The trader's 150 million dollar end-of-day options cost around 420, and it's a 255 Call, where the stock price impact far outweighs the time value effect.

I think【maybe probably perhaps】we can add to the position, and the stock price should rebound above 420 tomorrow, so that the 150 million dollar options order can turn a profit.

---

Of course, there's also a possibility that MSTR continues to fall, and the trader loses tens of millions on the 150 million dollar end-of-day options, but they don't care.

For example:

The 241122 end-of-day options total 8,769 contracts, with their cost around 420. If MSTR's stock price drops to 400, the loss on these options would be roughly 8,769 x (420 - 400) x 100 = $17,538,000.

Don't get shaken out of the market, average down if your cost basis is high - a rebound is highly likely tomorrow!

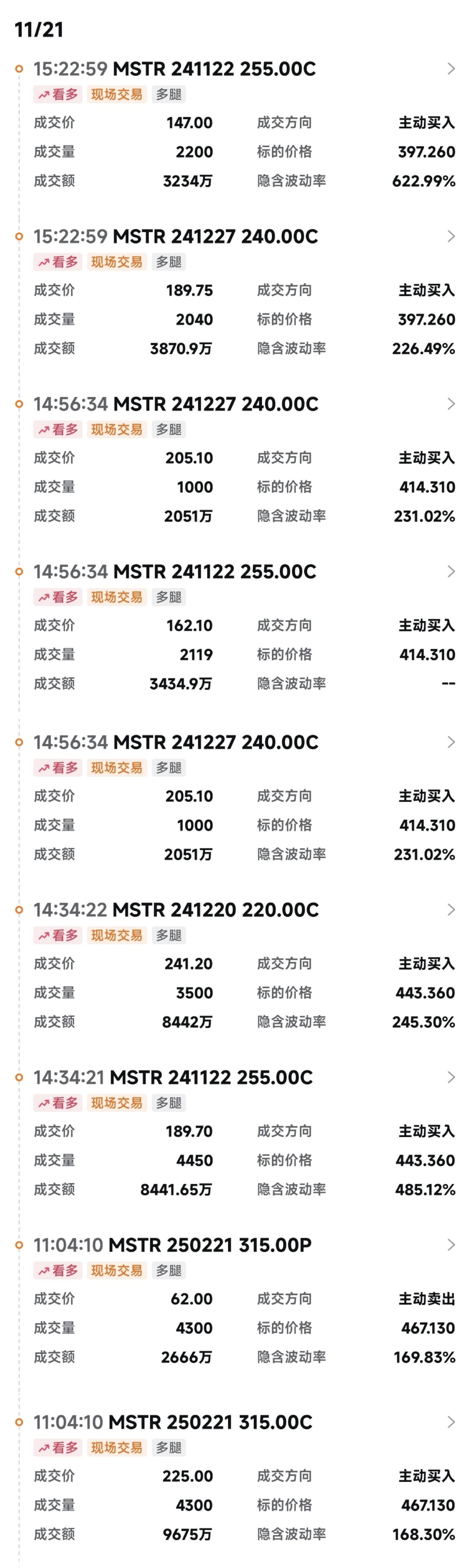

No fluff, just look at what traders are doing with options today:

1. Bought 150 million worth of 241122 Call (weekly options, average cost around 420)

2. Bought 80 million worth of 241220 Call (cost at 443.36)

3. Bought 80 million worth of 241227 Call (average cost around 405)

4. Constructed a synthetic long strategy, equivalent to buying 430K shares of MSTR (cost around 470)

$Strategy(MSTR.US)$Daily Target 2X Long MSTR ETF(MSTX.US)$T-REX 2X Long MSTR Daily Target ETF(MSTU.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.