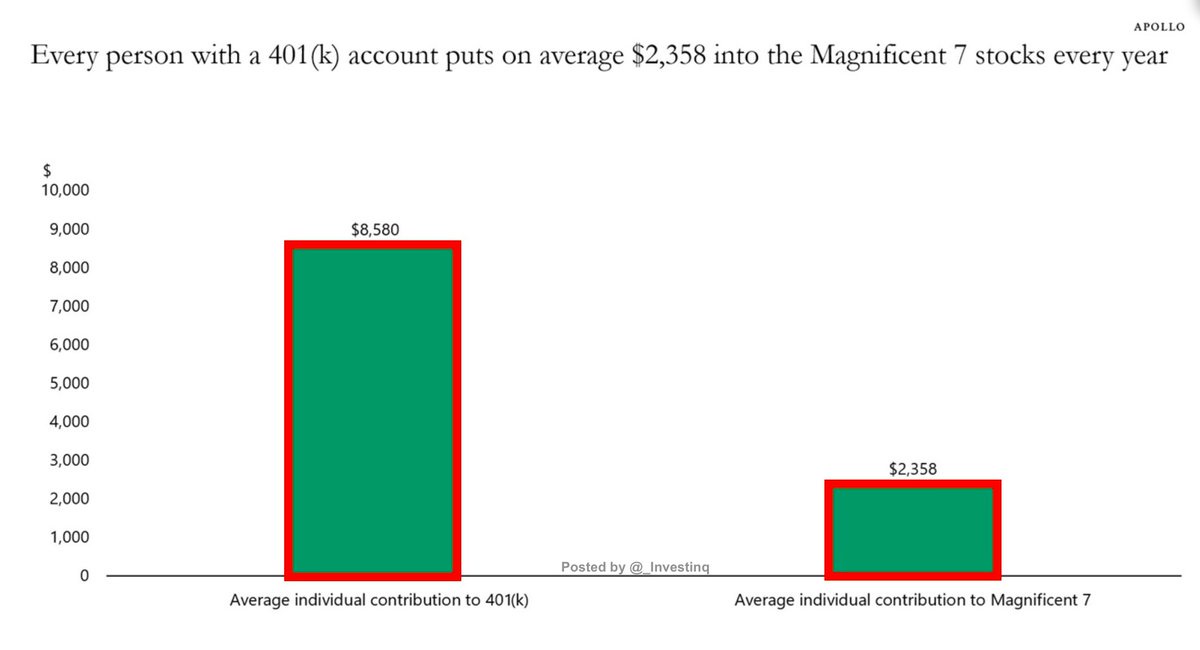

Every year, the average American worker puts about $8,500 into their 401(k).

Around 71% of that money goes into stocks, and since the Magnificent Seven now make up nearly 40% of the S&P 500, roughly $2,300 automatically ends up in those same seven names, Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, and Tesla. This happens regardless of whether those companies are cheap or expensive because index funds buy based on market cap, not valuation.That constant stream of retirement money fuels these stocks, giving them a powerful tailwind and making the market more dependent on their performance. When these companies go up, everyone’s 401(k) looks great but when they stumble, the pain spreads far beyond just tech investors.The problem is that this setup concentrates too much wealth in too few companies. As their market caps grow, passive funds are forced to buy even more of them, while smaller or undervalued companies get left behind.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.