Posts

Posts Likes Received

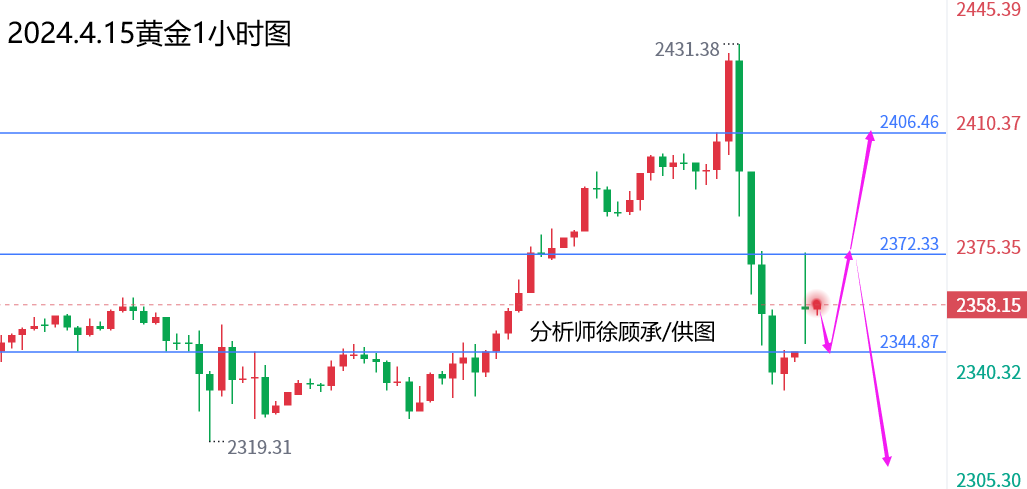

Likes ReceivedGold: On the weekly chart, there was a significant spike and then a sharp pullback, forming a pin bar. On Friday, the price hit a high near 2431.5 before retreating sharply in the late session, dropping to as low as 2334—a full $100 decline. This suggests that the bulls, after driving prices higher, began offloading positions, and the lack of strong buying support led to a continuous sell-off. Does this weekly pin bar confirm a top formation?

Xu Gucheng personally disagrees. Given the current global inflationary pressures, most currencies are weak in the long term, including stock markets, leaving gold as the primary safe-haven investment. Second, geopolitical tensions have escalated in recent years, with frequent military conflicts worldwide—gold thrives in such turbulent times. Therefore, Friday's spike and retreat were likely driven by heavy short-selling pressure. Once the shorts stabilize, prices are expected to rebound and resume their upward trend based on technical support.

Currently at 2358, cautious traders should wait for a pullback to 2346-2350 to go long, with lighter positions. Add to positions at 2335, targeting 2382/2430. Alternatively, a breakout above 2373 could signal a direct long entry, still targeting 2430.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.