Let's talk about global startup acquisitions from 2000 to the first half of 2024. The corporate acquisition market has been nothing short of spectacular, with U.S. companies playing the absolute leading role.

Regional differences are stark—North American companies are "light-years ahead" in acquiring startups. Their acquisition pace is four times that of European companies and 7 to 10 times faster than Asian companies. Why is this the case? It reflects the unique advantages of North America, particularly the U.S., in corporate development strategies and innovation resource integration. Zooming in on Silicon Valley, it's practically the "epicenter" of startup acquisitions. Six of the world's top 10 startup acquirers are based in Silicon Valley. Data shows that Silicon Valley companies completed 814 startup M&A deals, accounting for 33% of the total and roughly one-third of all startup acquisitions by Fortune Global 500 companies. Silicon Valley is a hub for highly innovative startups and powerhouse corporations, forming an incredibly dynamic entrepreneurial ecosystem where resource integration and synergy between startups and established companies feel as natural as breathing.

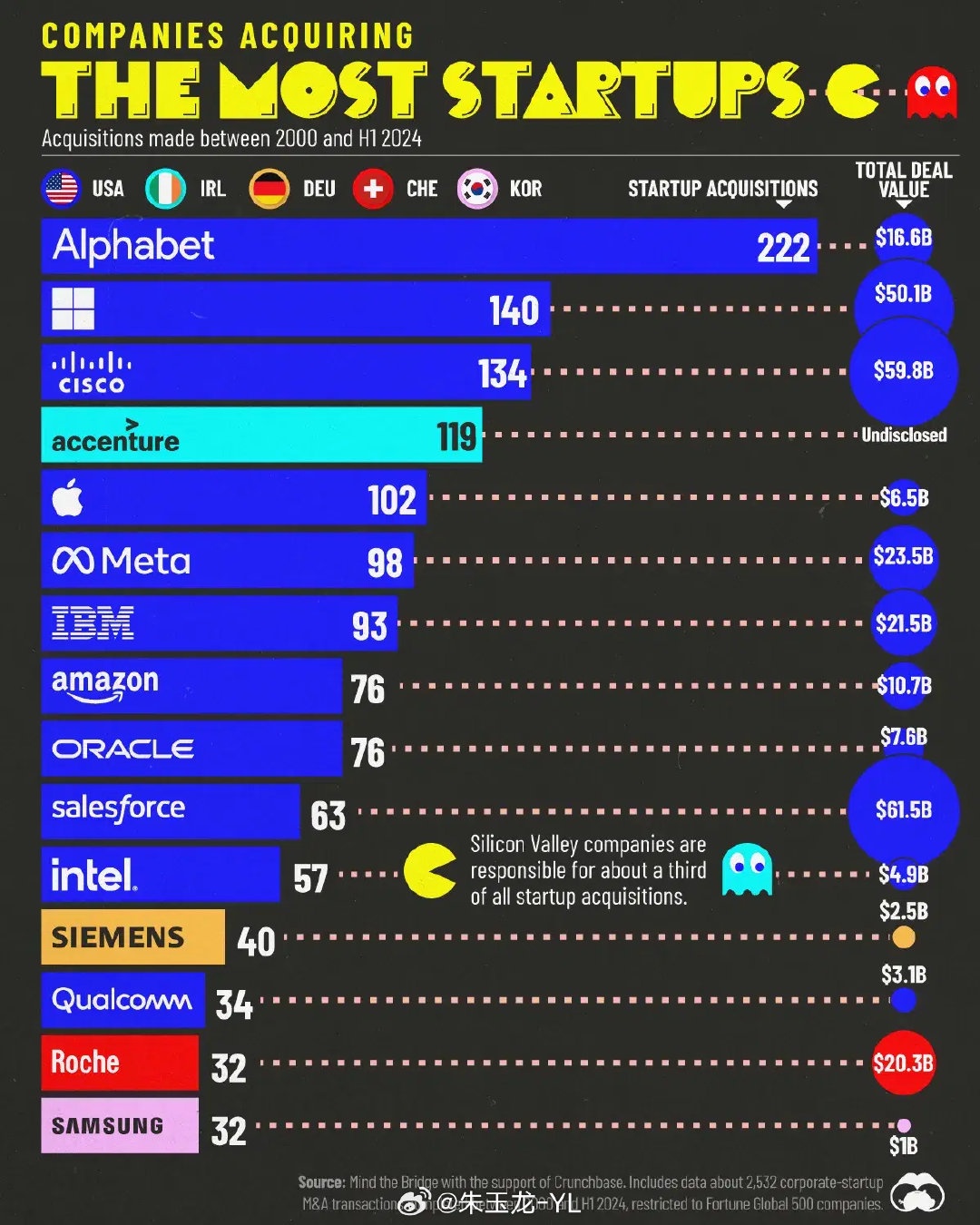

In terms of corporate rankings, Alphabet (Google) leads the pack with 222 acquisitions, showcasing its aggressive strategy of casting a wide net in the startup space. Microsoft and Cisco Systems follow closely with 140 and 134 acquisitions, respectively. Further down the list, U.S. tech giants like Apple, Meta, IBM, Amazon, Oracle, and Salesforce also make the top 10.

These giants act like "innovation hunters," constantly acquiring startups to secure new technologies, talent, and market opportunities, thereby consolidating and expanding their business empires. The top 10 also includes some "unusual suspects." Accenture is the only non-tech giant—a global professional services firm that enriches its offerings and enhances capabilities through startup acquisitions. Meanwhile, Siemens (Germany), Roche (Switzerland), and Samsung (South Korea) are the only non-U.S. companies in the top 15, all industry titans in their own right, using acquisitions to boost innovation and competitiveness.

Startups are typically acquired around 6 years after founding (46%), with another 35% of targets aged 6–10 years. Fewer than 20% are more mature companies. This suggests most acquired startups are still in growth stages, possessing unique tech or ideas but needing larger firms' resources (e.g., funding, market access) to scale. The surge in startup acquisitions has profoundly impacted global business. For tech giants, buying startups is an efficient way to rapidly secure innovation and maintain competitive edges. By integrating startups' tech and talent, they can faster launch new products/services to meet evolving market demands, while startups gain platforms to maximize their value.

Acquisition activity plays a vital role in driving tech innovation and industrial advancement!

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.