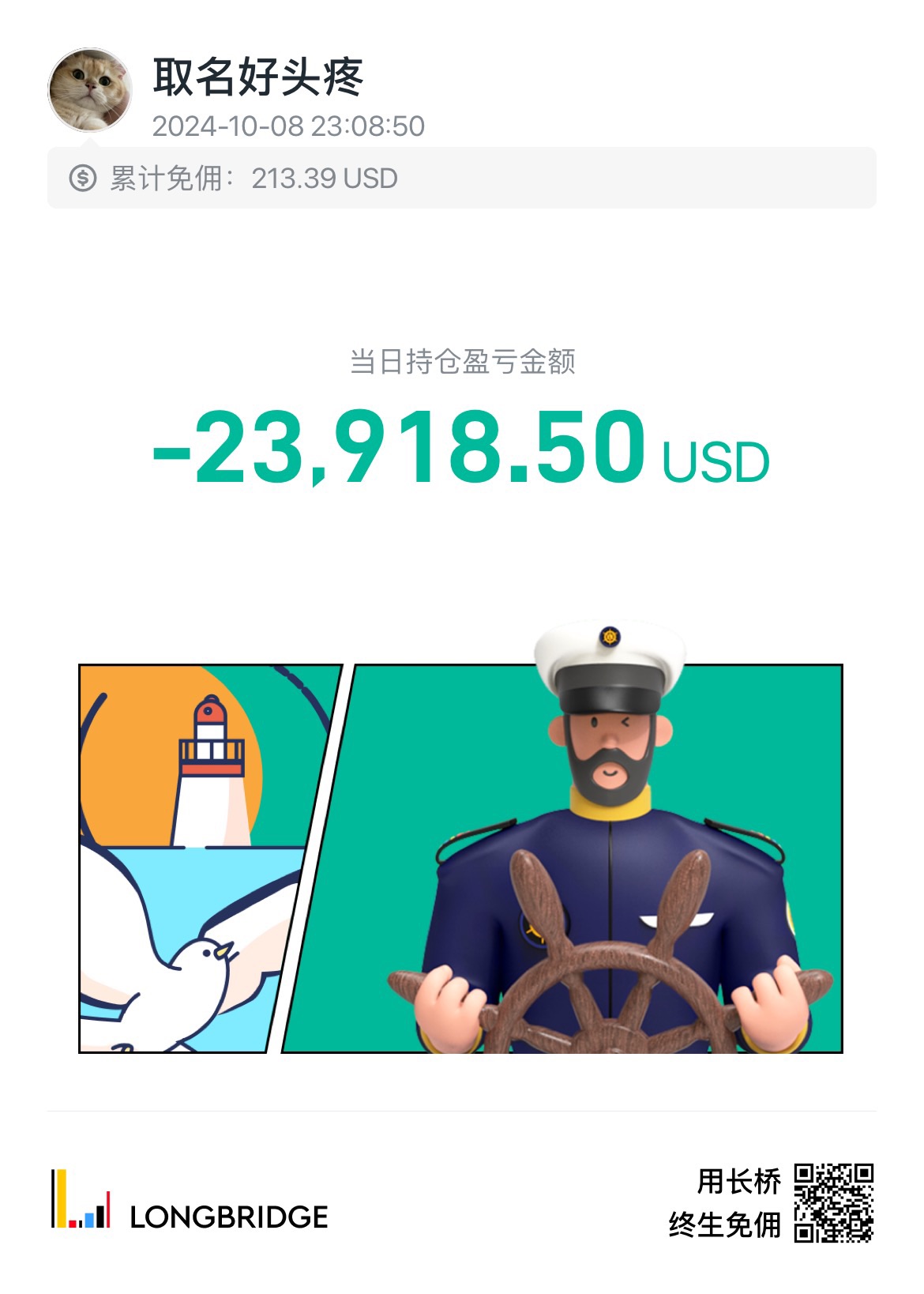

Let's encourage each other. Today, I lost 40% of my principal. Here are some reflections:

1. My risk awareness was too poor, easily influenced by emotions and market information.

2. Short calls accounted for half of my position, leading to excessively low risk tolerance.

3. Blind gambler mentality, failing to control profit-taking and stop-loss levels, always wanting to chase the last bit of profit.

4. Leverage further magnified the losses—a bloody lesson.

$Alibaba(BABA.US)$PDD(PDD.US)Recording the tuition fee this time, basically lost all the profits and part of the principal earned during this period. After reviewing, there are a few points:

1. The style was too aggressive, frequently going all-in on short calls. Even if I didn't lose this time, I would eventually lose. In the future, focus on stocks + long calls, with short calls not exceeding 10%.

2. Heavy gambling mentality, always wanting to make a big bet and not stopping until all profits are taken. Protecting the principal is the principle; it's important to take profits and cut losses in batches. Winning rate is always more important than payout ratio.

3. Always make calm judgments. Because I missed selling the previous two times and was certain it would surge on the 8th, I held all my chips. The fact proves that there is no absolutely certain future in the market. Be clear about who you are competing with, who can make money, and why you are qualified to make money.

4. Stay humble and keep learning.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.