🚀📊 The real "profit engine" of US stocks in the next 5 years has been exposed

This chart provides a very rare and easily overlooked perspective:

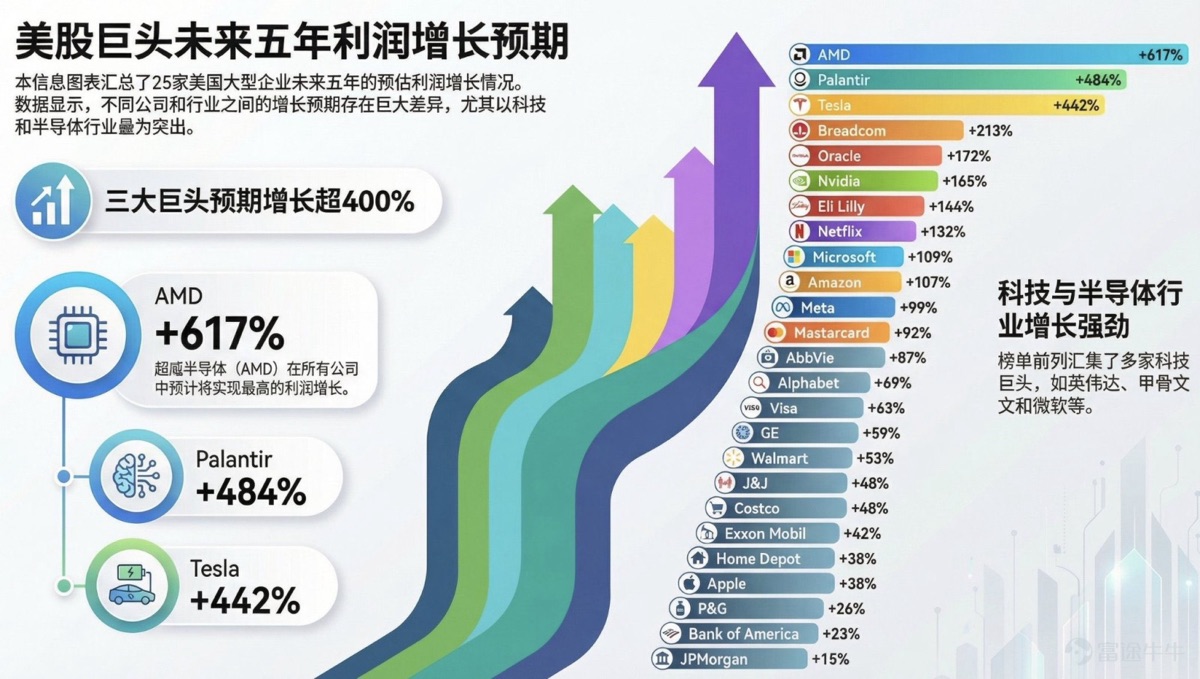

Not stock prices, not sentiment, but—the ranking of profit growth expectations for the next 5 years.

The subjects are:

The 25 largest companies by market cap in the US.

And the conclusion is more "extreme" than many imagine.

1️⃣ Three companies with profit expectations far ahead

The top three are not the traditional "stable giants" but a combination of strong cycles × new technologies:

• $AMD(AMD.US): +617%

• $Palantir Tech(PLTR.US): +484%

• $Tesla(TSLA.US): +442%

2️⃣ The second tier: Tech and "tech-like"

The following companies still have strong profit expectations but are clearly in the "understandable range":

• $Broadcom(AVGO.US)

• $Oracle(ORCL.US)

• $NVIDIA(NVDA.US)

• $Microsoft(MSFT.US)

• $Amazon(AMZN.US)

• $Meta Platforms(META.US)

These companies are more like:

Having proven themselves, now continuing to scale up.

Growth still comes from AI, but the slope is not as steep as the first tier.

3️⃣ What this table really tells you is not "which to buy"

But a more important question:

In the next 5 years,

Which companies are in the stage of "qualitative change in profit structure"?

The market will always give these companies:

• Higher fault tolerance

• Higher valuation flexibility

• Longer trend duration

And this is often not judged by short-term news.

If there's only one clue to understand US stocks in the next 5 years, this "profit growth ranking" is more honest than stock price trends.

Who do you think will be the next company to join the "400% profit expectation club"?

📣 Keep tracking how AI, computing power, and automation are changing corporate profit structures, and which companies are at the forefront of inflection points.

If you care about "where profits come from, not how stock prices jump," subscribe and understand the cycle ahead of time.

#Stocks #AI #AMD #TSLA #PLTR #USStocks #EarningsGrowth #Investing #WallStreet

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.