Company Encyclopedia

View More

TE Connectivity

TEL.US

TE Connectivity plc, together with its subsidiaries, manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas. The company operates through two reportable segments, Transportation Solutions and Industrial Solutions. It provides antennas, application tooling, cable assemblies, connectors, electromagnetic compatibility/electromagnetic interference solutions, energy and power, fiber optics, heat shrink tubing, identification and labeling, medical components, passive components, relays and contactors, sensors, switches, terminals and splices, wires and cables, and wire protection and management solutions. The company also offers training and other services, including 3D printing for production, back shells prototyping, electrical installation training, HarnWare software, machine tooling service and repair, medical device design services, microfluidic devices, and sensor manufacturing services as well as conducts automotive webinars.

681.78 B

TEL.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

In-depth Strategic Analysis Report on Japan's Top 10 Business Giants: Core Competencies, Global Competitiveness, and Future Outlook (2025 Edition)

Written in front, unfortunately, Longbridge still cannot directly purchase Japanese stock market stocks. However, I currently hold some Hitachi-related assets through other channels. Making a little p...

$Veeco Instruments(VECO.US) $Applied Materials(AMAT.US) $COTN $TE Connectivity(TEL.US) $KLA(KLAC.US) $Lam Research(LRCX.US)

来源: Chips & Wafers

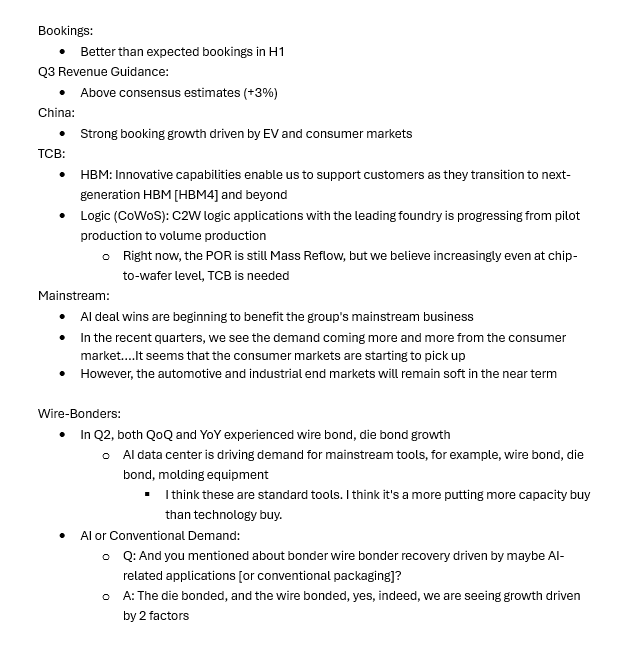

Fantastic report and call from #ASMPT ($ASMPT(522.HK)) with numerous industry implications:

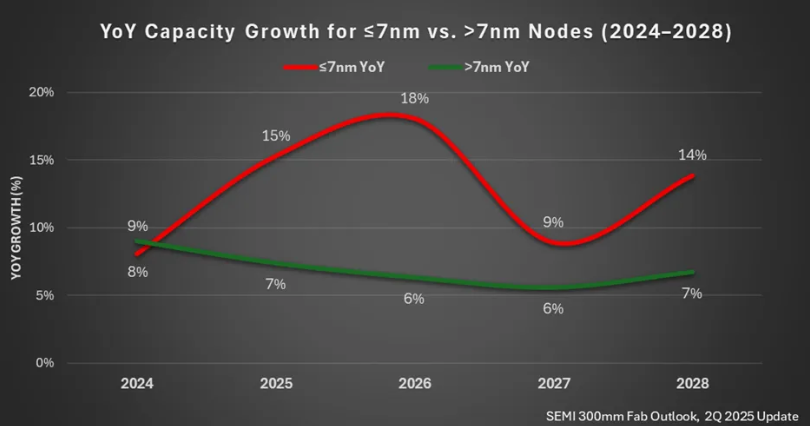

Here are some of the key points:· Booking and Q3 revenue guide above expectations· China demand strong; EV an...........................SEMI Forecasts 69% Growth in Advanced Chipmaking Capacity Through '28.

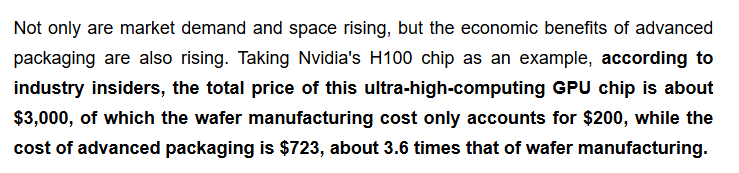

👉Capex on advanced process equipment is expected to increase +94% vs. '24.👉Investment in 2nm and below wafer equipment is proje...............We have heard a lot about Front-End China localization; that is China producing their own Front-End tools to replace international suppliers like $Applied Materials(AMAT.US)

$Lam Research(LRCX.US) $KL.....................