$ASML(ASML.US) CFO's video about Q1, future outlook: Q2 growth (sales of 5.7-6.2 billion); second half will be better than the first half; full-year 2024 expectations remain unchanged. https://www.asml.com/en/investors/financial-results/q1-2024

Now the night session has dropped 8%.

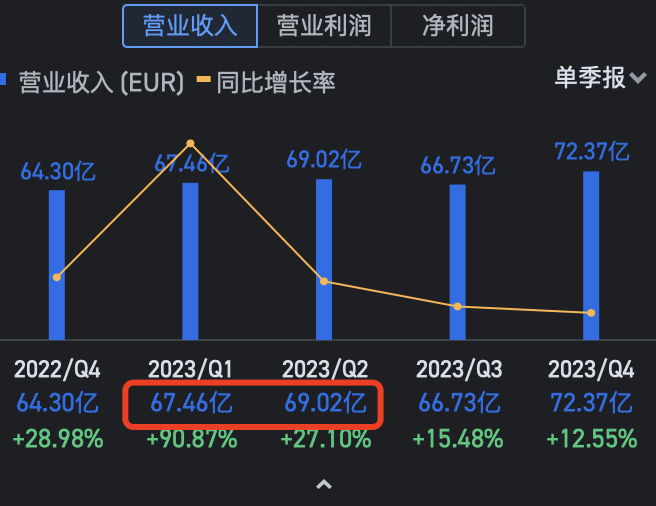

Q1 and Q2 year-over-year declines compared to 2023 Q1 and Q2 are significant, but they also said the second half will be better. As for how much better, they didn’t say. (Wait for tonight’s earnings call at 9 PM.)

Additionally, ASML's biggest clients are TSMC, Samsung, and Intel. Because there are few clients, if lithography machines are updated, the impact could be significant—everyone would prioritize buying the new ones.

The old EUV lithography machines sell for $150 million,

while the new high-NA EUV lithography machines cost $380 million.

The first one was sold to Intel last year, and Intel plans to start production using the system by the end of 2025.

The new high-NA EUV lithography machines take six months to install, and debugging and trial production will likely take a long time. So when the CFO says the second half will be better, does that mean they’ll sell more high-NA EUV lithography machines?

NVIDIA’s night session drop is a bit unfair, LOL. What’s affecting your GPU capacity is TSMC, and they didn’t even drop—yet you did. Just market sentiment...

Feel free to leave comments.

$Taiwan Semiconductor(TSM.US) $Intel(INTC.US) $SAMSUNG FANG(02814.HK) $NVIDIA(NVDA.US) $AMD(AMD.US) $Direxion Semicon Bull 3X(SOXL.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.