Never judge a book by its cover. Who would have thought that Alibaba's stock price would surge nearly 8% three days after its earnings report, hitting a six-month closing high.

Indeed, while Tencent's net profit grew 54% year-over-year, Alibaba's actually declined 11%. These results can hardly be called good, but they're certainly not bad either.

I actually think Alibaba's reforms over the past two years have been effective. Taotian's GMV and revenue have stabilized and are starting to recover.

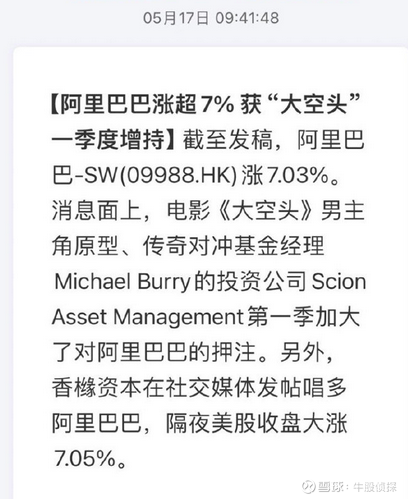

The fact that multiple investment firms, including Scion Asset Management (the investment company of Michael Burry, the real-life inspiration for the protagonist in The Big Short), have increased their stakes in Alibaba proves its value $Alibaba(BABA.US) $Tencent(TCEHY.US)

Source: Stock Detective

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.