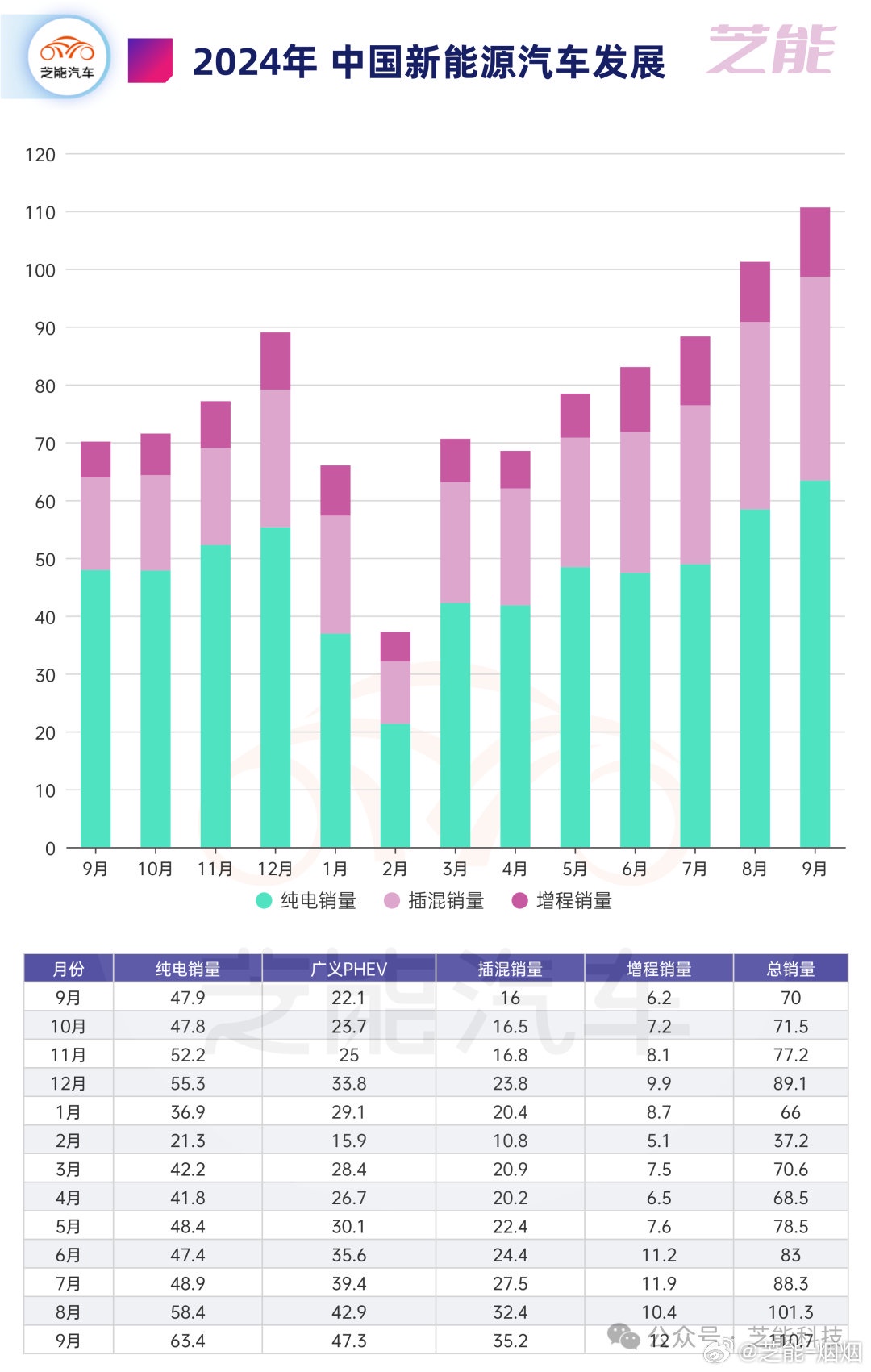

In September 2024, sales of China's new energy passenger vehicles reached 1.107 million units, a year-on-year increase of 58% and a month-on-month increase of 9%.

BYD led with sales of 369,200 units, followed by SAIC-GM-Wuling, Tesla, Li Auto, and Aito.

BYD performed well in both the pure electric and plug-in hybrid markets, while SAIC-GM-Wuling and Tesla focused on pure electric vehicles, and Li Auto and Aito mainly promoted extended-range technology.

Leapmotor, Nio, Galaxy, ZEEKR, and XPeng formed the second tier, each with its own characteristics.

Traditional automakers increased their investment in extended-range technology, competition in the pure electric vehicle market intensified, and sales of new energy vehicles with engines grew significantly.

The landscape of China's new energy vehicle market is clear, with various brands competing for market share through different strategies.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.