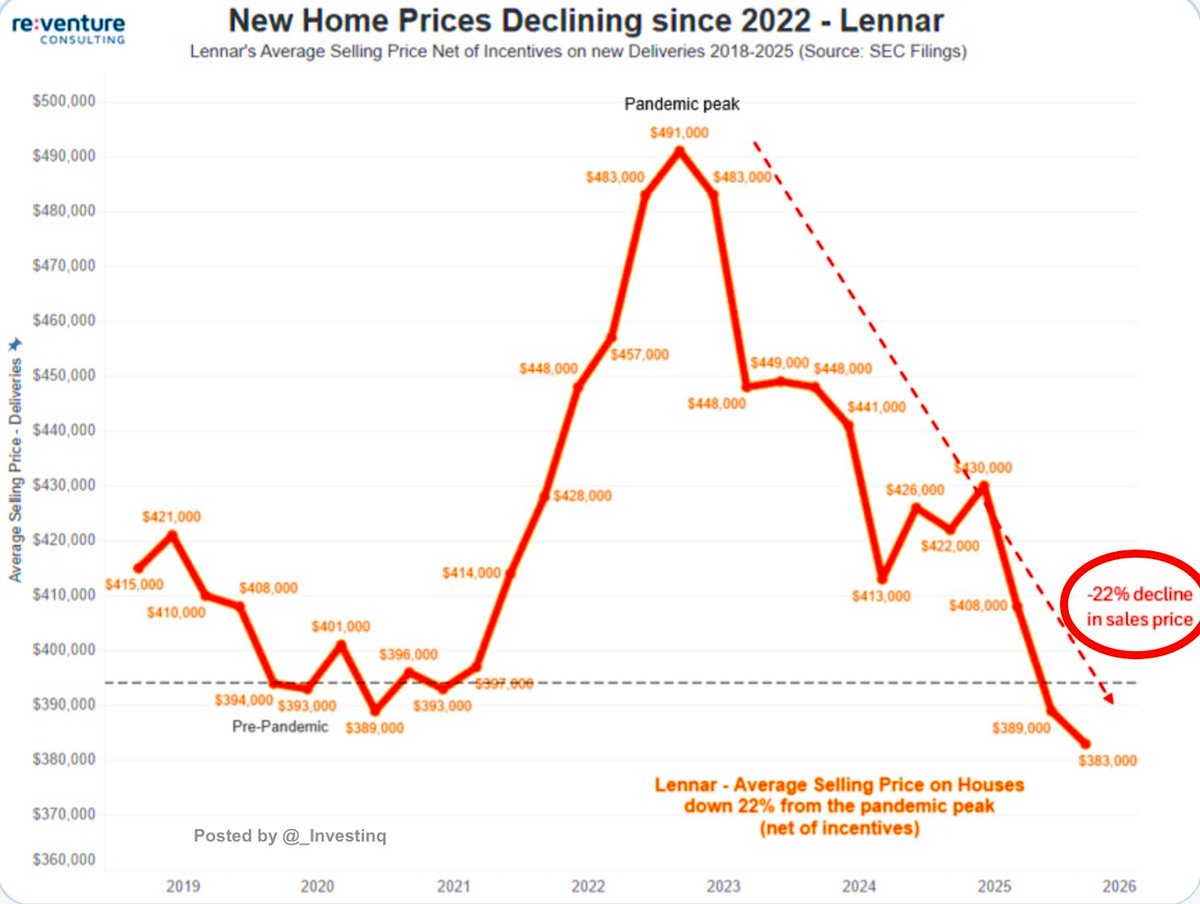

The U.S. housing market in 2025 is working through a sharp correction after the pandemic years of easy money and surging demand. Lennar one of the biggest builders in the country, showed just how far conditions have shifted in its Q3 numbers. Revenue dropped 8.8% from last year as average selling prices slid 9%. Home prices are now sitting below 2019 levels and are down roughly 22% from the highs of 2022. The fall in pricing has crushed margins, with gross margin shrinking from 29.2% in Q3 2022 to 17.5% this year. Operating income and net profits have nearly been cut in half, and earnings per share are down 46%. Lennar has kept sales volumes intact by leaning heavily on discounts. New orders jumped 12% because the company pushed through bigger price cuts and incentives, which now eat up 14.3% of the sale price. These concessions are counted in Lennar’s average selling price but never show up in the government’s housing data, making the real price adjustment look smaller than it actually is. Even with this push, Lennar lowered delivery expectations for Q4 to avoid excess inventory and keep margins from collapsing further.

The existing-home market has adjusted far more slowly. Many sellers refuse to cut prices enough to match what buyers can afford. That standoff has caused sales activity to dry up. Volumes are down about a quarter compared with 2019 and more than 30% compared with 2021. Listings are piling up, and buyers are turning toward the discounted new homes that builders are willing to move. The gap between existing and new-home markets keeps widening, and the real clearing of prices is happening through the builder channel. This is the fallout of higher mortgage rates and the end of cheap credit Affordability has been pushed to the edge, and prices are being repriced lower across the board. Investors and landlords are also under pressure as rents soften and costs rise. Some are sitting on vacant properties, others are burning cash and being forced to sell. The pressure is showing up in both single-family rentals and larger multifamily buildings.The affordability crisis remains front and center. First-time buyers and young families are locked out unless builders cut deep or throw in heavy incentives. Demand is shifting geographically as well. Migration flows and employment patterns are pushing growth into suburban and exurban areas while high-priced urban housing stays out of reach. The housing market has un wound the excesses of the pandemic era but the reset is not complete. Prices are still finding their floor, incentives remain a critical part of activity, and investor strategies are being tested as cash flows weaken. What is unfolding is not just a drop in home prices but a structural adjustment in how the market functions after years of conditions that were never sustainable.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.