Here's what's going on with the Fed and Wall Street right now and it's kinda wild when you understand the full picture (save this).

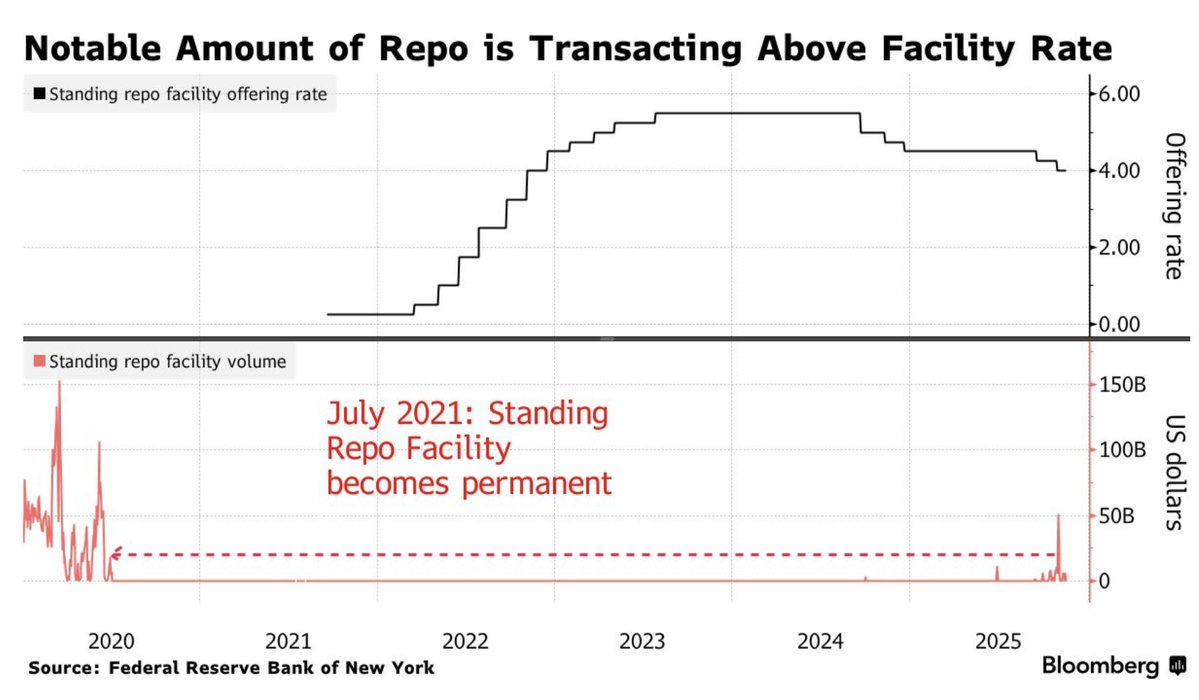

The Fed created something called the Standing Repo Facility (SRF) back in 2021 as basically an emergency lending window for banks and dealers. Think of it like this, banks need cash overnight to keep operations running smoothly. Normally they borrow from each other in what's called the repo market but when that market gets tight when money becomes scarce and expensive, the Fed steps in and says we'll lend you cash at a fixed rate. Right now that rate is sitting at around 4.00%. One of the main reasons why the Fed does this is to stabilize short term interest rates. By offering cash at 4.00%, the Fed creates a hard ceiling on repo rates. If the market ever tries to spike higher, banks can simply borrow from the SRF instead forcing rates back down and keeping the financial plumbing from blowing out. Here's the proble, almost nobody's using it, even though they arguably should be. Over the past couple months, we've been seeing repo rates spike above what the Fed is offering through the SRF. That happens when the market gets tight and dealers are willing to pay more than the Fed's rate to access private funding. You'd think banks would immediately jump on the Fed's cheaper option, right? Wrong. Last week, Fed President John Williams called in the primary dealers basically the big Wall Street trading houses to a meeting and urged them to use the facility more. Their response? A polite but firm rejection.The reason is simple but tells you something important about how Wall Street actually operates, stigma. Borrowing directly from the Federal Reserve is seen as a sign of trouble.If a major dealer suddenly starts regularly tapping the Fed's emergency window, market participants interpret that as this bank is in financial distress. It's like if you suddenly started asking your parents for regular money sure it's available, but everyone notices and forms an opinion.But here's where it gets more interesting. Back in November, banks actually did borrow a record $50.35 billion from the SRF in a single day, the highest since 2021. That happened because the liquidity pressure got real enough that the stigma concern started becoming secondary to actually getting cash. The Fed has been draining liquidity from the system through quantitative tightening (basically shrinking its balance sheet) and meanwhile the Treasury has been issuing massive amounts of new debt competing for the same cash. Money got tight.Now we're at a point where repo rates are regularly trading above the Fed's offered rate but dealers still won't use the facility in size because they're worried about market perception. What this actually means is that Fed is essentially standing there with an offer that makes economic sens, but dealers are choosing to pay more money to preserve their reputation. It's a classic example of how markets aren't purely rational psychology and perception matter just as much as price. This is a warning sign for year end liquidity. We're heading into one of the tightest times of year for cash in the financial system month end and quarter end settlements create massive temporary demand for cash. If dealers won't tap the Fed's facility and the market doesn't have enough private liquidity to go around, you could see some real dysfunction. The Fed had that closed door meeting with the dealers partly to figure out how bad this could get and to basically explain that yes using the SRF is totally normal and they shouldn't be embarrassed.Keep an eye on SOFR (the overnight secured financing rate) and tri party repo rates as we get closer to month end. If those spike materially above the Fed's target range and stay there, it tells you the Fed is losing rate control, which becomes a problem not just for the Fed's credibility but for the actual functioning of these critical markets. However with all of this, I do believe SRF is actually working as designed, it's preventing rates from spiking catastrophically even though dealers aren't using it optimally and these spikes in rates will eventually stabilize.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.