AI pharmaceutical industry hits the fast-forward button

Global tech giant NVIDIA has invested heavily in over 10 AI pharmaceutical companies, declaring to the world: The new gold rush in the pharmaceutical industry has arrived!

Today, the AI pharmaceutical field has attracted numerous companies rushing to get involved, including not only tech giants like NVIDIA, Google, and Baidu but also overseas pharmaceutical giants such as Merck, Roche, and AbbVie, as well as well-known domestic companies like Porton Pharma, WuXi AppTec, and Fosun Pharma.

Why is the AI pharmaceutical track so hot?

01

Global TOP20 Pharmaceutical Giants Enter the Game

How hot is AI pharmaceuticals? The rush of multinational pharmaceutical giants to enter the field speaks volumes.

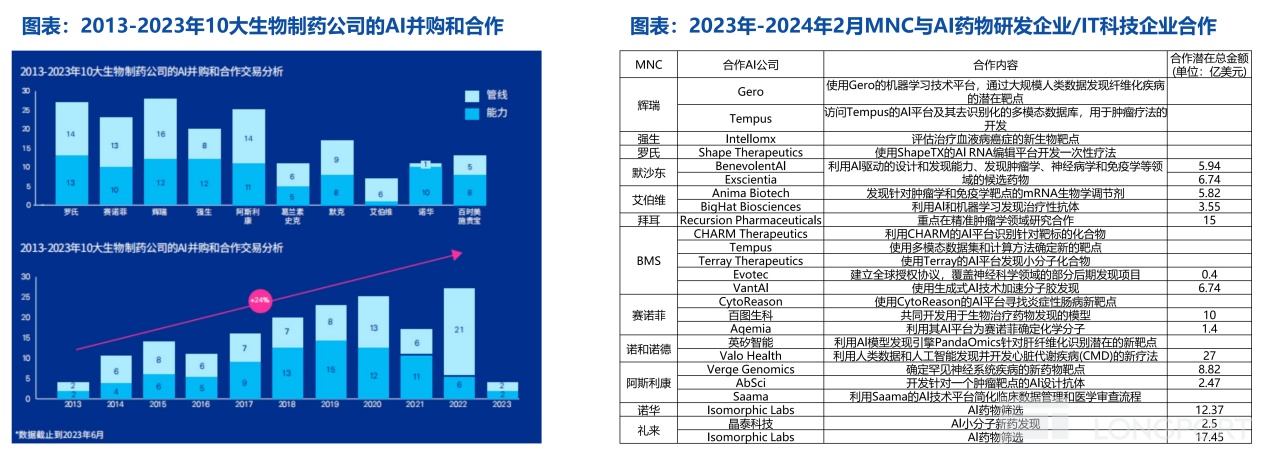

Currently, the world's top 20 pharmaceutical giants, such as Pfizer, Johnson & Johnson, Sanofi, and Novartis, have all partnered with AI companies. Since 2016, the number of such collaborations has increased year by year, reaching 132 in 2020 alone.

It's worth noting that few sectors can attract all the top 20 global pharmaceutical companies to compete for a share. Even the "hotcake" ADC drugs failed to "sweep all the giants" (for example, Novartis has not entered the ADC field).

The popularity of AI pharmaceuticals is also reflected in transaction amounts.

The most famous example is the 2021 collaboration between Recursion and Roche's Genentech: the former uses its technology to empower drug discovery in neuroscience and oncology, while the latter may initiate up to 40 projects, each with development, commercialization, net sales milestones, and tiered royalties exceeding $300 million. If all projects are successfully developed and commercialized, Recursion could earn over $12 billion.

It's worth mentioning that from 2020 to 2021, 12 overseas AI pharmaceutical companies successfully went public. Among them, Recursion, one of NVIDIA's investments, listed on NASDAQ in April 2021, with its stock price soaring by about 86% that month. It is currently the highest-valued company in the AI pharmaceutical field, with a market cap of $2.013 billion as of April 10.

In recent years, the AI pharmaceutical sector has remained hot. According to Huachuang Securities, from 2023 to February 2024, the potential total value of collaborations between multinational pharmaceutical giants and AI drug R&D or IT tech companies has reached $12 billion, with an average of $840 million per project.

The last sector to receive such "heavenly riches" was the ADC track. This speaks volumes about the allure of "AI + new drug R&D."

Source: Huachuang Securities Research Report

AI + new drug R&D applies artificial intelligence (AI) technology to drug development, enabling rapid and precise completion of key steps such as target identification, compound screening, and pharmacokinetic property prediction. This not only significantly shortens the R&D cycle but also reduces the probability of failure and overall R&D costs, potentially breaking the "Rule of Tens" (10 years and $1 billion) in pharmaceutical R&D.

Even more noteworthy, AI technology can identify previously "undruggable" targets and even discover entirely new therapeutic targets, generating novel drug molecules with uniquely optimized properties, greatly surpassing the limitations of traditional drug R&D.

This new R&D model is not only bringing profound changes to the pharmaceutical industry but also sparking a global wave of investment and financing in AI pharmaceuticals.

According to MedMarket Insights, global AI pharmaceutical financing totaled approximately $13.5 billion from 2021 to Q3 2023, with activities primarily concentrated in the U.S., China, the U.K., the EU, and Israel. The U.S. and China accounted for 95% of the total financing deals.

Additionally, Research And Markets data shows that in 2022, there were 144 global AI drug R&D financing events, totaling $6.202 billion (approximately RMB 42.67 billion), with 71 in the U.S., 43 in China, and 30 in other regions.

The vibrancy of the investment market reflects the revolutionary changes and immense potential AI pharmaceuticals bring to the industry. This is the fundamental reason why the AI pharmaceutical field has garnered so much attention.

02

China's AI Pharmaceutical "Dawn Battle"

According to iResearch, China's AI pharmaceutical market was valued at RMB 81.63 million in 2020 and is expected to reach RMB 770 million by 2025, with a CAGR of 56.8%, indicating rapid growth.

The enormous potential of AI in new drug R&D has attracted many companies to enter the field.

From an industry chain perspective, AI + new drug R&D can be divided into three segments:

Upstream: Companies providing AI hardware and software support, including chips, databases, and cloud computing, such as NVIDIA, Google, and IBM. Midstream: AI drug R&D companies like Insilico Medicine and AGL Pharma, as well as IT tech firms like Google, IBM, and BAT. Downstream: Drug sales, including pharmaceutical companies and CXOs like Fosun Pharma, Huadong Medicine, WuXi AppTec, and Pharmaron.

AI Pharmaceutical Industry Chain

Source: Galaxy Securities Research Report

Midstream AI drug R&D companies can be categorized into three business models: AI+SaaS, AI+CRO, and AI+Biotech.

AI+SaaS companies provide AI-assisted drug development software platforms, represented by ConcertAI, Westlake Omics, and Woshi Tech. AI+CRO companies collaborate with downstream partners through technical service outsourcing, including Schrödinger, XtalPi, and XINGYAO Tech. AI+Biotech companies focus on in-house drug pipelines, advancing them independently or through licensing/collaborations, such as Recursion and Insilico Medicine.

Among domestic AI drug R&D companies, Insilico Medicine and AGL Pharma lead with 5 clinical-stage pipelines each, followed by AccutarBio, Unknown Science, and Regor Therapeutics with 4 each.

Downstream pharmaceutical and CXO companies are also entering the AI pharmaceutical track through collaborations and software services.

For example, Yunnan Baiyao partnered with Huawei to apply AI technology to drug R&D, including molecule design and database development. Fosun Pharma collaborated with Insilico Medicine to develop small-molecule innovative drugs, with the first FIC compound already in Phase I clinical trials in China. In August 2023, CSPC Pharmaceutical Group partnered with Insilico Medicine and XtalPi to leverage AI for drug design.

More CXO companies are entering the AI pharmaceutical field, including Porton Pharma, Pharmaron, HitGen, Medicilon, and ChemPartner. WuXi AppTec, the domestic CXO leader, invested in 7 AI-powered drug R&D companies from 2018 to 2021.

Porton Pharma, a small-molecule drug CRO/CDMO service provider, has built a CADD/AIDD platform (computer- and AI-assisted drug design). As of H1 2023, it has supported 52 new drug projects, with 2 in Phase I clinical trials and 3 in the IND stage. Currently, 15 clients have purchased its CADD/AIDD services.

03

Why AI Pharmaceuticals?

The market widely predicts that AI pharmaceuticals will become the next growth driver for the pharmaceutical industry, thanks to its disruptive innovation and vast market potential.

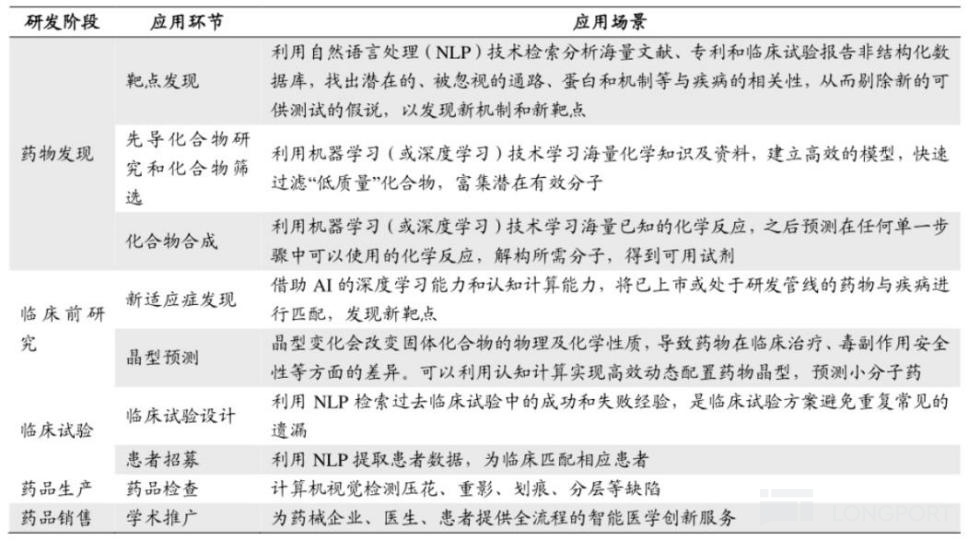

AI technology is now integrated into all stages of new drug R&D: drug discovery, preclinical research (new indication discovery), clinical research (trial design), production (quality control), and sales (academic promotion).

Overview of AI Applications in Drug R&D

Source: Soochow Securities Research Report

Undeniably, AI technology has brought significant changes and efficiency improvements to drug R&D.

Compared to traditional drug R&D's low success rates, long cycles, and high costs, AI pharmaceuticals can save time, reduce costs, and improve success rates, thanks to AI's powerful data processing and predictive modeling capabilities.

Currently, AI + small-molecule drug R&D is relatively mature, but with advances in algorithms (tools for predicting macromolecule structures and functions), AI + macromolecule R&D is gaining momentum. The rapid growth of the biologics market further fuels AI + pharmaceutical development.

Compared to traditional small-molecule drugs, biologics (e.g., monoclonal antibodies, bispecific antibodies, ADCs) have seen rapid growth and significant market expansion.

According to PharmaDJ, in 2023, 43 companies globally advanced 102 drug pipelines to clinical stages, with 29 overseas companies accounting for 68 pipelines. Among 93 Chinese AI pharma companies, 14 advanced 34 pipelines to clinical stages.

These signs indicate AI pharmaceuticals are entering a period of rapid development.

It's no exaggeration to say that the rise of AI pharmaceuticals heralds a new era for the industry. Companies that successfully integrate AI technology will gain a competitive edge.

04

Conclusion

AI pharmaceuticals have become a new trend in the pharmaceutical industry, with more technological innovations and R&D breakthroughs expected.

Thanks to its unique advantages and vast market potential, AI pharmaceuticals are seen as the industry's next growth driver.

In the U.S., some AI pharmaceutical companies have already achieved profitability, leading the way. We look forward to domestic companies catching up and creating remarkable achievements.

References:

1. Company financial reports, announcements, and official accounts

2. "AI Pharmaceutical Commercialization Milestone! First Profitable Company Emerges," PharmaDJ, 2024-03-28

3. "20240323-Pharmaceutical Industry Investment Insights & Research Weekly #69: AI Ushers in a New Era of Drug R&D," Huachuang Securities

4. "20240327-Pharmaceutical Industry China's High-Quality Economic Development Series: AI and Digital Economy Drive Pharma Industry Upgrade," Galaxy Securities

$PR(301230.SZ) $WUXI APPTEC(02359.HK) $Yunnan Baiyao(000538.SZ)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.