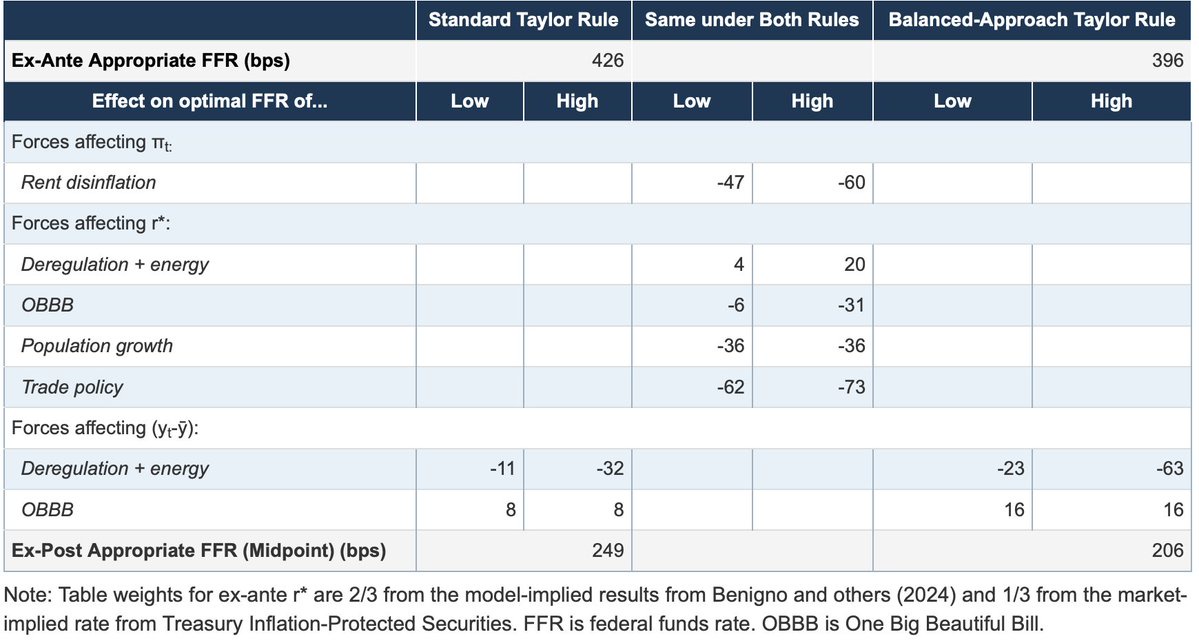

Fed Governor Stephen Miran says interest rates are roughly 2 percentage points too high, meaning the Fed is keeping policy much tighter than it should.

He puts the nominal neutral rate basically the “just right” interest rate in today’s dollars, the one you can directly line up against the Fed’s current rate at about 3.6%–3.9%. That’s close to today’s 4.1% but once he factors in 2025 policy shifts slower immigration, new tariffs, tax changes, and deregulation, he argues the real neutral rate, which strips out inflation, is closer to zero.This marks the sharpest split inside the Fed in years. Miran warns that leaving policy this restrictive risks unnecessary layoffs and damage to the job market.Most Fed officials and markets still believe the neutral rate is steady or even higher, leaving Miran isolated in his view.In other words, he thinks the Fed is unintentionally running the economy too cold and could cause lasting harm if it doesn’t ease up.The real question: is Miran ahead of the curve on r*, or is he underestimating the risk of inflation sticking around?Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.