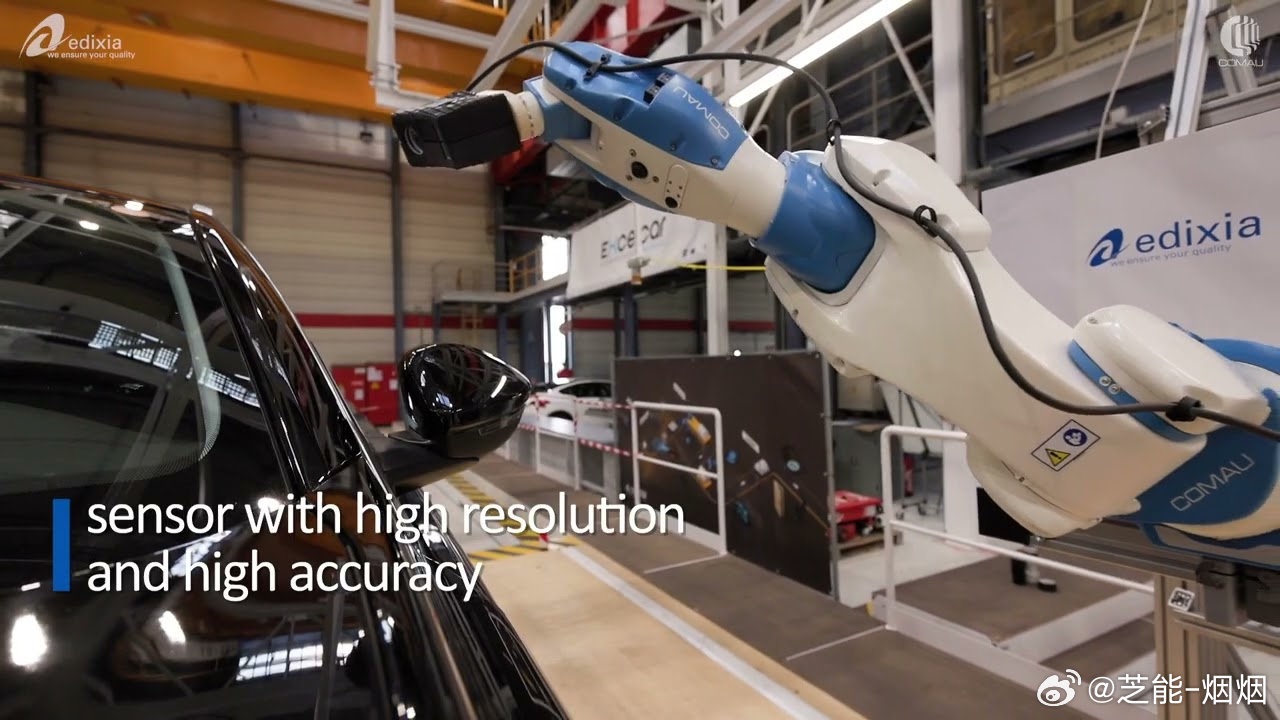

Stellantis announced the sale of a majority stake in its subsidiary Comau to One Equity Partners (OEP), with both parties signing a binding agreement. Stellantis will become a minority shareholder. The transaction is expected to be completed by the end of 2024, subject to regulatory approvals and other conditions. Financial terms remain confidential. Comau specializes in industrial automation and robotics, excelling in automotive manufacturing and electric vehicles, while also covering multiple industrial sectors. It operates innovation centers and production facilities worldwide with a large workforce. This move is part of the strategic agreement established during the merger of Peugeot SA and Fiat Chrysler Automobiles in January 2021. Comau's management will remain unchanged, stating that as an independent company, it can pursue new opportunities and investments autonomously. Carlos Tavares noted that this decision will help Comau grow independently while allowing Stellantis to focus on its core business.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.