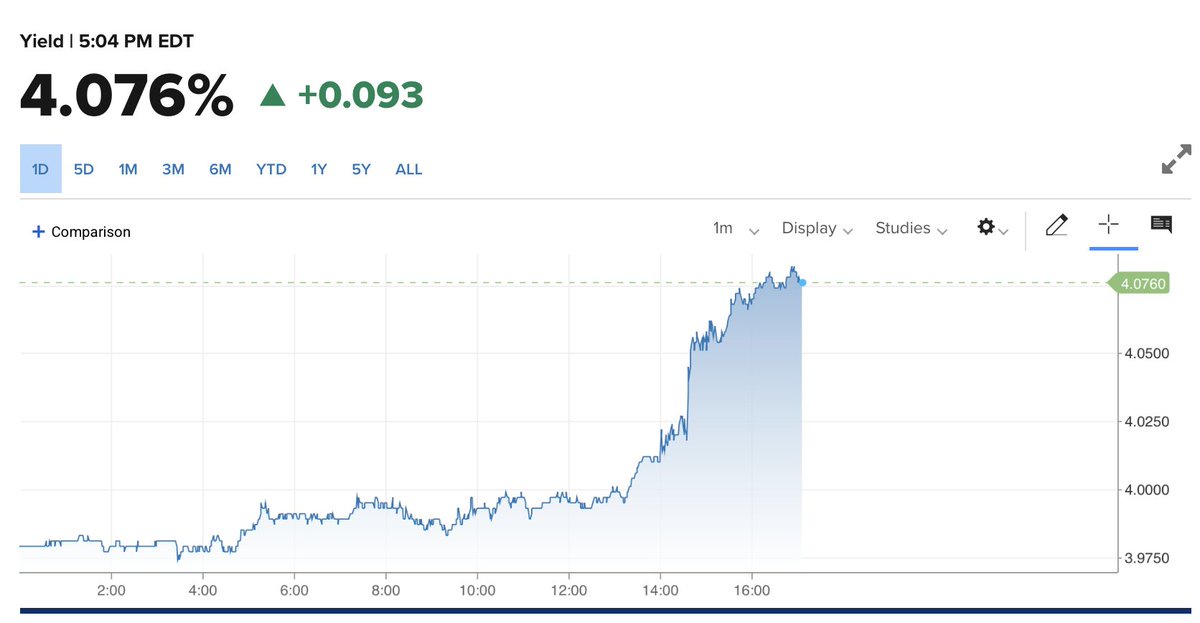

The 10-year Treasury yield jumped 9 basis points to around 4.08%, its sharpest move in weeks, after the Fed’s meeting and it all came down to Jerome Powell throwing cold water on the market’s December rate cut hopes.

Here’s what happened in simple terms. The Fed cut rates by 25 basis points, bringing the federal funds rate to 3.75% - 4%, and confirmed plans to end quantitative tightening in December. That was expected. Traders had already priced it in. What wasn’t expected was Powell’s tone right after.During the press conference, Powell said a December rate cut is “far from a foregone conclusion”, and noted there were “strongly differing views” among Fed officials. Translation: the Fed isn’t sure whether it wants to keep cutting or hold steady. That sent bond yields higher because investors suddenly realized the “easy money” path might not last.When rate cuts get delayed, bond prices fall and yields rise, especially on long-term bonds like the 10-year Treasury. That’s exactly what happened today. The 10-year yield moved from around 3.98% to 4.08%, while the 2-year also climbed roughly 8 basis points. The yield curve steepened slightly signaling that the market expects short-term rates to come down slowly but long-term inflation to stick around.Powell mentioned that inflation is still “somewhat elevated” at around 3%, and hinted it could stay that way. He also said there are “two-sided risks” meaning the Fed is now balancing between keeping jobs strong and preventing inflation from heating back up. With unemployment at 4.3%, Powell made it clear the economy isn’t in danger yet.Another factor: the government shutdown has delayed key data releases like jobs and inflation reports. Powell said the Fed will have to “collect every scrap of data we can find” until normal reporting resumes. That uncertainty makes policymakers less likely to commit to more cuts right now.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.