It has been found that everyone has questions about why there is wear and tear with triple leverage.

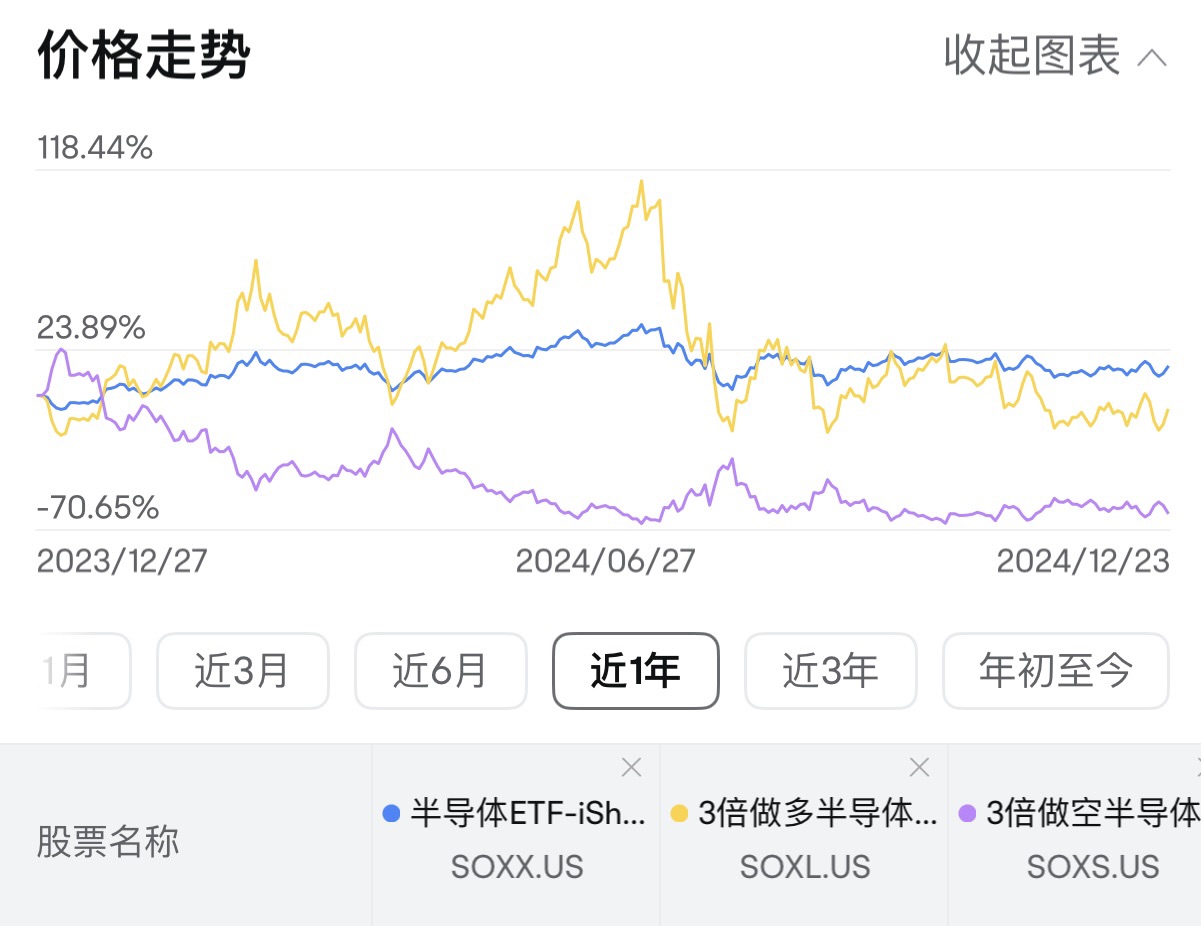

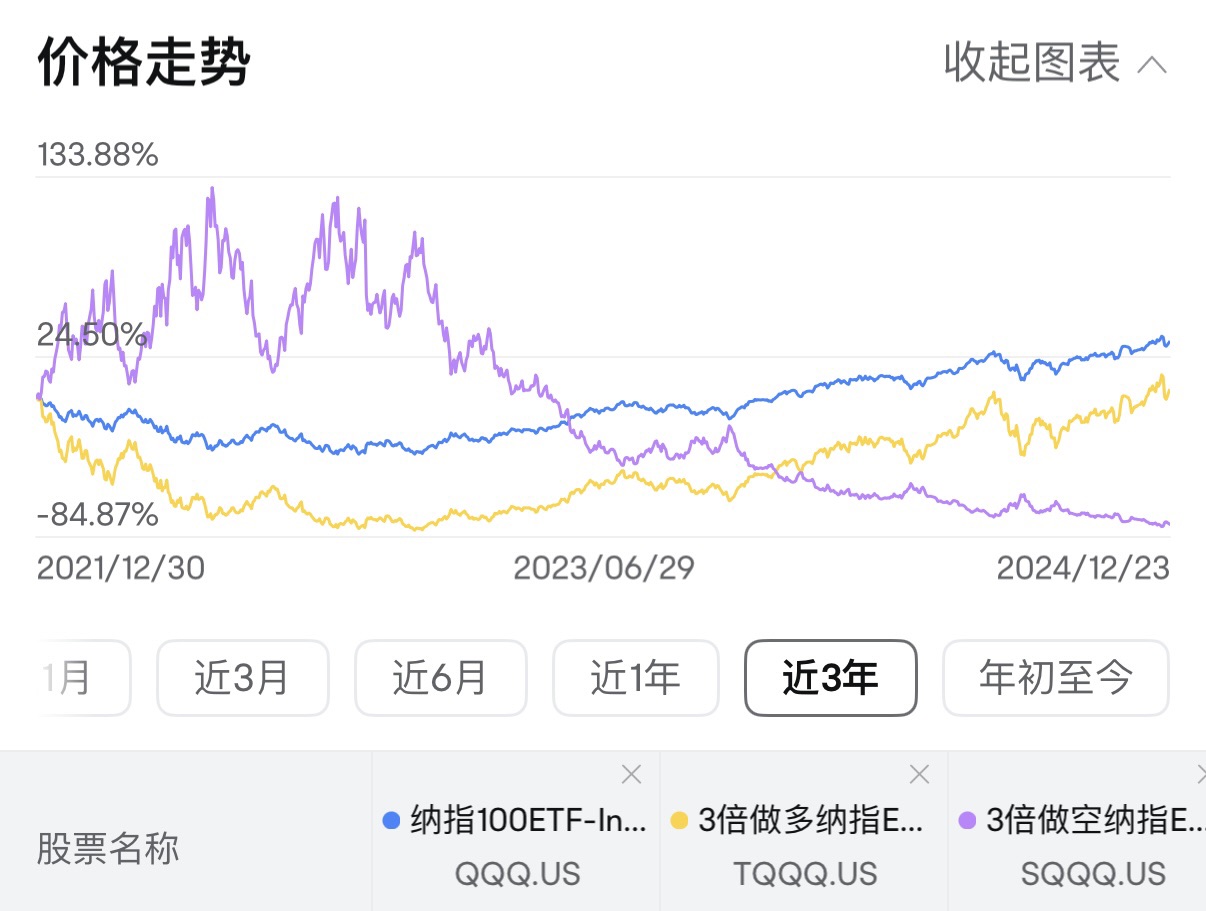

For example, the Nasdaq is in a long bull market, but TQQQ has not outperformed QQQ over three years; similarly, this year is a bull market for semiconductors, but SOXL has not outperformed SOXX over one year.

Let's do a simple calculation to understand.

Day 1, Day 2, Day 3, Day 4, Day 5, Day 6

One times: +10% -5% +8% -10% +5% -8%

Three times long: +30% -15% +24% -30% +15% -24%

Three times short: -30% +15% -24% +30% -15% +24%

Returns

One times 100*1.1*0.95*1.08*0.9*1.05*0.92=98.12

Three times long 100*1.3*0.85*1.24*0.7*1.15*0.76=83.83

Three times short 100*0.7*1.15*0.76*1.3*0.85*1.24=83.83

Conclusion: As long as the tracked asset does not experience a prolonged one-sided rise or fall, both three times long and three times short are likely to underperform the tracked asset in the end.

$Invesco QQQ Trust(QQQ.US)$iShares Semiconductor ETF(SOXX.US)$Proshares UltraPro QQQ(TQQQ.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.