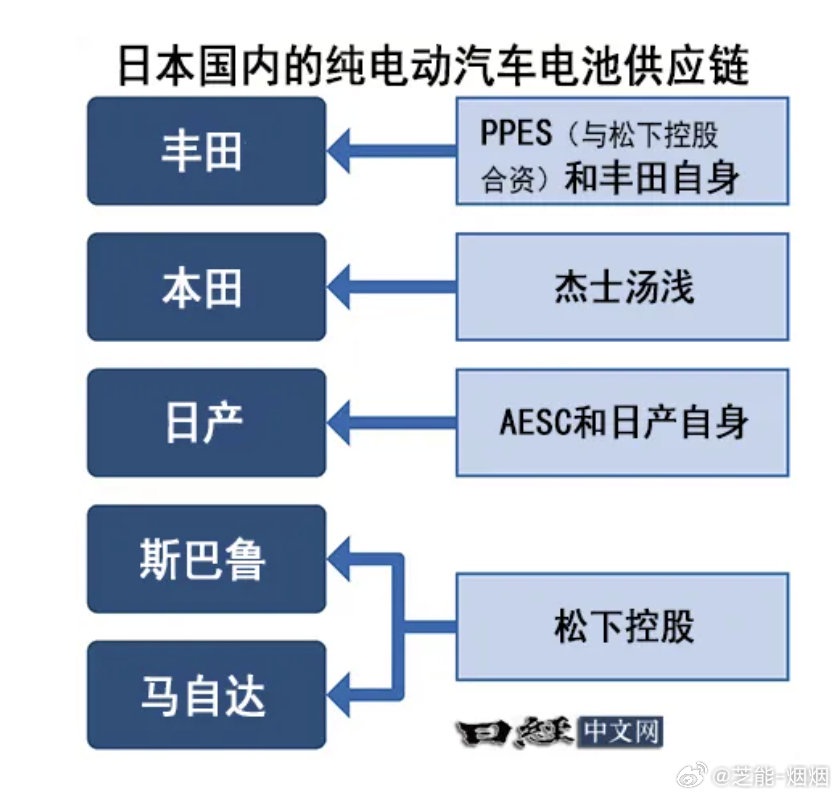

Japan once had a glorious history in fields like semiconductors and LCD panels, but suffered losses in scale competition with overseas companies. Now, in the field of automotive batteries, facing the strong rise of Chinese companies, Japan has decided to go all out to build a domestic supply chain. Japanese automakers and the government have really gone all in. Toyota, Nissan, and other automakers plan to invest 1 trillion yen in domestic EV battery production, while the Ministry of Economy, Trade and Industry has allocated up to 347.9 billion yen in subsidies. Mazda and Subaru have partnered with Panasonic Holdings to build new battery assembly plants in Yamaguchi and Gunma prefectures, with a total investment of 546.3 billion yen, and they’ll also receive substantial subsidies. Toyota is even splurging 245 billion yen to build new battery factories in Fukuoka Prefecture and other locations, while Nissan is also constructing a new plant in Fukuoka, aiming for mass production by fiscal year 2028.

Why is Japan pushing so hard? Just look at the global automotive battery market. Data from a South Korean research firm shows that in 2023, the global market share (by installed capacity) was dominated by six Chinese companies, including CATL and BYD, with Japan’s Panasonic Holdings ranking only fourth. Back in the day, Japan was a leader in automotive batteries—Mitsubishi launched the world’s first mass-produced pure electric car, the i-MiEV, in 2009, and Nissan released the first-generation LEAF in 2010, both using Japanese-made batteries. But later, Chinese companies overtook them with their strong supply chains.

What makes Chinese companies so strong? Vertical integration across the entire supply chain, from raw materials to manufacturing. Take graphite for anode materials—China accounts for over 70% of global production. For lithium hydroxide used in cathode materials, Japan mostly relies on imports from China. By integrating these resources, Chinese companies can produce highly cost-effective cars. In Japan, however, manufacturing processes are fragmented among numerous small and medium-sized equipment makers, leading to high communication and coordination costs with battery manufacturers.

Japan has now recognized the problem. Beyond subsidizing automakers, it’s also providing subsidies to material and equipment manufacturers in hopes of rebuilding the supply chain. However, Japan is pinning its hopes on next-generation all-solid-state batteries to turn the tide, but practical implementation is still a ways off. Meanwhile, battery fire incidents involving Chinese and South Korean EVs have given Japan an opportunity. A professor at Nagoya University has stated that Japan should continue developing batteries with differentiated safety performance.

Whether Japan can successfully build a resilient supply chain to compete with China remains to be seen!

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.