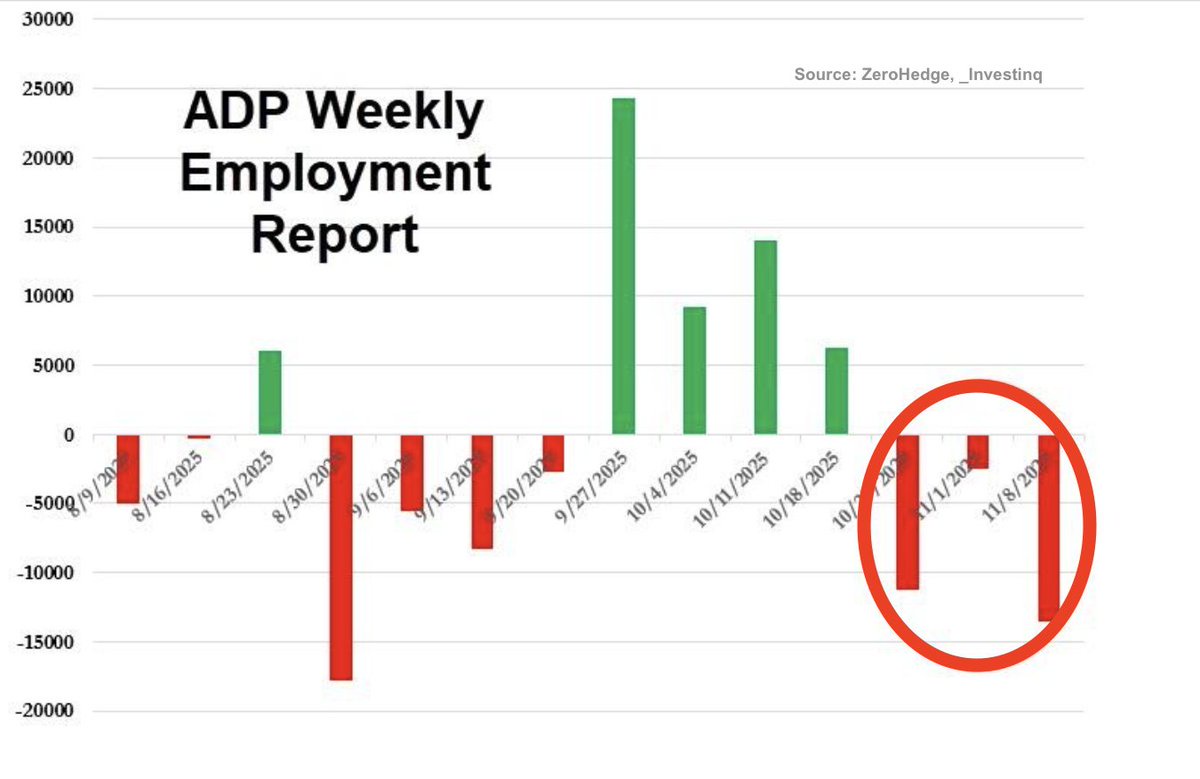

The labor market is deteriorating at a pace that should worry anyone focused on the health of the economy. ADP just released data showing private employers shed an average of 13,500 jobs per week over the four weeks ending November 8, 2025 and that's a catastrophic deterioration from the previous period when companies were only shedding 2,500 jobs weekly. We're talking about a 440% increase in job losses week over week.

Just a month ago, the private labor market looked like it was stabilizing. October was supposed to be the turning point, with private employers adding 42,000 jobs but the trajectory has completely flipped. This rapid reversal tells us the labor market weakness that started showing up in the summer is now accelerating even faster and employers are rapidly pulling back on hiring. Also, the inflation report just came out today and Inflation just doesn't matter as much anymore. Yes, the headline producer price index rose to 2.7% year over year in September, which came in slightly above expectations of 2.6%. But core PPI inflation actually fell, it came in at 2.6%, below the 2.7% expectation. The inflation story has fundamentally changed. We're not dealing with runaway price pressures anymore. Producer prices are basically stable which means the Fed's concern about inflation spiraling out of control has largely dissipated. The real problem now is on the employment side of the central bank's dual mandate and that become the urgent priority.This is why the market has just completely repriced Fed rate cut probabilities in the last week. Just a week or two ago, a December rate cut was basically off the table. The CME FedWatch Tool was only showing a 30-42% probability. But then New York Federal Reserve President John Williams gave a speech on Friday where he effectively called for a rate cut. He said downside risks to employment have increased as the labor market has cooled while upside risks to inflation have lessened. That's Fed speak for we need to cut. After these reports this morning, the prediction markets are now pricing in 85% of a rate cut, so it is fairly safe to say, the fed will be cutting in December.Source: StockMarket.News

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.