Feed Explorer

Feed Explorer Steady achiever

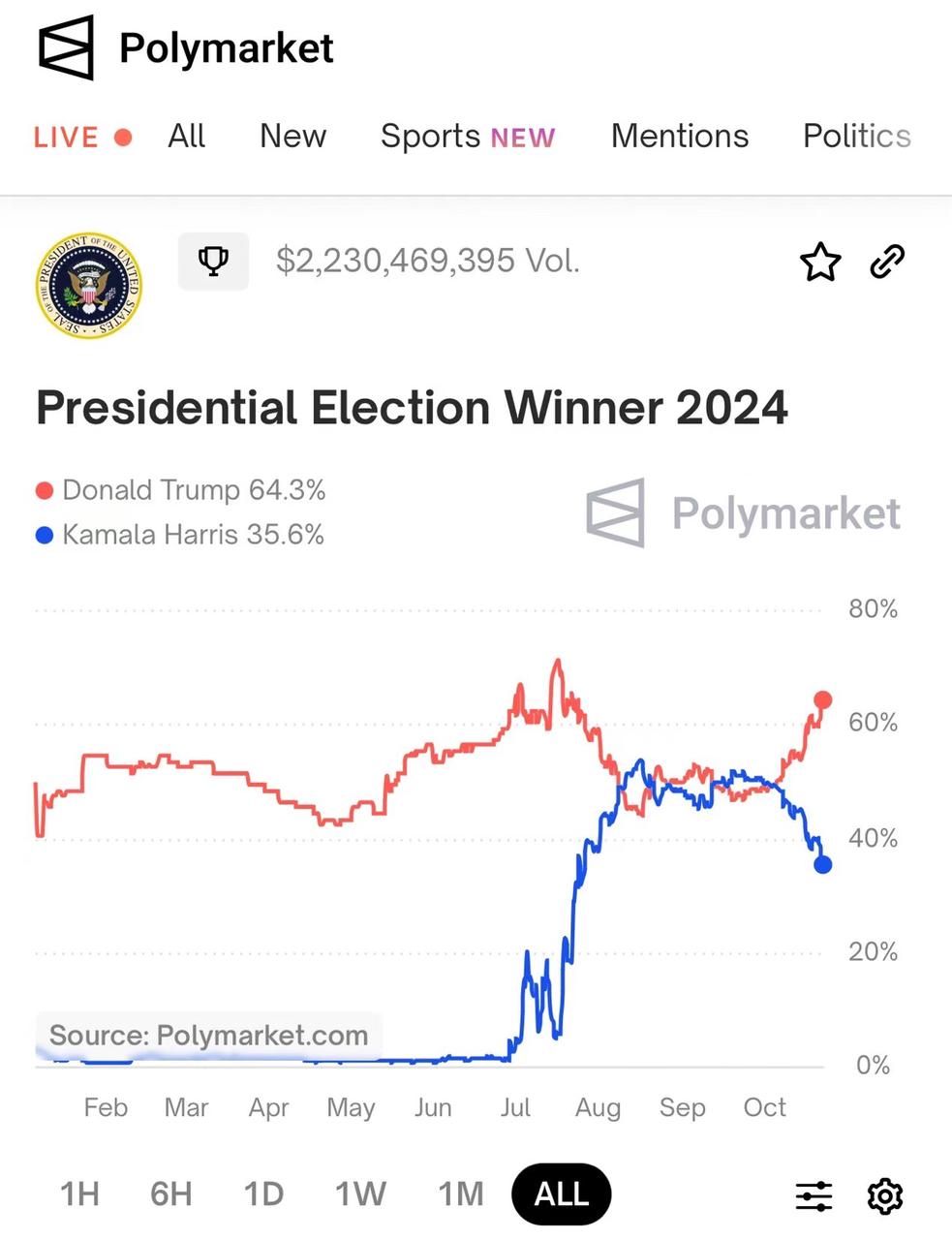

Steady achieverMost users on Polymarket are crypto supporters, to be honest its 60% water content is quite significant.

The US election has entered a fiercely contested stage, and investors seem to be placing their "smart money" on a Trump victory. On the blockchain betting platform Polymarket, over $2.2 billion has been wagered, with 64.3% betting on Trump's win.

Major investment banks' views on the US election:

1. Goldman Sachs: Trump's winning index has hit a record high, while Harris's index has returned to Biden's level;

2. UBS: The Republican vs. Democratic election hedge trades tracked by UBS have risen 15% this month, and the market has largely priced in expectations of a Trump victory;

3. JP Morgan: Hedge funds are aggressively buying Republican wins while selling Democratic wins (dumping renewable energy stocks). Over the past month, Republican win trades have outperformed Democratic win trades by about 7%;

4. Deutsche Bank: A Trump victory could lead to a stronger US dollar, and a Republican sweep (red wave) could bring greater market volatility;

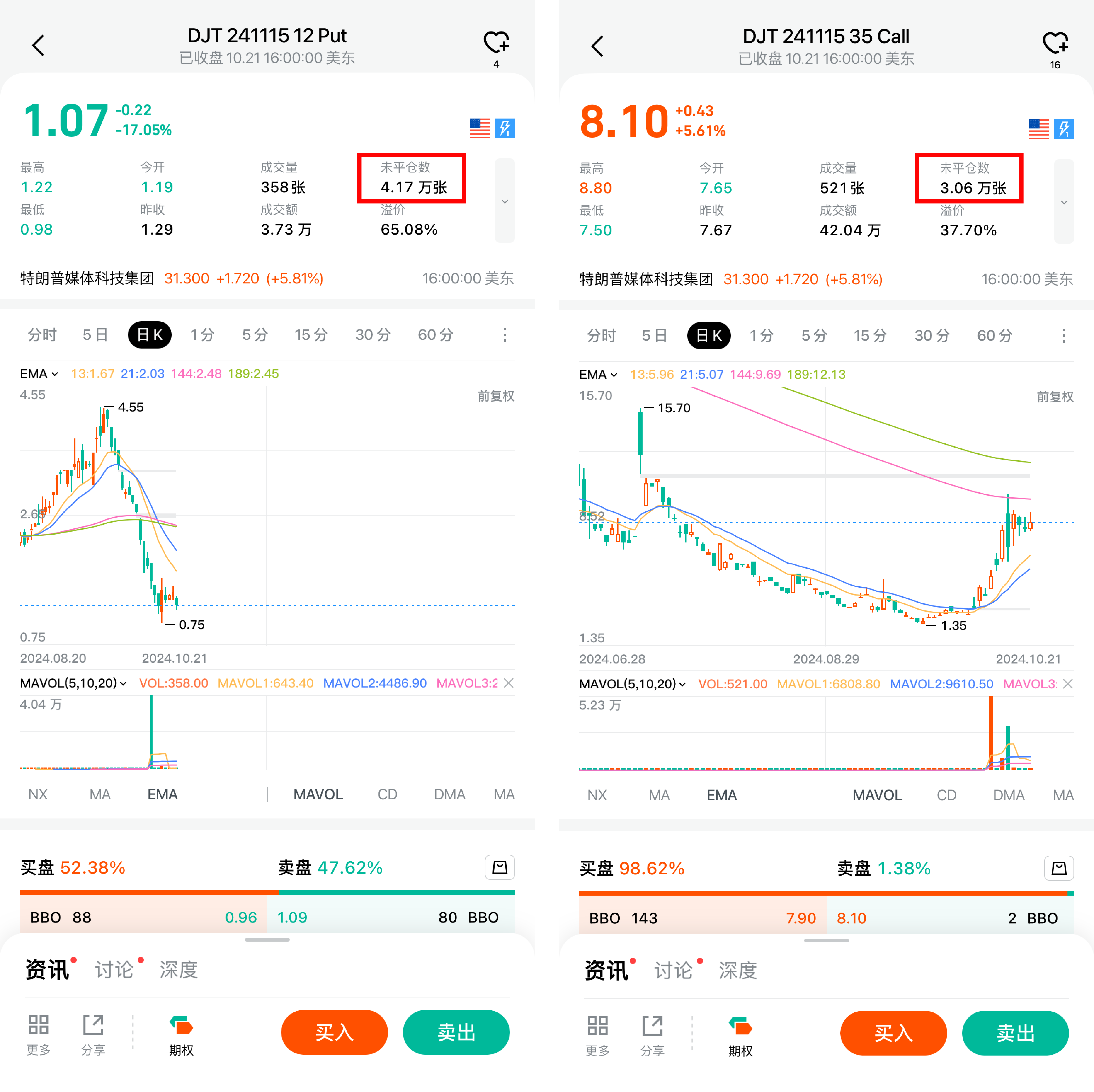

In terms of options, based on open interest distribution, investors are betting on multiple call and put options expiring on November 15, 2024:

1. The call options with the highest total open interest have strike prices of $25 and $35, with open contracts exceeding 30,000 each;

2. The put options with the highest total open interest have strike prices of $7 and $12, with open contracts exceeding 40,000 each;

$Trump Media & Tech(DJT.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.