1️⃣ Stock Price and Market Sentiment

Short-term Characteristics

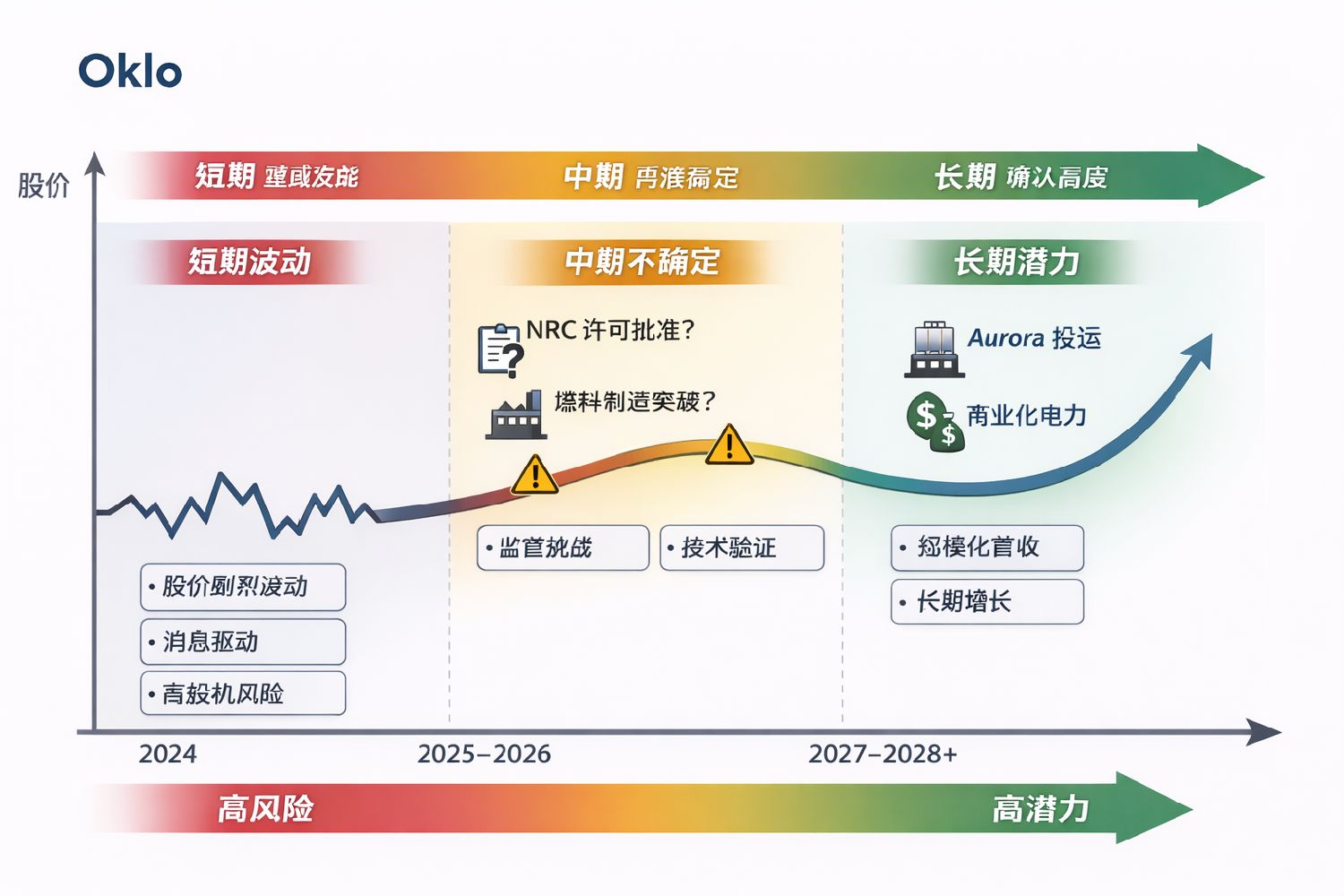

High volatility: Stock prices are mainly influenced by policies, market sentiment, nuclear energy hotspots, and large capital speculation.

News-driven: For example, when tech companies like Meta sign nuclear energy supply agreements, stock prices may rise in the short term.

Investment risks: Short-term investments remain speculative, lacking stable cash flow support.

Long-term Trends

High potential after successful commercialization: If permits are smoothly approved and Aurora Powerhouse becomes operational, long-term stock prices may see significant growth.

2️⃣ Technical R&D Perspective — Nuclear Energy Project Progress

Core Technologies

Small Modular Reactors (SMR) and micro fast reactors (Aurora Powerhouse).

Goal: Clean, reliable, and scalable electricity, especially for remote or high-demand areas.

Progress

Site preparation has been completed at the Idaho National Laboratory (INL).

Advancing NRC permit applications and fuel manufacturing design approvals.

Expected trial operation by 2027–2028.

Technical Risks

Complex and time-consuming permitting processes; engineering or material issues may cause delays.

Innovative technology, but mass production and commercialization remain unverified.

3️⃣ Policy and Industry Perspective — Policy and Market Environment

Industry Opportunities

AI, data centers, and rising electricity consumption → Nuclear energy as a clean baseload power source becomes a focal demand.

Large tech companies (e.g., Meta) signing long-term power supply agreements boost market confidence.

Policy Support

The U.S. government and DOE provide technical and permitting support, with nuclear energy policies becoming more lenient.

Nuclear safety and permitting regulations remain strict, but overall favorable for new nuclear energy enterprises.

Policy Risks

Any regulatory delays or safety incidents could severely impact company permits and market confidence.

Policy and subsidy changes may affect financing and cost structures.

🔹 Summary of Global Trends

Perspective Short-term Mid-term Long-term

Investors High volatility, news-driven High valuation divergence and risk High potential if commercialization succeeds

Technical R&D Innovation, permit progress Pending field validation Scalable if successfully operational

Policy & Industry Policy tailwinds, industry hotspots Monitor regulations and safety Long-term bullish on nuclear demand

✅ Core Assessment: Oklo is a typical high-growth, early-stage innovative company with high short-term risks and investment volatility; long-term potential is evident if permits and projects proceed smoothly.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.