Company Encyclopedia

View More

Zhihu

ZH.US

Zhihu is a premium Q&A community and original content platform in the Chinese internet, known for its professional and friendly community atmosphere as well as diverse content formats.

10.720 T

ZH.USMarket value -Rank by Market Cap -/-

Valuation analysis

P/E

1Y

3Y

5Y

10Y

P/E

-

Industry Ranking

-/-

- P/E

- Price

- High

- Median

- Low

P/B

1Y

3Y

5Y

10Y

P/B

-

Industry Ranking

-/-

- P/B

- Price

- High

- Median

- Low

P/S

1Y

3Y

5Y

10Y

P/S

-

Industry Ranking

-/-

- P/S

- Price

- High

- Median

- Low

Dividend Yield

1Y

3Y

5Y

10Y

Dividend Yield

-

Industry Ranking

-/-

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

News

View More

Posts

View More

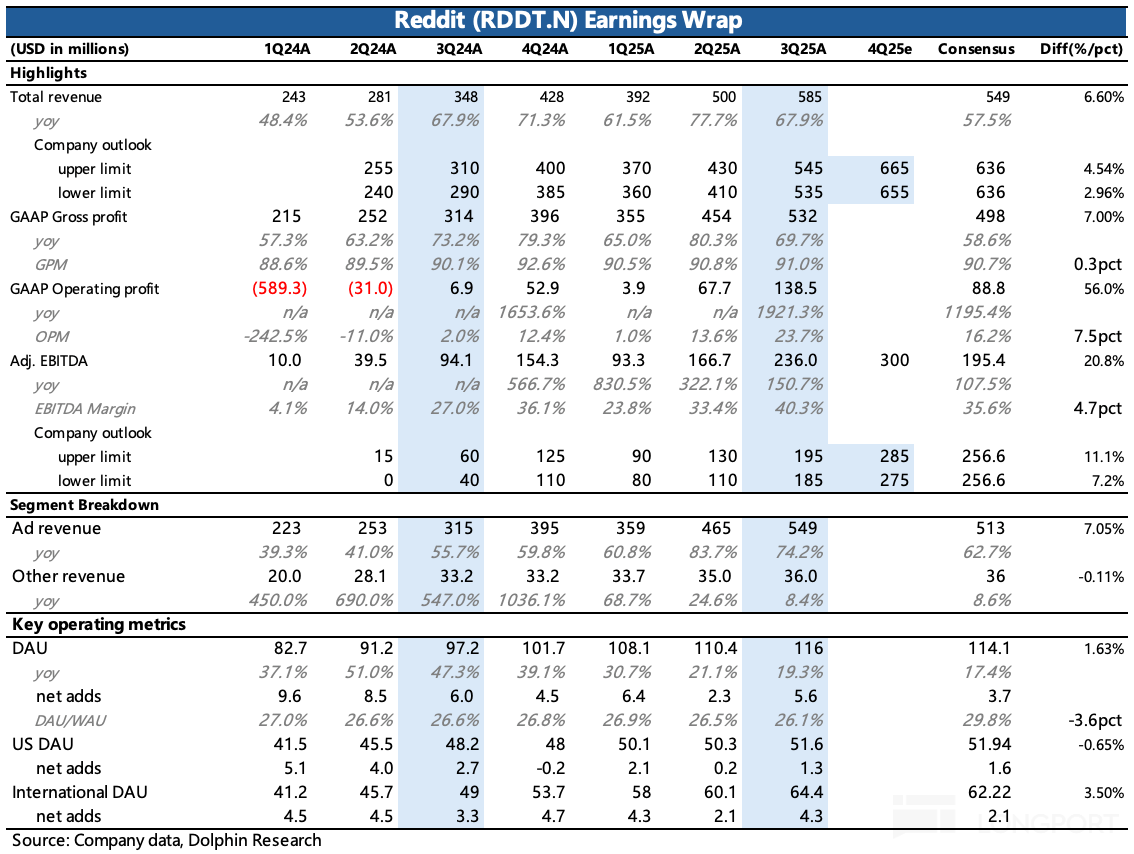

Reddit: Another unexpected surge, how to view the correction of expectation differences before and after the earnings report?

Discussing the third-quarter report of $Reddit(RDDT.US), this time it is actually similar to the situation in the second quarter, also involving a process of expectation correction: 1. Before the earn...

Reddit: The American version of "Zhihu + Tieba", how does it manage to sprout new growth from an old tree?

Indirectly riding on the east wind of AI