Rate Of Return

Rate Of Return Enduring value guardian

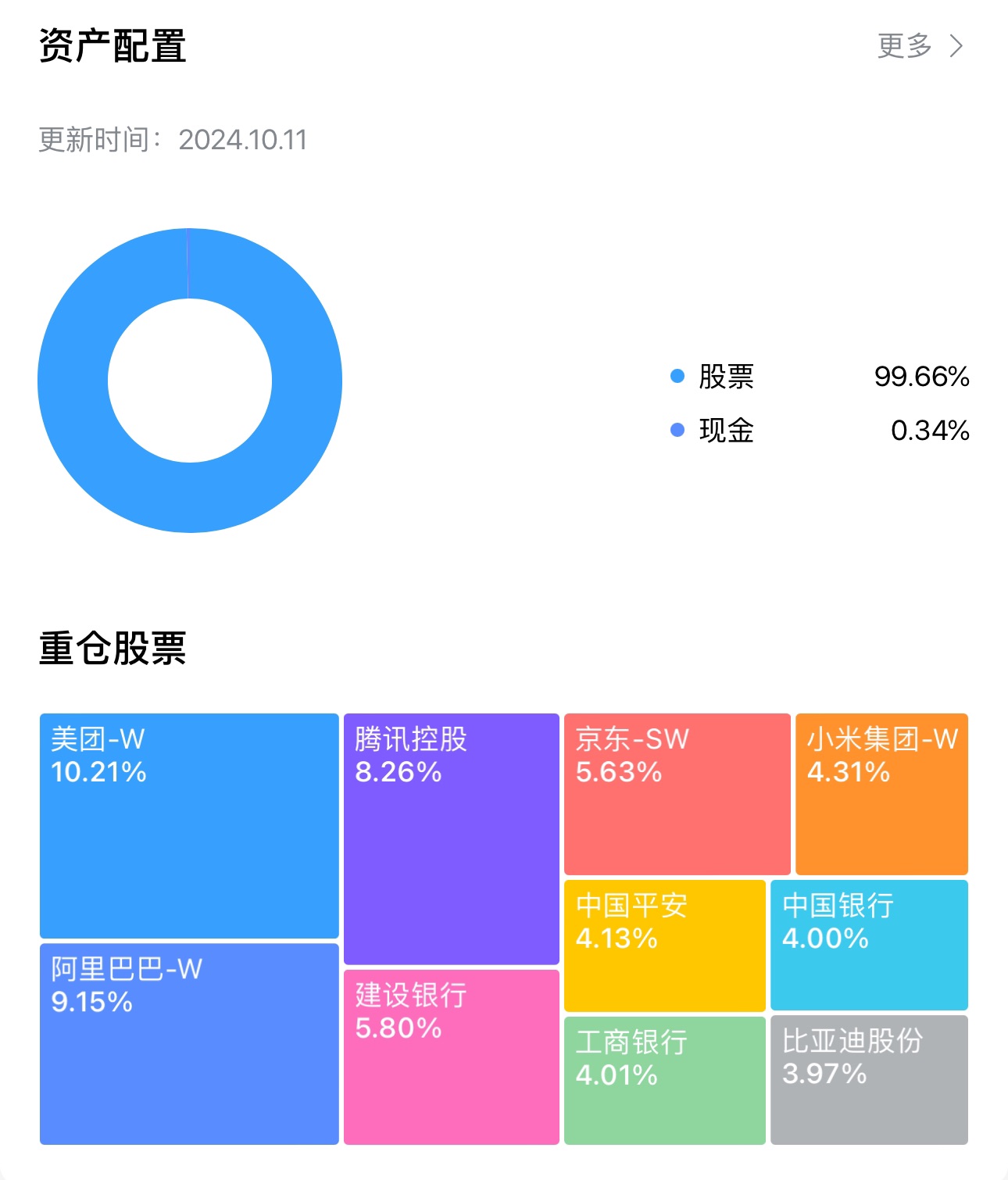

Enduring value guardian$iShares China Large Cap(FXI.US)FXI is just consumption + banking + online retail. Consumption, haha, everyone knows what it's like. The interest rate spread between bank loans and deposits is narrowing further, compressing profits with lots of bad debts. As for online retail, this year's Double 11, no one talked about buying anything. And about policies like swap facilities, first we need to see when the national team will actually buy and how much impact it will have. Plus, it's not even related to FXI—policies only support CSI 300ETF, and increased loans are only for A-share companies. Forget fundamentals, just looking at policies, FXI, this wild child, is bound to get beaten up. Add fundamentals into the mix, and it's just asking for a brutal beating...

Conclusion: Short-term speculation is still possible. Risk: No one knows when the big players will exit, requiring constant monitoring—waste of time.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.