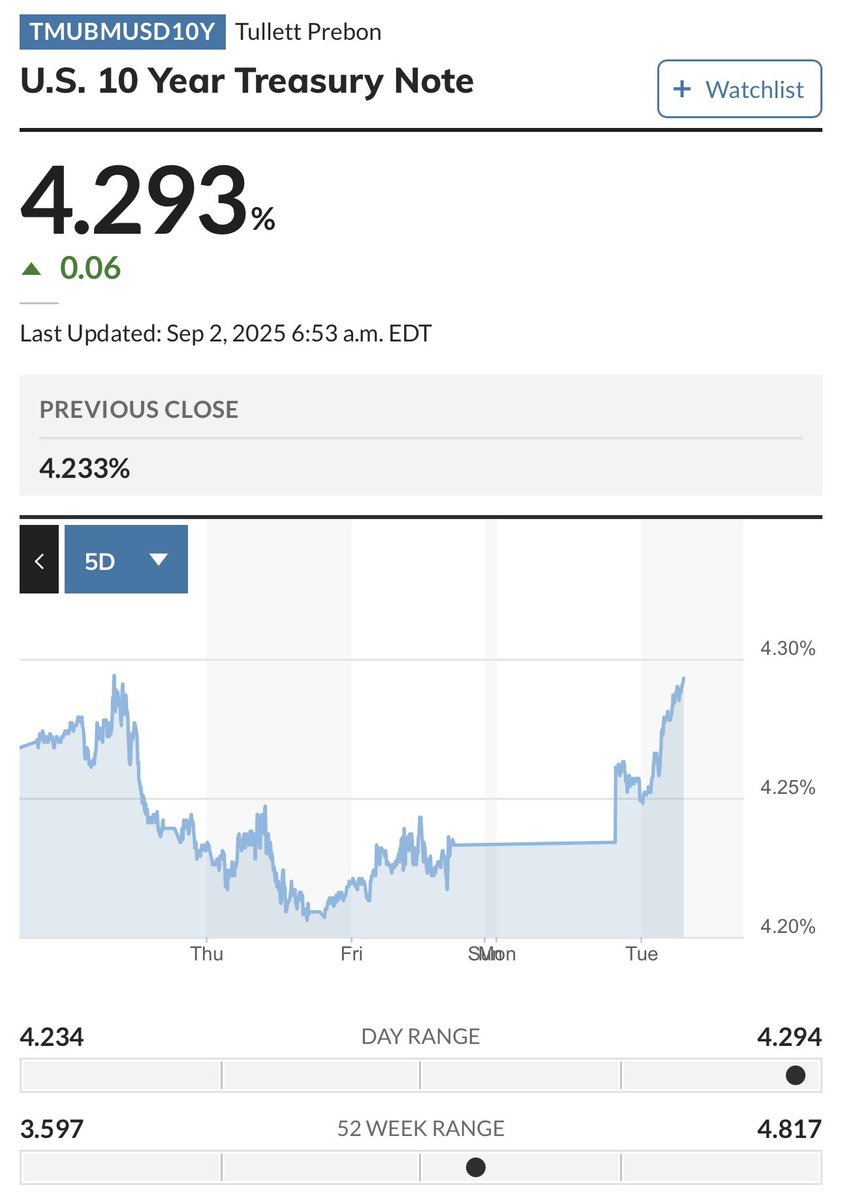

$NVIDIA(NVDA.US) $Palantir Tech(PLTR.US) $Tesla(TSLA.US) and other long duration stocks are likely to be impacted most if 10yrTYs continue to rise. In today’s pre-mkt trading, tech stocks extended last week’s losses, with $NVIDIA(NVDA.US) -1.6%, $Palantir Tech(PLTR.US) -2.3%, and $Tesla(TSLA.US) -1.0%. Higher P/E stocks get hurt most when long-term treasuries rise because a significant % of their value is “in the tail” which when discounted at a higher rate impacts their values disproportionately.

Why are long-term interest rates rising when traders are discounting 90% odds of the Fed cutting short-term rates at their Sept 16-17 meeting? Because investors are worried that long term inflation expectations remain sticky to the upside, driven by higher tariffs, higher deficit spending, and a more dovish Fed once Trump appoints a new Fed chair after Jay Powell’s term ends in May.The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.