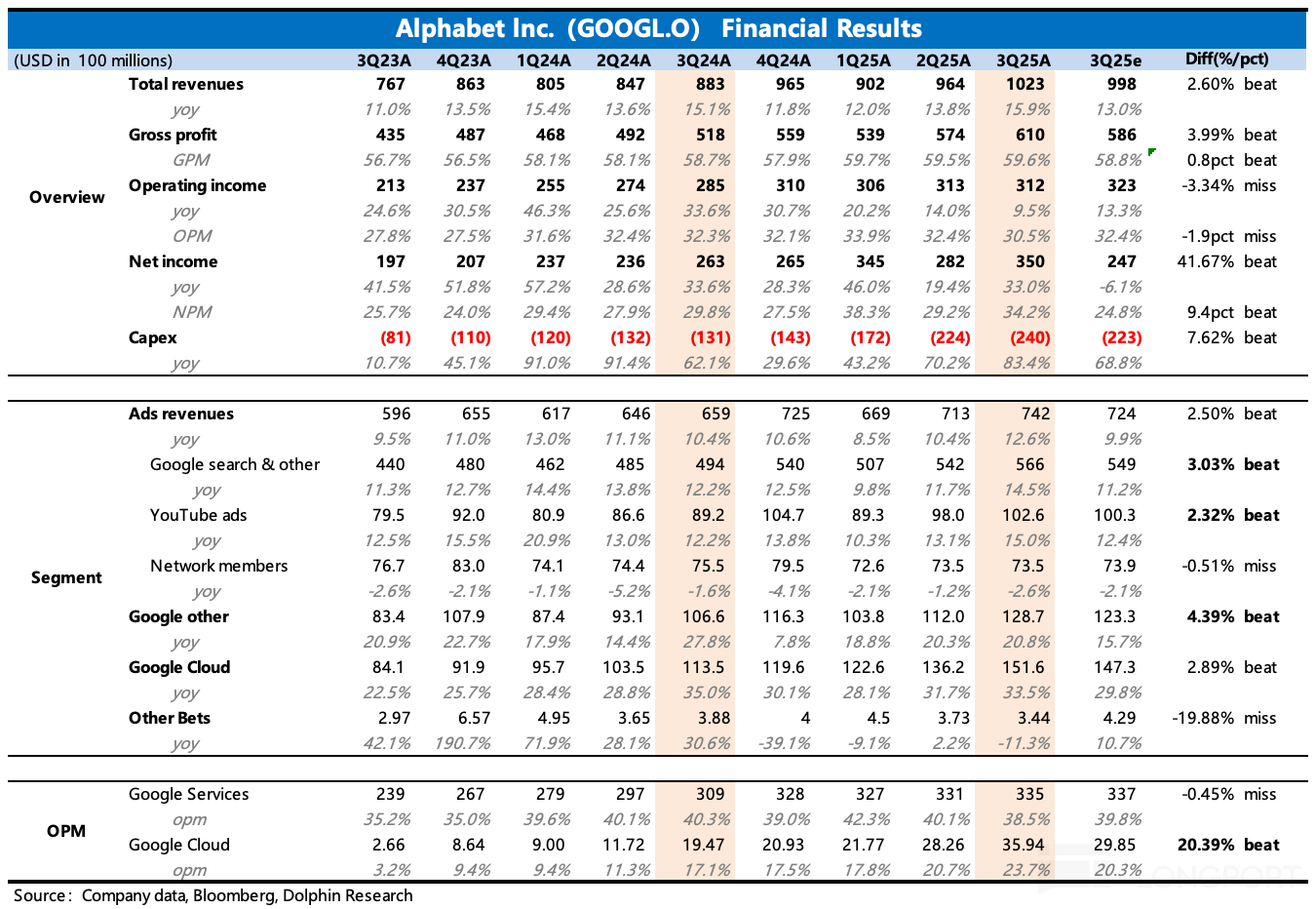

After the market closed on October 29th, Eastern Time, $Alphabet(GOOGL.US) $Alphabet - C(GOOG.US) parent company Alphabet released its Q3 2025 financial report. After two months of revaluation under t...