Budget liquor doesn't have 'Black Myth: Wukong'

Introduction: Facing pressure from premium brands' "downgrading" above and competition from local white-label products below, the bare-bottle liquor market also confronts the rigidity of consumers who refuse to buy into any marketing stories.

01 Vacancy Created

In the bare-bottle liquor market, which "benefits" from consumption downgrading, Niulanshan, the "King of Bare-Bottle Liquor," has failed to maintain its triumphant momentum.

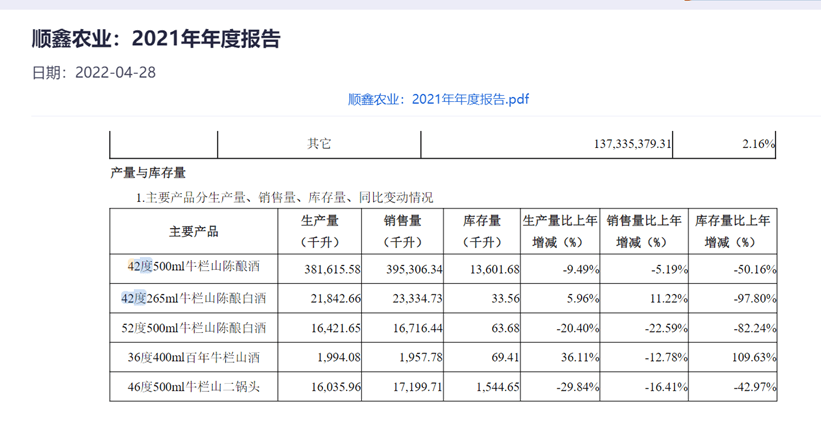

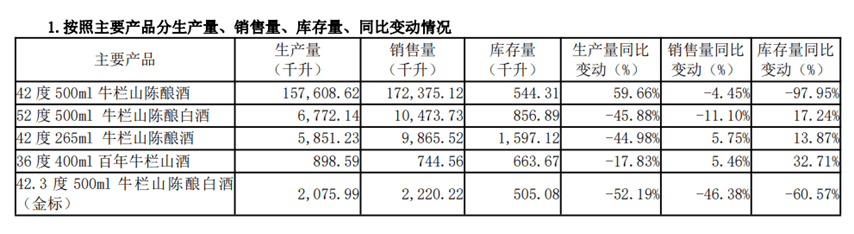

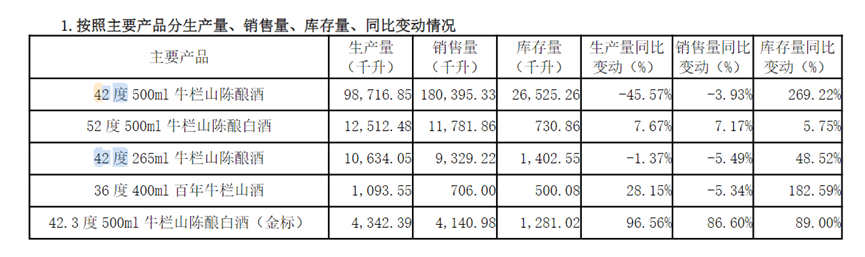

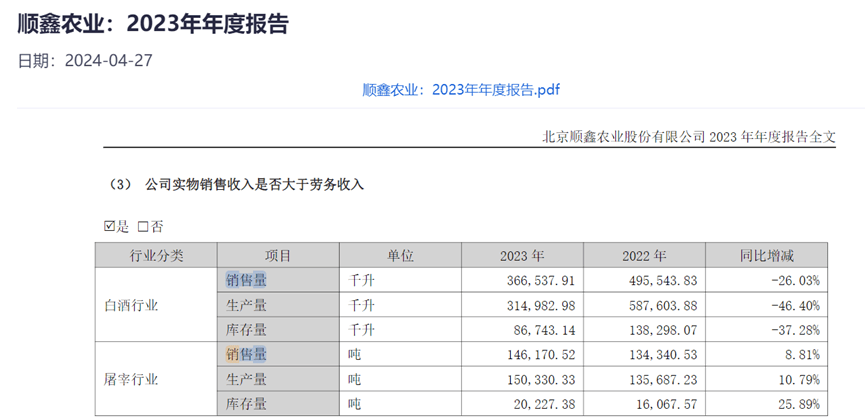

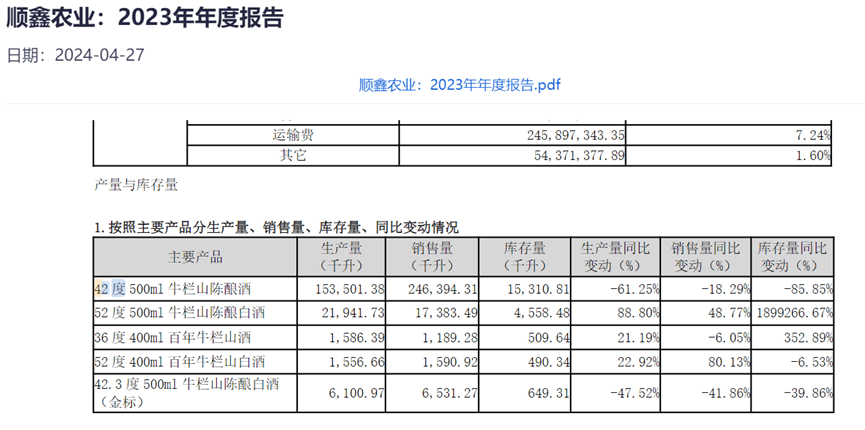

Niulanshan's core product, White Niuer (42° 500ml Niulanshan Chenniang Liquor), saw its sales drop from nearly 400 million liters (800 million bottles) to 367 million liters (under 500 million bottles) in just three years.

On the evening of August 26, Shunxin Agriculture's 2024 semi-annual report revealed company revenue of 5.687 billion yuan, down 8.45% year-on-year. While the liquor segment grew 3.17% YoY, contract liabilities—a key indicator of distributor prepayments—plummeted over 70%.

Contrary to the steady expansion of the bare-bottle liquor market, Shunxin Agriculture's three low-price core products—42° 500ml Niulanshan Chenniang (White Niuer), 52° 500ml Niulanshan Chenniang, and 42.3° 500ml Niulanshan Chenniang (Gold Label)—all saw sales decline in H1, dropping 4.45%, 11.10%, and 46.38% respectively.

With its "affordable quality" positioning, White Niuer became a national hit through differentiation, once propelling Shunxin Agriculture to become the liquor industry's volume leader.

In 2019, Shunxin Agriculture sold 717,600 kiloliters of liquor, generating 10.289 billion yuan in revenue and entering the "10-billion-yuan club."

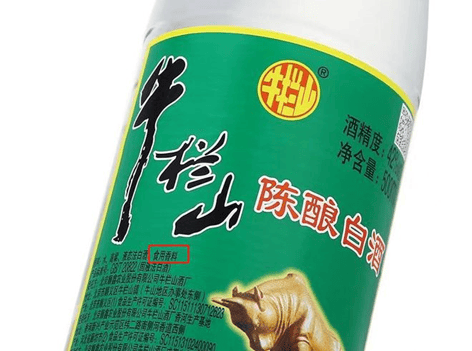

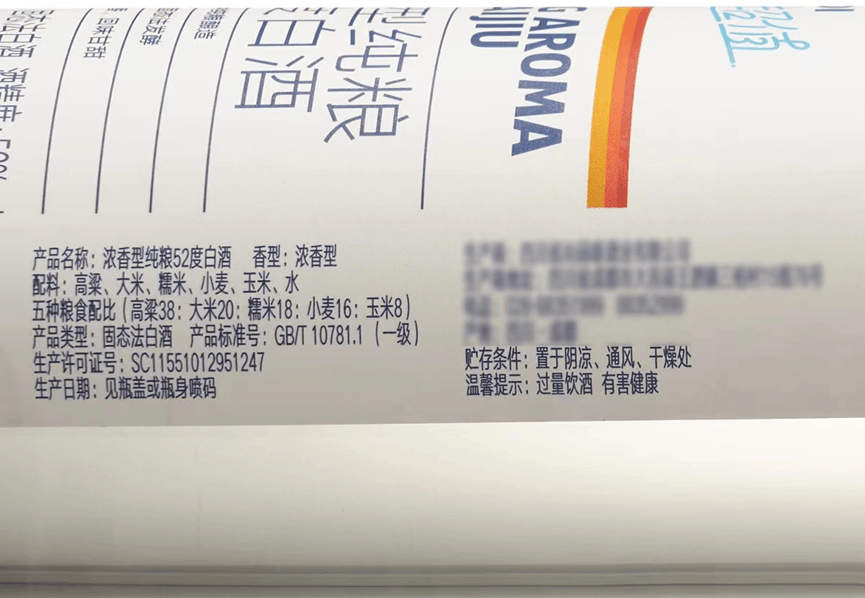

The 2022 updated liquor standards cemented consumer perception that "White Niuer isn't grain liquor," severely damaging its reputation.

The new standards prohibit non-grain alcohol and additives in liquor production, reclassifying flavored blends like White Niuer as "configured liquor."

A year later, White Niuer's H1 2023 production and sales fell 46% and 4% respectively, while inventory surged 270%. This decline continued into 2024.

The low-end liquor vacuum left by White Niuer's reclassification became prime territory for competitors.

After all, a 10-yuan product generating billions in revenue is irresistible to premium brands.

02 Territory Wars

For premium brands that touted "upgrading" last year, entering the low-end market is partly a forced move.

Amid macroeconomic headwinds, premium liquor shows stable but polarized demand, while commercial demand for mid-premium products shrinks. All face prolonged inventory adjustments.

With constraints everywhere, brands pivot to new growth.

Only the mass-market segment shines. Bare-bottle liquor, with 14% CAGR (China Alcoholic Drinks Association), is projected to exceed 150 billion yuan in 2024.

National brands like Shanxi Xinghuacun Fenjiu's Red Label Fenjiu and Shaanxi Xifeng's Green Neck Xifeng now "downgrade" to challenge Niulanshan.

After initial success, these brands expand nationally. Red Label Fenjiu, a "classic" high-value product, drove Fenjiu's aroma-type market growth, selling 140 million bottles in 2019 (vs. Shunxin's 1.4 billion).

By 2023, Red Label reached 200 million bottles as Fenjiu's revenue hit 31.928 billion yuan, while Shunxin's liquor revenue shrank to 6.823 billion yuan (493 million White Niuer bottles).

Xifeng, another 10-billion-yuan brand, leverages its Green Neck Xifeng's strong Shaanxi penetration and "Four Famous Liquors" pedigree. In 2023, it contributed over 1 billion yuan locally and expanded into Henan, rivaling Red Label and White Niuer.

New entrants like Jiangxiaobai (2019 revenue: ~3 billion yuan) and Guangliang Liquor (400 million bottles sold) adopt youth-focused pricing and pop-culture marketing. Retailers like ALDI (9.9-yuan SKU), Freshippo (30-yuan range, 60% growth), and Pang Donglai's collaborations (40-70 yuan) further disrupt the ecosystem.

03 The Cold, Hard Ceiling

Some brands promote "premium bare-bottle liquor" (40-60 yuan) as a blue ocean, but price-sensitive consumers reject 70+ yuan options. Luzhou Laojiao's 98-yuan Black Cap, positioned against Red Label, remains niche (3.236 billion yuan in 2023, 10.7% of revenue).

Industry insiders note: bare-bottle liquor looks attractive but is brutally competitive—squeezed between downgrading premiums and local white labels, with consumers immune to branding narratives.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.