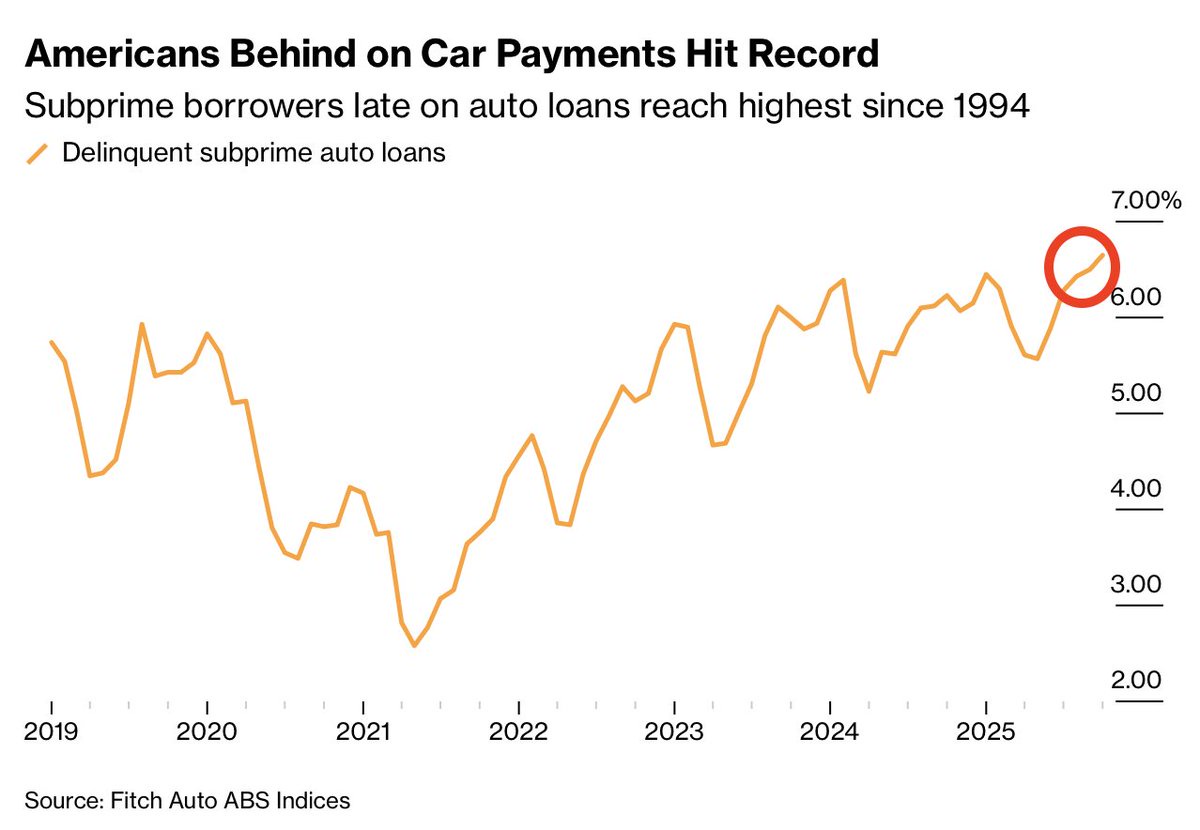

We hit 6.65% on subprime auto loan delinquencies in October. That's the highest since they started tracking this stuff in the early 90s.

The reason this matters so much is that a car payment is different from credit card debt or student loans or whatever else. Your car is how most people get to work. You miss a payment on your car and suddenly you're getting repossessed, then potentially losing your job in the process.What's even more crazy is that car prices have been insane, rates are still high and then you've got monthly payments north of $750 for new cars and $540 for used ones. Meanwhile wages for people at the bottom are basically flat. They’re not keeping up with anything. Housing costs up, food costs up, energy up, healthcare up everything except the actual money these people make.Also, during the pandemic and after, lenders went insane trying to chase yield. Underwriting standards basically evaporated. People took 72 month loans at crazy rates for overpriced cars. Now those cars have depreciated, they’re underwater on them and the rates are even higher now. People are literally getting hit from every angle at once and things are going to get a whole lot worse before they get any better for millions of Americans.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.