Some key quotes and charts from TSMC's Q3 2024 earnings call

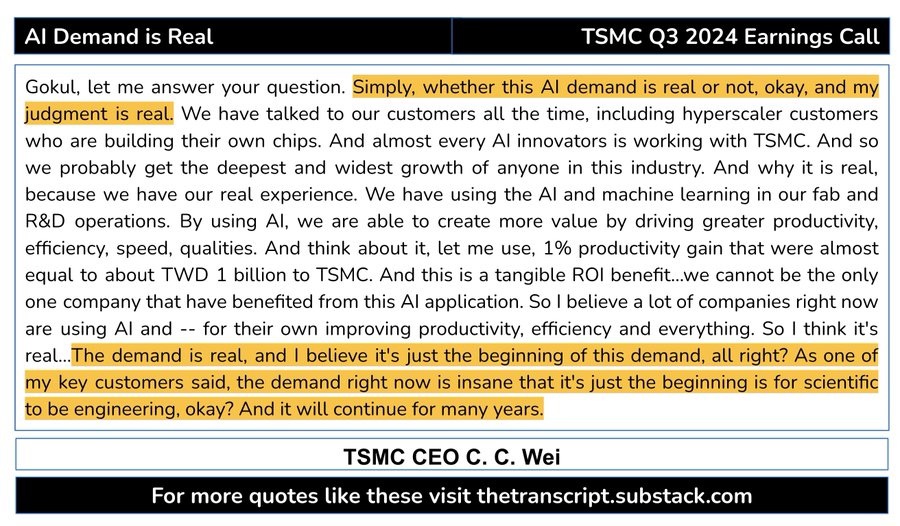

1. AI demand is real: "The demand is real, and I believe this is just the beginning of this demand, okay?" As one of my major clients said, the current demand is crazy.

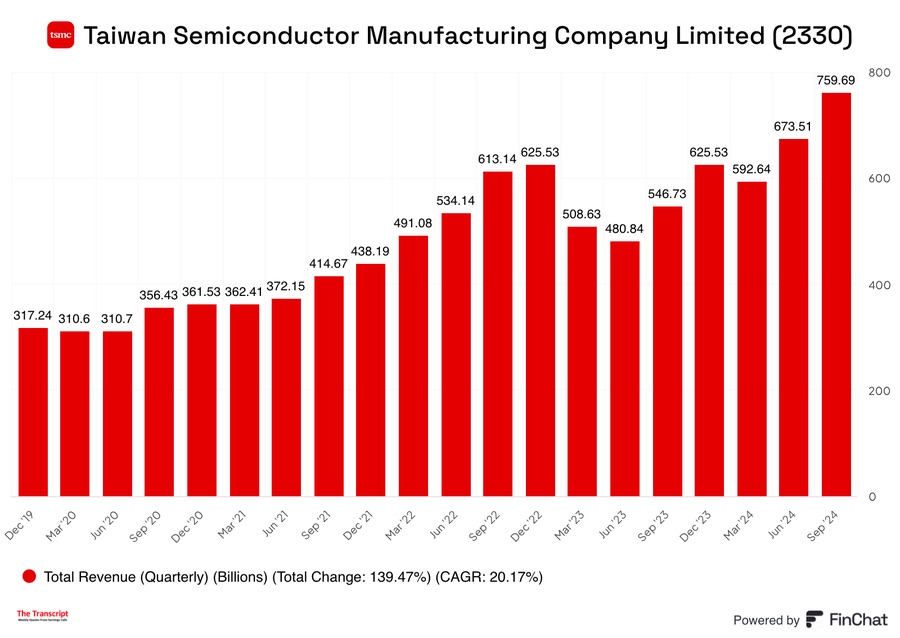

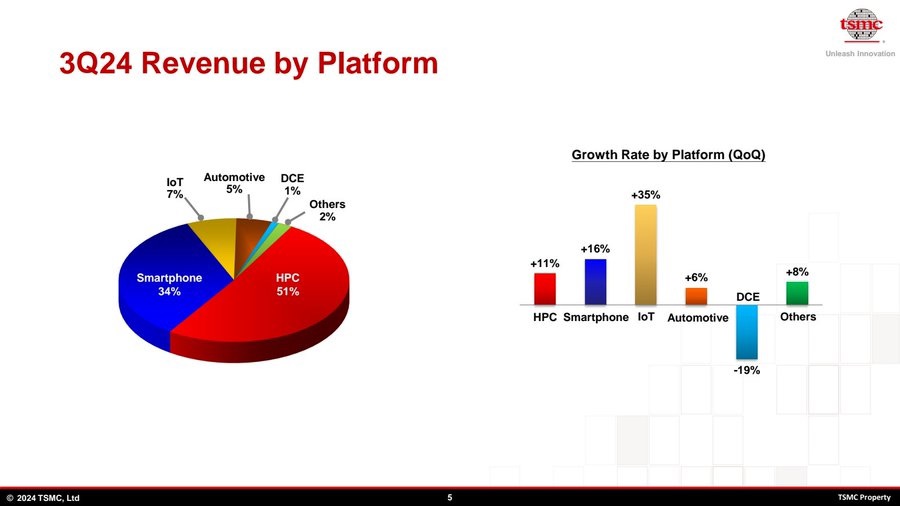

2. AI-driven growth: "TSMC's Q3 revenue increased 12.8% quarter-over-quarter, driven by strong demand for our industry-leading 3nm and 5nm technologies from smartphones and AI-related applications."

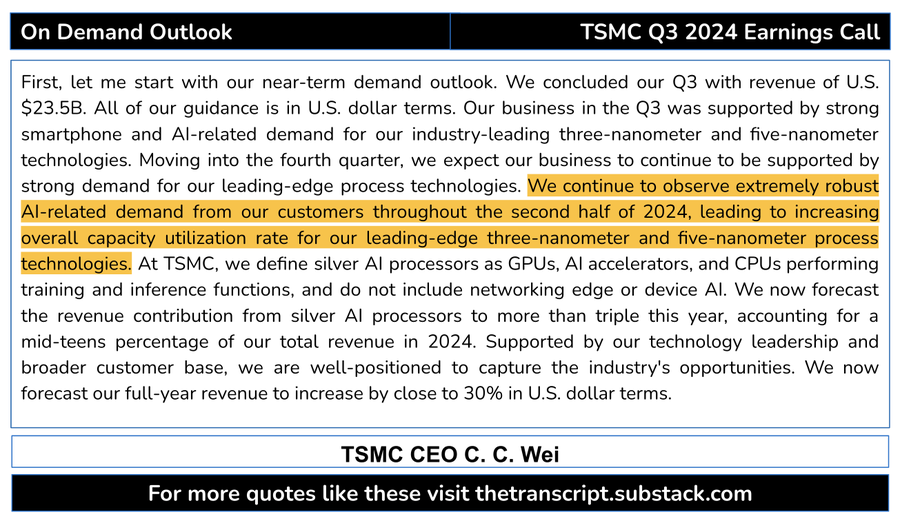

3. Strong demand outlook: "We continue to observe extremely strong AI-related demand from customers in the first half of 2024, which has improved the overall capacity utilization of our leading 3nm and 5nm process technologies" - CEO

4. Overall semiconductor demand: "For overall semiconductor demand, excluding AI, I think everything is stabilizing and starting to improve".

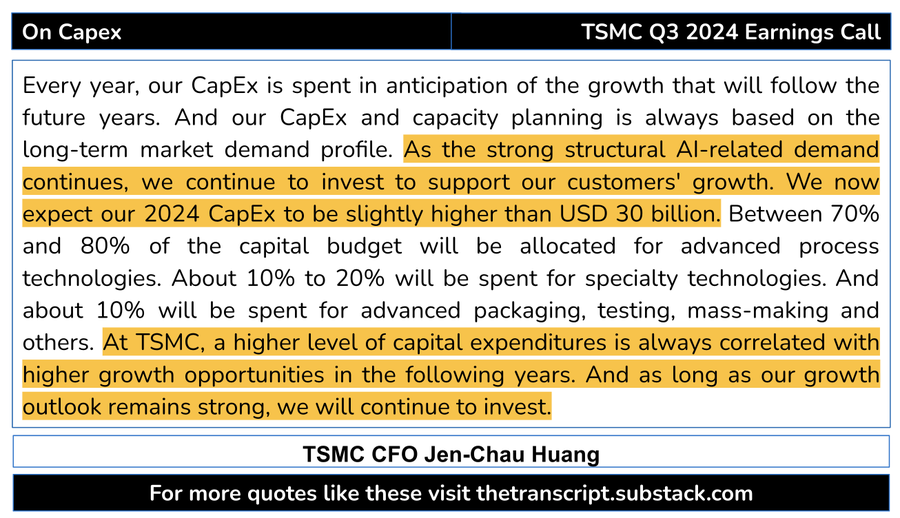

5. About capital expenditure: "We now expect 2024 capital expenditure to be slightly above $30 billion... For TSMC, higher levels of capital expenditure are always associated with greater growth opportunities in the coming years" - CFO

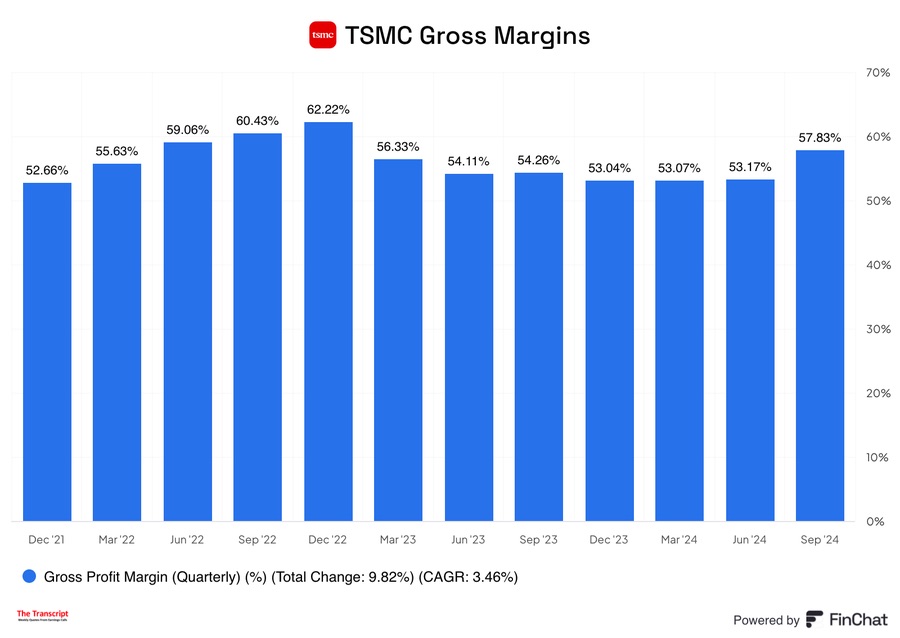

6. On gross margins: "We are capital-intensive, so we need very high gross margins to survive"

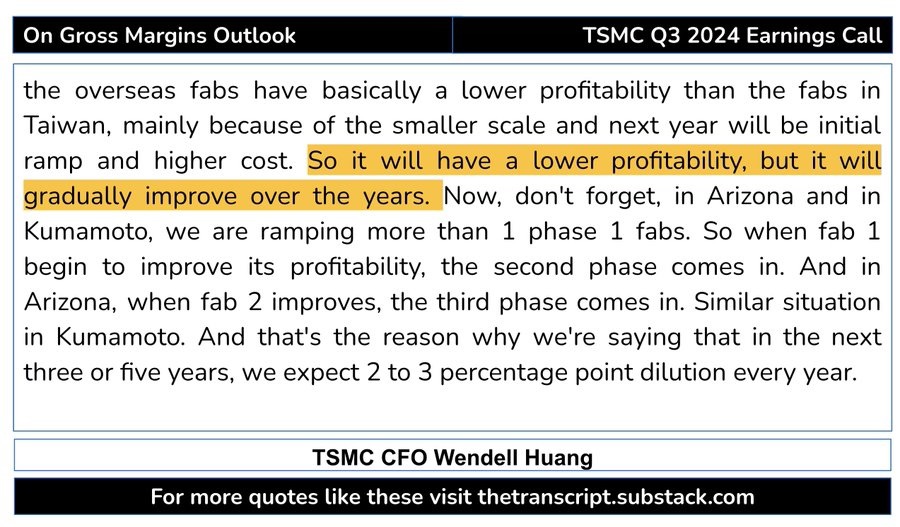

7. Comparison of overseas and Taiwan fabs' profitability: "The profitability of overseas fabs is basically lower than that of Taiwan fabs, mainly due to smaller scale... This will gradually improve in the coming years."

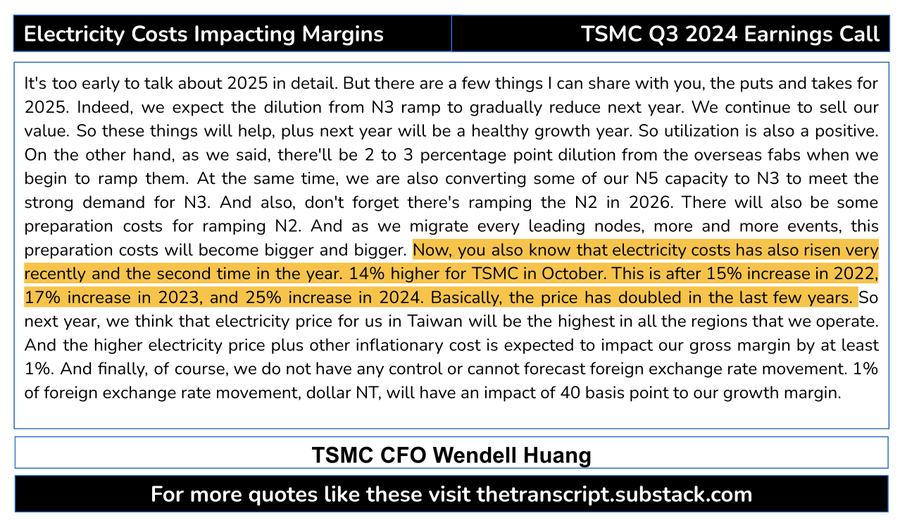

8. Power costs affecting profits: "TSMC's power costs recently increased by 14% in October, following increases of 15% in 2022, 17% in 2023, and 25% in 2024. This means prices have basically doubled over the past few years."

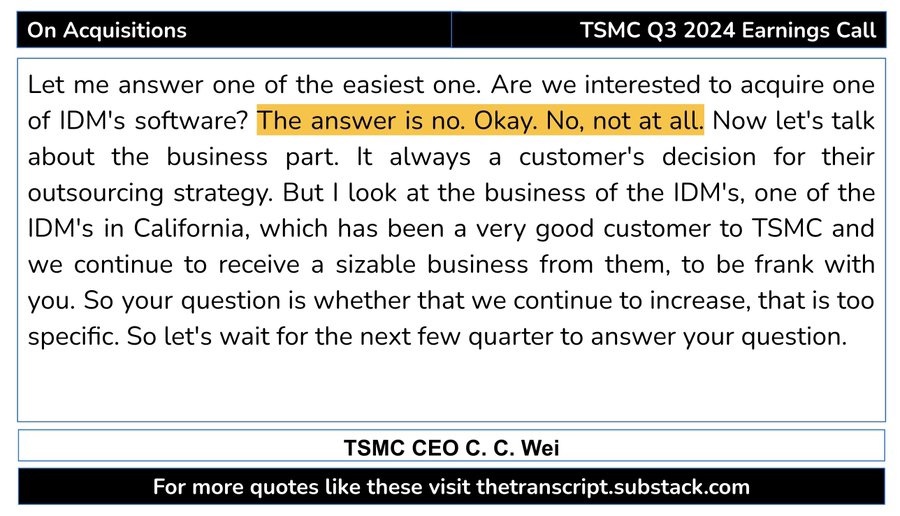

9. About acquiring Intel: "No, not at all"

$Taiwan Semiconductor(TSM.US)$NVIDIA(NVDA.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.