Likes Received

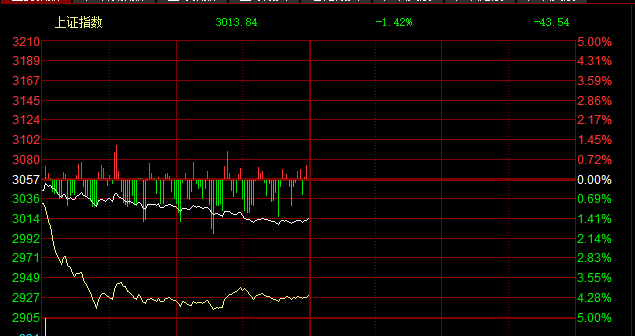

Likes ReceivedAll sectors are in the red, with over 5,000 stocks declining. The market is replaying the stock market crash before the Chinese New Year these past two days.

The yellow line representing small-cap stocks has dropped by 5%. Staying out of the market these two days makes you the biggest winner—when it's raining and thundering, it's best to stay indoors.

However, after such an extreme plunge, the subsequent rebound is something to look forward to. The post-holiday rally is still fresh in our memories, and now it's a test of insight and understanding.

State-owned enterprises (SOEs) can't sustain without a trillion-yuan market, and that's exactly what's happening. CRRC is fluctuating, failing to maintain momentum.

Meanwhile, high-quality small-cap stocks are showing signs of strength against the trend. The only two stocks with three consecutive limit-ups are both driven by strong Q1 earnings forecasts and generous dividends—performance is the key theme.

As long as they align with the policies of the 'New National Nine Articles'—offering dividends and solid earnings—would you rather spend 10 billion to boost one large-cap stock or 20 million to boost one high-quality, attractive small-cap?

Going forward, the rebound play will focus on high-quality, earnings-driven small-cap stocks.

But for now, the safe havens remain: SOEs and newly listed stocks. Let’s navigate this tough period by focusing on these two directions first.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.